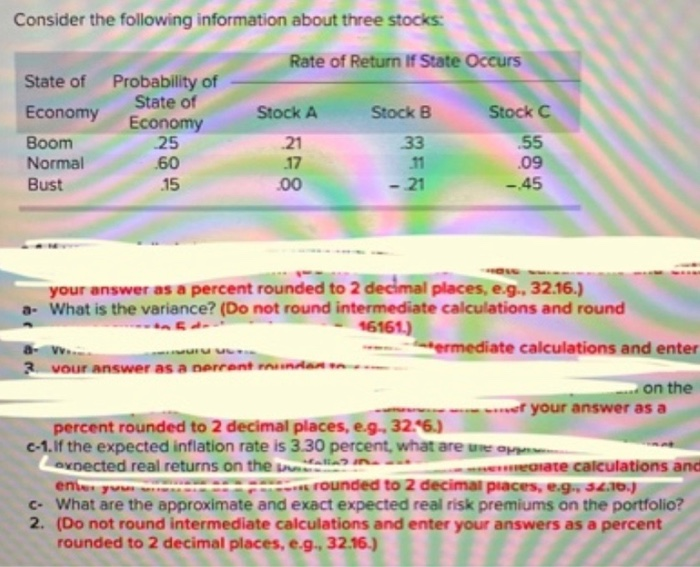

Question: please help find the variance & the last question please. Consider the following information about three stocks: Rate of Return If State Occurs Probability of

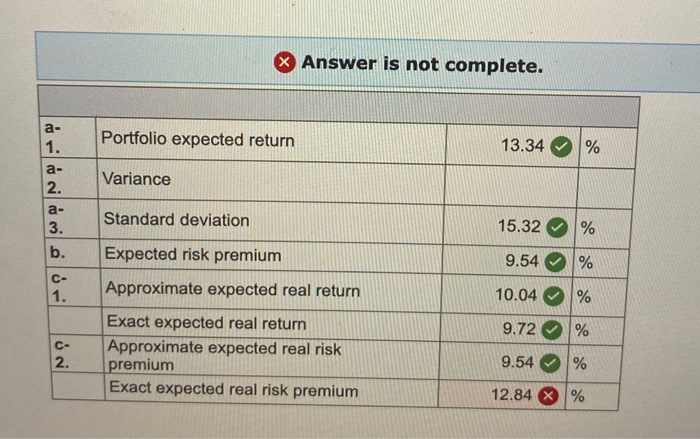

Consider the following information about three stocks: Rate of Return If State Occurs Probability of State of Economy 25 Stock A State of Economy Boom Normal Bust Stock C Stock B 33 .60 09 .15 45 your answer as a percent rounded to 2 decimal places, e.g. 32.16.) What is the variance? (Do not round intermediate calculations and round 16161.) VIU termediate calculations and enter VOUR Answer as a perront on the f your answer as a percent rounded to 2 decimal places, C-1. If the expected inflation rate is 3.30 percent, what are un expected real returns on the w all ediate calculations and en y .. Founded to 2 decimal places, e.g., 54.10.) C. What are the approximate and exact expected real risk premiums on the portfolio? 2. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) X Answer is not complete. Portfolio expected return 13.34 /% Variance Standard deviation % 15.32 9.54 % Expected risk premium Approximate expected real return 10.04 9.72 Exact expected real return Approximate expected real risk premium Exact expected real risk premium % 9.54 12.84 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts