Question: PLEASE HELP FOR THE FINANCIAL STATEMENT Due to the limit of Chegg wrods per question. I cannot copy and paste all the collums inside Complete

PLEASE HELP FOR THE FINANCIAL STATEMENT

Due to the limit of Chegg wrods per question. I cannot copy and paste all the collums inside

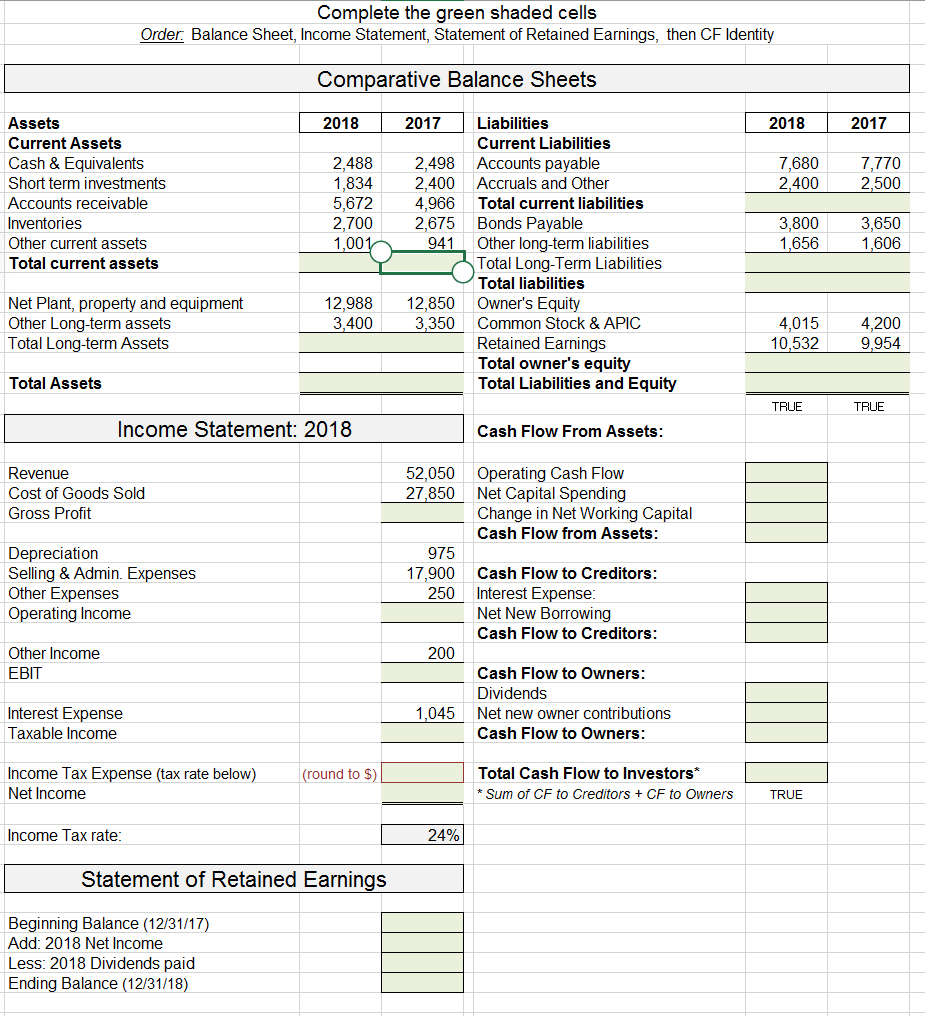

Complete the green shaded cells Order. Balance Sheet, Income Statement, Statement of Retained Earnings, then CF Identity Comparative Balance Sheets 2018 | 2017 2018 2017 7,680 2,400 7,770 2,500 Assets Current Assets Cash & Equivalents Short term investments Accounts receivable Inventories Other current assets Total current assets 2,488 1,834 5,672 2,700 1,001 2,498 2,400 4,966 2,675 941 3,800 1,656 3,650 1,606 Liabilities Current Liabilities Accounts payable Accruals and Other Total current liabilities Bonds Payable Other long-term liabilities Total Long-Term Liabilities Total liabilities Owner's Equity Common Stock & APIC Retained Earnings Total owner's equity Total Liabilities and Equity Net Plant, property and equipment Other Long-term assets Total Long-term Assets 12,988 3,400 12,850 3,350 4,015 10,532 4,200 9,954 Total Assets TRUE TRUE Income Statement: 2018 Cash Flow From Assets: Revenue Cost of Goods Sold Gross Profit 52,050 27,850 Operating Cash Flow Net Capital Spending Change in Net Working Capital Cash Flow from Assets: Depreciation Selling & Admin. Expenses Other Expenses Operating Income 975 17,900 250 Cash Flow to Creditors: Interest Expense: Net New Borrowing Cash Flow to Creditors: 200 Other Income EBIT 1,045 Cash Flow to Owners: Dividends Net new owner contributions Cash Flow to Owners: Interest Expense Taxable income Income Tax Expense (tax rate below) Net Income (round to $) Total Cash Flow to Investors* *Sum of CF to Creditors + CF to Owners TRUE Income Tax rate: 24% Statement of Retained Earnings Beginning Balance (12/31/17) Add: 2018 Net Income Less: 2018 Dividends paid Ending Balance (12/31/18)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts