Question: PLEASE HELP FOR PART C & D !! PART A & B ARE CORRECT RA=4.508+1.40RM+eARB=2.20z+1.70RM+eBM=248;RsquareA=0.30;R-squareB=0.20 Assume you create portfolio P with investment proportions of 0.60

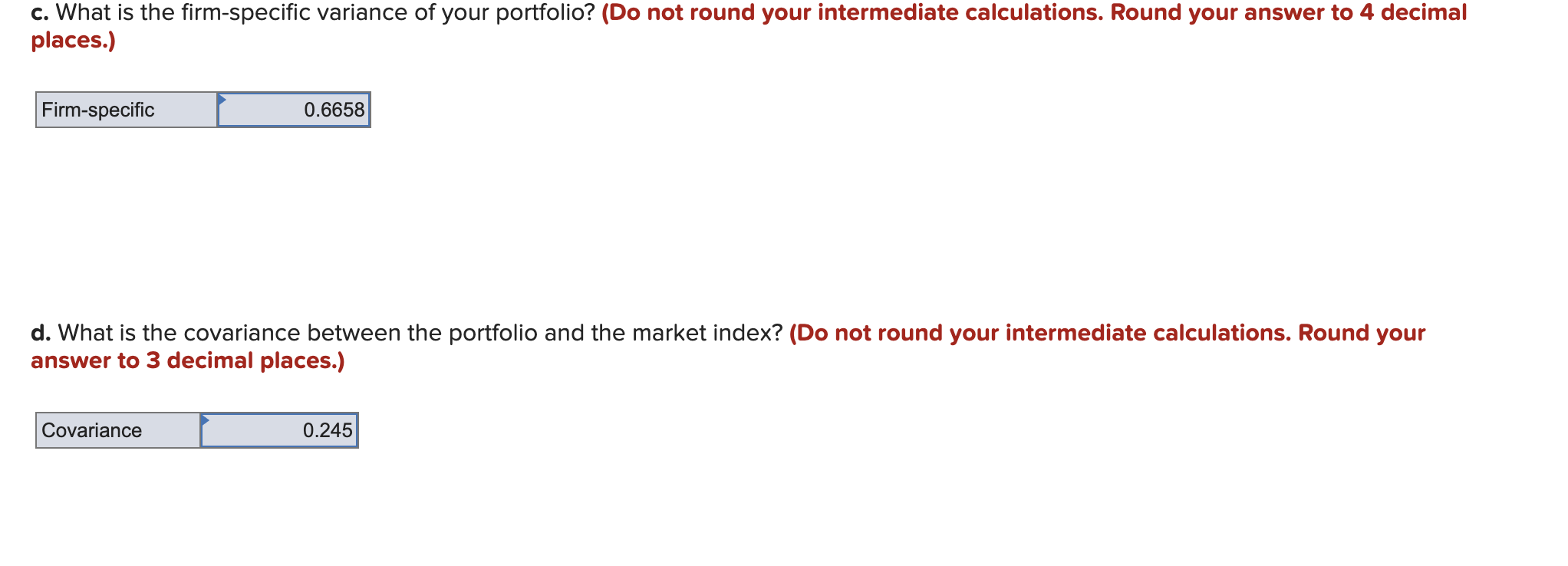

PLEASE HELP FOR PART C & D !!

PART A & B ARE CORRECT

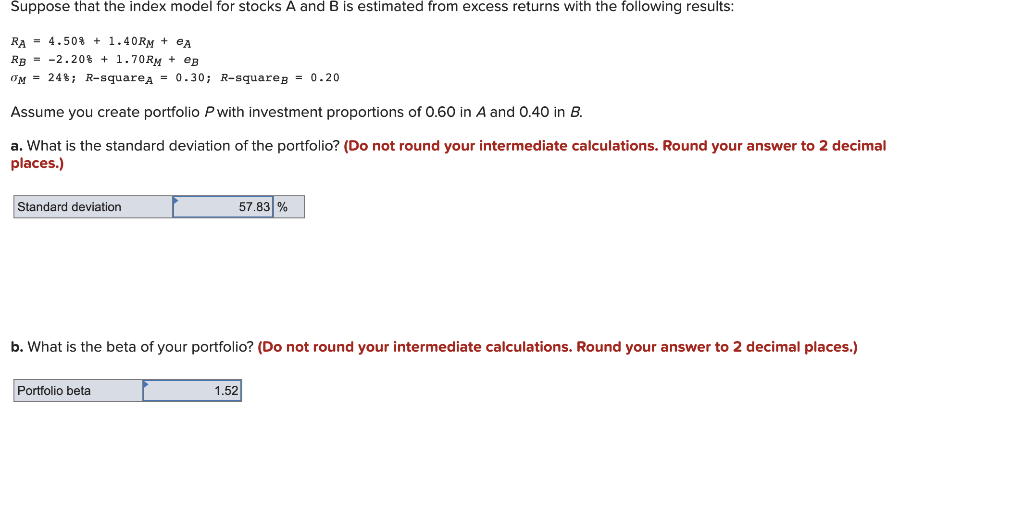

RA=4.508+1.40RM+eARB=2.20z+1.70RM+eBM=248;RsquareA=0.30;R-squareB=0.20 Assume you create portfolio P with investment proportions of 0.60 in A and 0.40 in B. a. What is the standard deviation of the portfolio? (Do not round your intermediate calculations. Round your answer to 2 decimal places.) b. What is the beta of your portfolio? (Do not round your intermediate calculations. Round your answer to 2 decimal places.) d. What is the covariance between the portfolio and the market index? (Do not round your intermediate calculations. Round your answer to 3 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts