Question: please help! For each transaction, indicate which accounts are involved in that transaction, whether transaction causes the account to increase or decrease, the type of

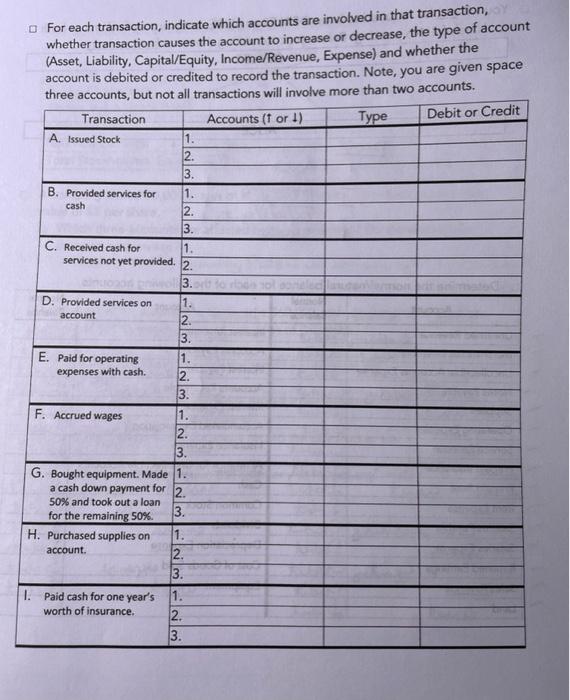

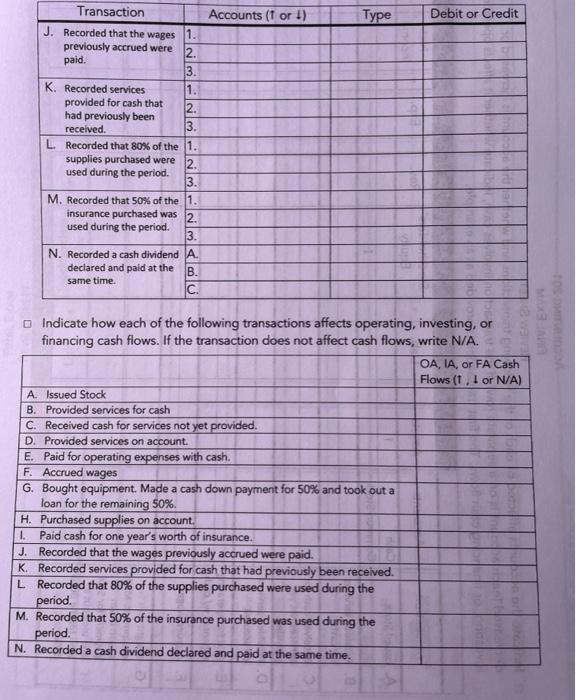

For each transaction, indicate which accounts are involved in that transaction, whether transaction causes the account to increase or decrease, the type of account (Asset, Liability, Capital/Equity, Income/Revenue, Expense) and whether the account is debited or credited to record the transaction. Note, you are given space three accounts, but not all transactions will involve more than two accounts. Transaction Accounts (f or 1) Type Debit or Credit A Issued Stock 1. 2. 3. B. Provided services for 1. cash 2. 3. C. Received cash for 1. services not yet provided. 2. 3. D. Provided services on 1. account 2. 3. E. Paid for operating 1. expenses with cash. 2. 3. F. Accrued wages 1. 2. 3. G. Bought equipment. Made 1. a cash down payment for 2. 50% and took out a loan for the remaining 50% 3. H. Purchased supplies on 1. account. 2. 3. 1. Paid cash for one year's 1. worth of insurance 2. 3. Accounts (f or :) Type Debit or Credit Transaction J. Recorded that the wages 1. previously accrued were 2. paid. 3. K. Recorded services 1. provided for cash that 2. had previously been received 3. L. Recorded that 80% of the 1. supplies purchased were 2. used during the period. M. Recorded that 50% of the 1. insurance purchased was 2 used during the period. | N. Recorded a cash dividend A. declared and paid at the B. same time. to ourn BU Indicate how each of the following transactions affects operating, investing, or financing cash flows. If the transaction does not affect cash flows, write N/A. OA, IA, or FA Cash Flows (1.1 or NA) A. Issued Stock B. Provided services for cash C. Received cash for services not yet provided. D. Provided services on account. E. Paid for operating expenses with cash. F. Accrued wages G. Bought equipment. Made a cash down payment for 50% and took out a loan for the remaining 50%. H. Purchased supplies on account. 1. Paid cash for one year's worth of insurance, J. Recorded that the wages previously accrued were paid K. Recorded services provided for cash that had previously been received. L Recorded that 80% of the supplies purchased were used during the period. M. Recorded that 50% of the insurance purchased was used during the period. N. Recorded a cash dividend declared and paid at the same time. DO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts