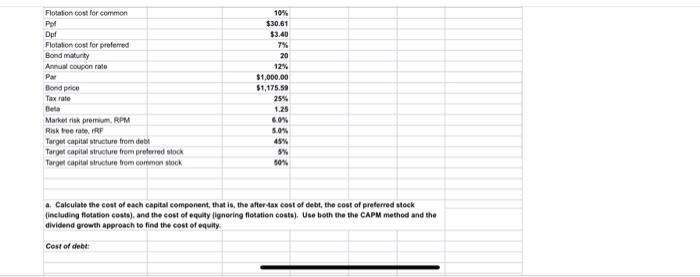

Question: please help Flotation cost for common Pol Dpt Flotation cost for preferred Bond Marty Annual coupon rate Par Bond price Tax rate Beta Market risk

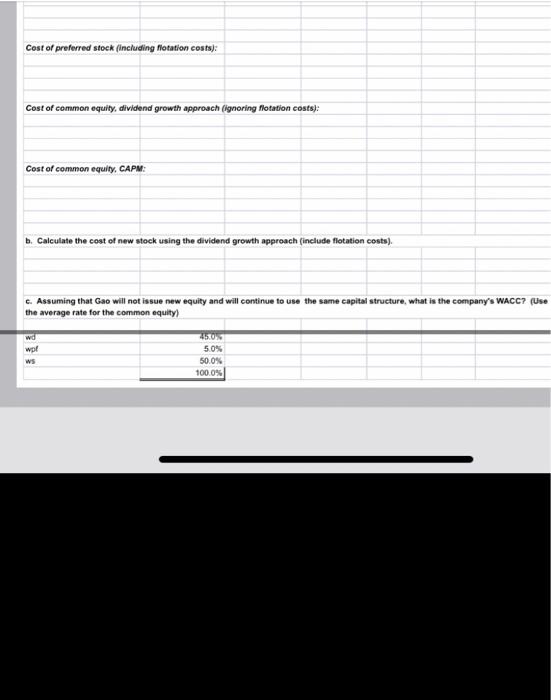

Flotation cost for common Pol Dpt Flotation cost for preferred Bond Marty Annual coupon rate Par Bond price Tax rate Beta Market risk promum, RPM Risk tree rate RF Target capital structure from det Target capital structure from preferred stock Targel capital structure from cormon stock 10% $30.61 $3.40 7% 20 12% $1,000.00 $1,175.59 25% 1.25 6.0% 50% 45% % 50% a. Calculate the cost of each capital component, that is, the after tax cost of debt, the cost of preferred stock including flotation costs), and the cost of equity ignoring flotation costs). Uso both the the CAPM method and the dividend growth approach to find the cost of equity Cost of debt Cost of preferred stock (including flotation costs): Cost of common equity, dividend growth approach (ignoring flotation costs): Cost of common equity, CAPM: b. Calculate the cost of new stock using the dividend growth approach include flotation costs) c. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the company's WACC? (Use the average rate for the common equity) wo wpl ws 350 50% 50.0% 100.0% Flotation cost for common Pol Dpt Flotation cost for preferred Bond Marty Annual coupon rate Par Bond price Tax rate Beta Market risk promum, RPM Risk tree rate RF Target capital structure from det Target capital structure from preferred stock Targel capital structure from cormon stock 10% $30.61 $3.40 7% 20 12% $1,000.00 $1,175.59 25% 1.25 6.0% 50% 45% % 50% a. Calculate the cost of each capital component, that is, the after tax cost of debt, the cost of preferred stock including flotation costs), and the cost of equity ignoring flotation costs). Uso both the the CAPM method and the dividend growth approach to find the cost of equity Cost of debt Cost of preferred stock (including flotation costs): Cost of common equity, dividend growth approach (ignoring flotation costs): Cost of common equity, CAPM: b. Calculate the cost of new stock using the dividend growth approach include flotation costs) c. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the company's WACC? (Use the average rate for the common equity) wo wpl ws 350 50% 50.0% 100.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts