Question: Please help filled the same way its listed below and provide equations. Thanks. e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that

Please help filled the same way its listed below and provide equations. Thanks.

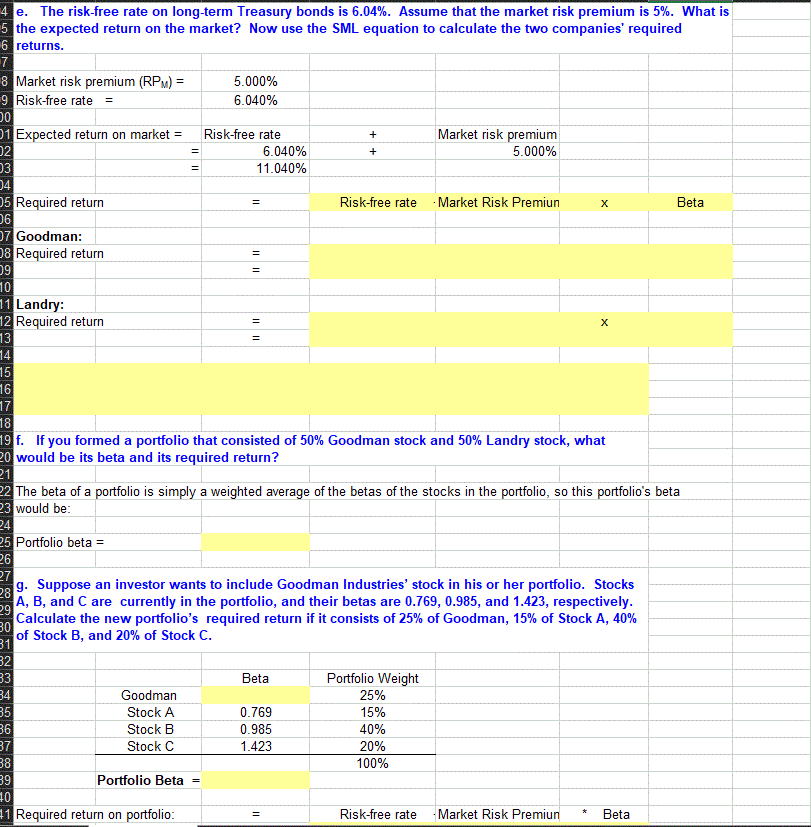

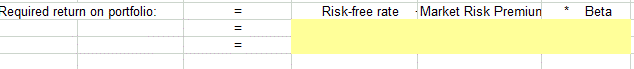

e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 5%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns Market risk premium (RPw)- Risk-free rateE 5.000% 6.040% Market risk premium 5.000% Expected return on market = Risk-free rate 6.040% 11-040% 03 Required return Risk-free rate Market Risk Premiun Beta Goodman Required return Landry Required return f. If you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what 0would be its beta and its required return? The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's beta would be 5 Portfolio beta- g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, and C are currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively Calculate the new portfolio's required return if it consists of 25% of Goodman, 15% of Stock A, 40% of Stock B, and 20% of Stock C. Portfolio Weight 25% 15% 40% 20% 100% Beta Goodman Stock A Stock B Stock C 0.769 0.985 1.423 Portfolio Beta - Required return on portfolio Risk-free rate -Market Risk Premiun *Beta equired return on portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts