Question: Please help fill out the APV calculations! Finding share value using after-tax WACC method PV (free cash flow, 2022-2027) in Oct. 2022 Terminal value of

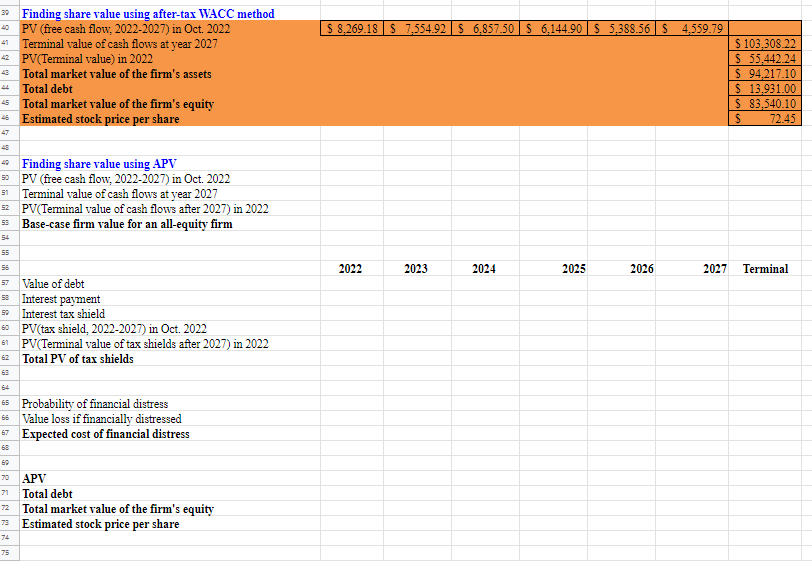

Please help fill out the APV calculations!

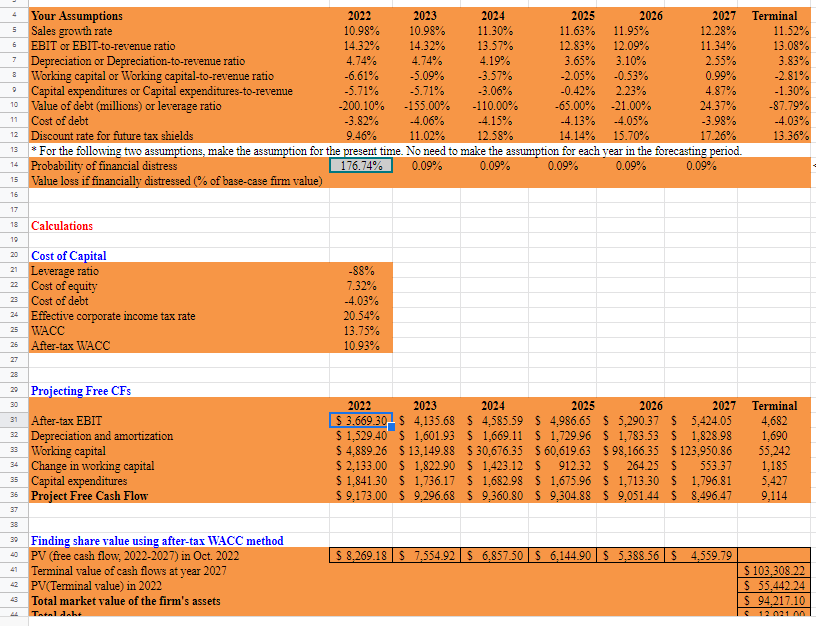

Finding share value using after-tax WACC method PV (free cash flow, 2022-2027) in Oct. 2022 Terminal value of cash flows at year 2027 PV(Terminal value) in 2022 Total market value of the firm's assets Total debt Total market value of the firm's equity Estimated stock price per share Finding share value using APV PV (free cash flow, 2022-2027) in Oct. 2022 Terminal value of cash flows at year 2027 PV(Terminal value of cash flows after 2027) in 2022 Base-case firm value for an all-equity firm Value of debt \begin{tabular}{l|l|l|l|lll} 2022 & 2023 & 2024 & 2025 & 2026 & 2027 & Terminal \\ \hline & & & & \end{tabular} Interest payment Interest tax shield PV(tax shield, 2022-2027) in Oct. 2022 PV(Terminal value of tax shields atter 2027) in 2022 Total PV of tax shields Probability of financial distress Value loss if financially distressed Expected cost of financial distress APV Total debt Total market value of the firm's equity Estimated stock price per share Finding share value using after-tax WACC method PV (free cash flow, 2022-2027) in Oct. 2022 Terminal value of cash flows at year 2027 PV(Terminal value) in 2022 Total market value of the firm's assets Total debt Total market value of the firm's equity Estimated stock price per share Finding share value using APV PV (free cash flow, 2022-2027) in Oct. 2022 Terminal value of cash flows at year 2027 PV(Terminal value of cash flows after 2027) in 2022 Base-case firm value for an all-equity firm Value of debt \begin{tabular}{l|l|l|l|lll} 2022 & 2023 & 2024 & 2025 & 2026 & 2027 & Terminal \\ \hline & & & & \end{tabular} Interest payment Interest tax shield PV(tax shield, 2022-2027) in Oct. 2022 PV(Terminal value of tax shields atter 2027) in 2022 Total PV of tax shields Probability of financial distress Value loss if financially distressed Expected cost of financial distress APV Total debt Total market value of the firm's equity Estimated stock price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts