Question: PLEASE HELP!!! Ford Motors has decided to shift its strategy away from fully electric vehicles ( NY Times article ) . To promote the quality

PLEASE HELP!!!

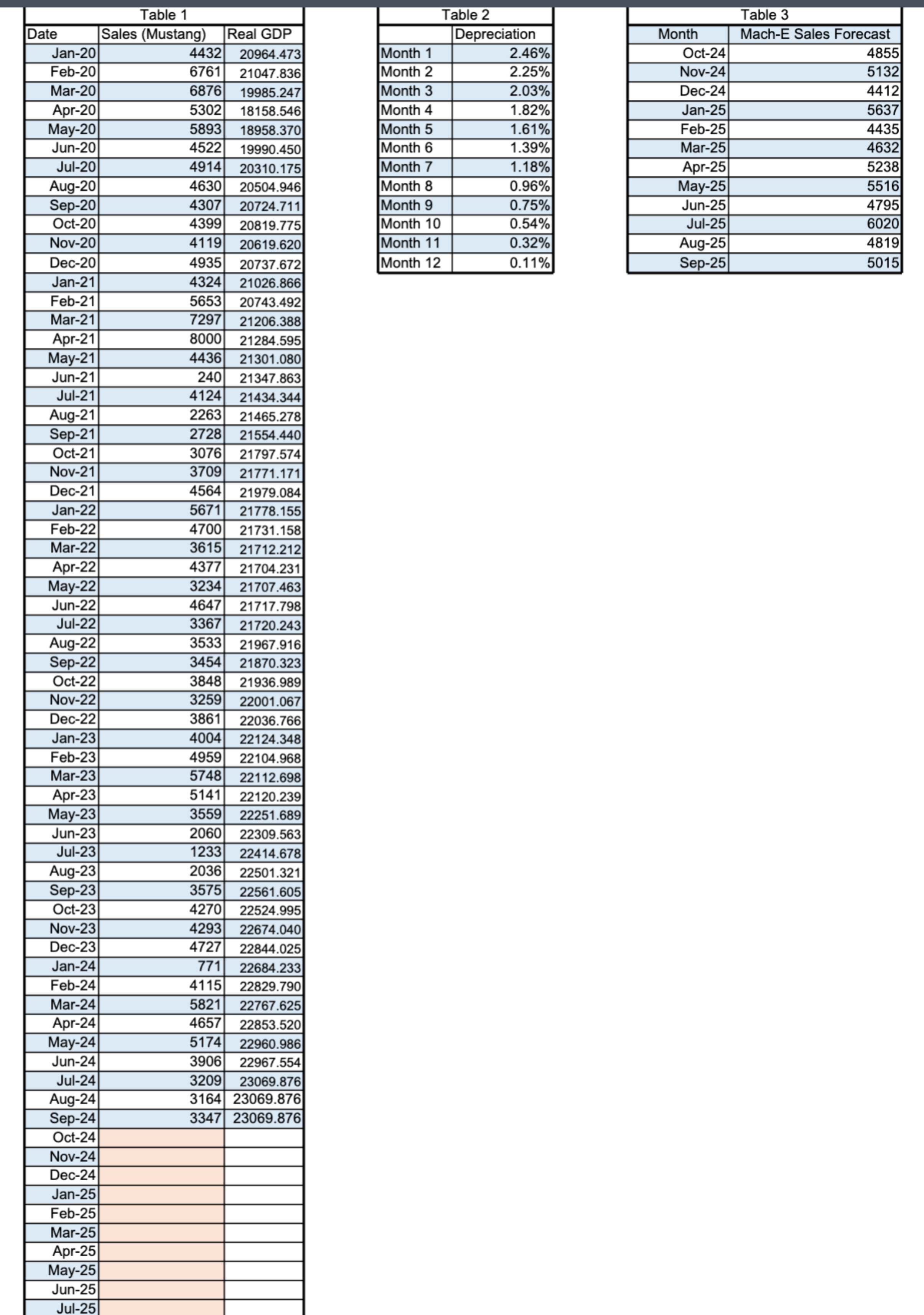

Ford Motors has decided to shift its strategy away from fully electric vehicles NY Times article To promote the quality of its hybrid cars, Jim Farley CEO plans to launch a special edition hybrid Mustang. Sales for this new model would begin in October and end in September

Ford plans to sell this new vehicle for $ and can manufacture each car for $ as variable costs. Fixed costs are estimated at million dollars per month. The necessary equipment can be purchased for million dollars and depreciated on a MACRS schedule depreciation table in the data file You predict that the equipment can be sold at the end of the project for million dollars.

Jim Farley has asked his team to carefully study whether Ford should produce this new version of the Mustang. He understands the new product will define the brand's public perception, at least for the next decade. Because of this, Ford spent million dollars on a marketing study over the previous year and another million dollars developing the new vehicle's engine over the last five years.

This special edition will undoubtedly affect the sales of the current models, particularly the Ford MachE SUV version of the Mustang Currently, the MachE is sold at $ with variable costs of $ and forecasted sales following the "MachE sales" table in the data file. If Ford produces the new vehicle, the price of the MachE will need to be reduced to $ and sales for the MachE are estimated to be reduced by relative to the current forecast.

Ford's policy is to set net working capital requirements at of sales, which will occur with the timing of the cash flows for October Month This means there is no initial outlay for NWC but changes in

NWC will first occur in Month The corporate tax rate is and the required rate of return is per year with annual compounding.

Due to the difficulty of predicting market reactions to new products, Ford analysts are not sure about the predicted decrease in sales for the MachE as well as the new price for the MachE if the Mustang

project is approved and would like you to focus your sensitivity analysis on these variables. They have provided you with some bounds for these variables. They believe the decrease in sales for the MachE will

most likely be between and and that the sale price for the MachE if the Mustang is approved, will be between $ and $

As an external consultant, your task is to evaluate this project. You are required to write a report and give your recommendation to accept or reject it Your recommendation must be technical and based on a

thorough analysis of the techniques studied in this course.

You must include estimated cash flows, three investment criteria measures NPV IRR, and one of your choice and a project analysis based on a case scenario and sensitivity analysis. You are required to analyze and interpret your results points will be deducted if your numerical answers don't have a written interpretation of the results

Here is a todo list that will help you to work through this problem:

Forecast monthly sales using the available historical data. You must decide which of the forecasting techniques discussed in class you will use and justify your decision. Use the data in Table for your forecast. You dont need to use all the data in Table if you dont think it is appropriate. DO NOT USE THE MACHE SALES FORECAST TABLE TABLE TO FORECAST SALES FOR THE MUSTANG

Obtain depreciation and book value for each of the periods

Obtain the proforma income statement Hint: Remember to always use incremental cash flows and the standalone principle. Be careful with the erosion effect for the MachE Specifically, you should take into

account the reduction in sales and the reduction in variable costs

Obtain the Operating Cash flows

Obtain the changes in Net Working Capital

Obtain capital spending; be careful with the tax implications of selling the equipment at the end of the project.

Obtain the project cash flows

the frequency of the project is monthly, so we need to transform the rate from per year with annual compounding to per month with monthly compounding.

Obtain Investment criteria measures

Obtain the bestcase scenario and worstcase scenario by changing the variables appropriately and recording the investment criteria measures in each case

obtain the sensitivity analysis: graphing will help with your analysis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock