Question: Please help find the present value for options 1 , 2 and 3 . Thank you! Gemma Laureta wants to open a new factory in

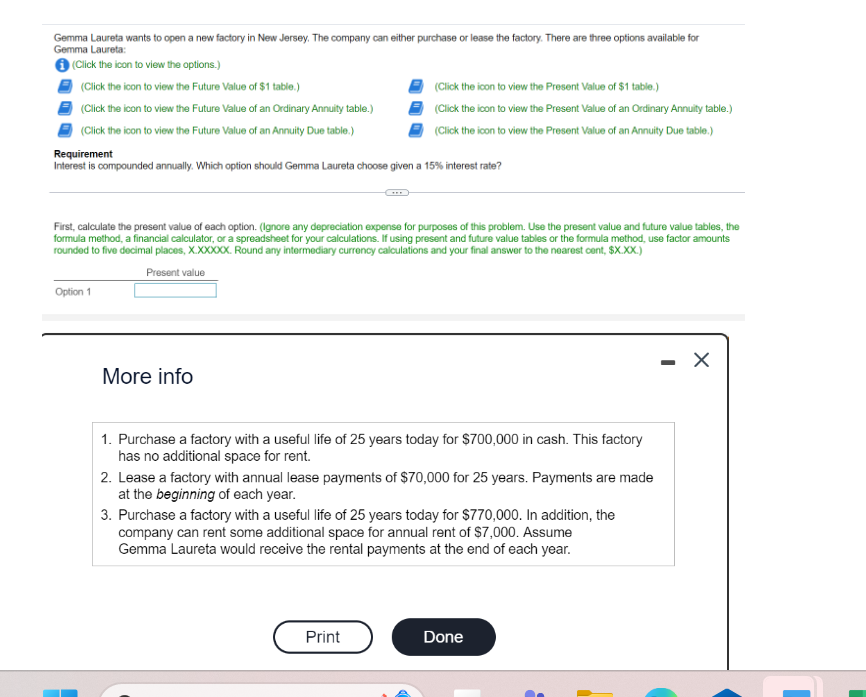

Please help find the present value for options and Thank you! Gemma Laureta wants to open a new factory in New Jersey. The company can either purchase or lease the factory. There are three options available for

Gemma Laureta:

iClick the icon to view the options.

Click the icon to view the Future Value of $ table.

Click the icon to view the Present Value of $ table.

EClick the icon to view the Future Value of an Ordinary Annuity table.

EClick the icon to view the Present Value of an Ordinary Annuity table.

E Click the icon to view the Future Value of an Annuity Due table.

EClick the icon to view the Present Value of an Annuity Due table.

Requirement

Interest is compounded annually. Which option should Gemma Laureta choose given a interest rate?

First, calculate the present value of each option. Ignore any depreciation expense for purposes of this problem. Use the present value and future value tables, the

formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts

rounded to five docimal places, XXOXOOX. Round any intermediary currency calculations and your final answer to the nearest cent, $

Present value

Option

More info

Purchase a factory with a useful life of years today for $ in cash. This factory

has no additional space for rent.

Lease a factory with annual lease payments of $ for years. Payments are made

at the beginning of each year.

Purchase a factory with a useful life of years today for $ In addition, the

company can rent some additional space for annual rent of $ Assume

Gemma Laureta would receive the rental payments at the end of each year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock