Question: please help for this question 2 Moral Hazard and Adverse Selection(50') We change the setting of question 1 slightly to discuss the effect of moral

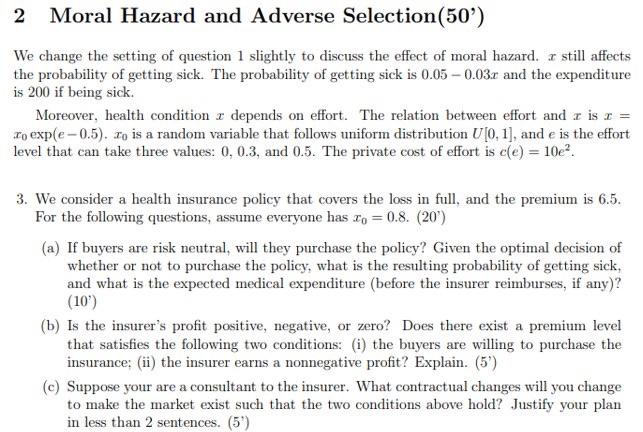

2 Moral Hazard and Adverse Selection(50') We change the setting of question 1 slightly to discuss the effect of moral hazard. still affects the probability of getting sick. The probability of getting sick is 0.05 -0.03. and the expenditure is 200 if being sick. Moreover, health condition r depends on effort. The relation between effort and r is r = To exp(e-0.5). To is a random variable that follows uniform distribution U[0,1], and e is the effort level that can take three values: 0.0.3, and 0.5. The private cost of effort is cle) = 10e. 3. We consider a health insurance policy that covers the loss in full, and the premium is 6.5. For the following questions, assume everyone has to = 0.8. (20") (a) If buyers are risk neutral, will they purchase the policy? Given the optimal decision of whether or not to purchase the policy, what is the resulting probability of getting sick, and what is the expected medical expenditure (before the insurer reimburses, if any)? (10) (b) Is the insurer's profit positive, negative, or zero? Does there exist a premium level that satisfies the following two conditions: (i) the buyers are willing to purchase the insurance; (ii) the insurer earns a nonnegative profit? Explain. (5) (c) Suppose your are a consultant to the insurer. What contractual changes will you change to make the market exist such that the two conditions above hold? Justify your plan in less than 2 sentences. (5') 2 Moral Hazard and Adverse Selection(50') We change the setting of question 1 slightly to discuss the effect of moral hazard. still affects the probability of getting sick. The probability of getting sick is 0.05 -0.03. and the expenditure is 200 if being sick. Moreover, health condition r depends on effort. The relation between effort and r is r = To exp(e-0.5). To is a random variable that follows uniform distribution U[0,1], and e is the effort level that can take three values: 0.0.3, and 0.5. The private cost of effort is cle) = 10e. 3. We consider a health insurance policy that covers the loss in full, and the premium is 6.5. For the following questions, assume everyone has to = 0.8. (20") (a) If buyers are risk neutral, will they purchase the policy? Given the optimal decision of whether or not to purchase the policy, what is the resulting probability of getting sick, and what is the expected medical expenditure (before the insurer reimburses, if any)? (10) (b) Is the insurer's profit positive, negative, or zero? Does there exist a premium level that satisfies the following two conditions: (i) the buyers are willing to purchase the insurance; (ii) the insurer earns a nonnegative profit? Explain. (5) (c) Suppose your are a consultant to the insurer. What contractual changes will you change to make the market exist such that the two conditions above hold? Justify your plan in less than 2 sentences. (5')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts