Question: Please help give the simple outcome answer, just the outcome for the blank is ok. links Q25: https://sp.jpmorgan.com/spweb/products/detail/MAP273809/index.html Q28: https://ycharts.com/indicators/10_year_treasury_rate#:~:text=Historically%2C%20the%2010%20Year%20treasury,long%20term%20average%20of%204.38%25 Which of the following profit

Please help give the simple outcome answer, just the outcome for the blank is ok.

links

Q25:

https://sp.jpmorgan.com/spweb/products/detail/MAP273809/index.html

Q28:

https://ycharts.com/indicators/10_year_treasury_rate#:~:text=Historically%2C%20the%2010%20Year%20treasury,long%20term%20average%20of%204.38%25

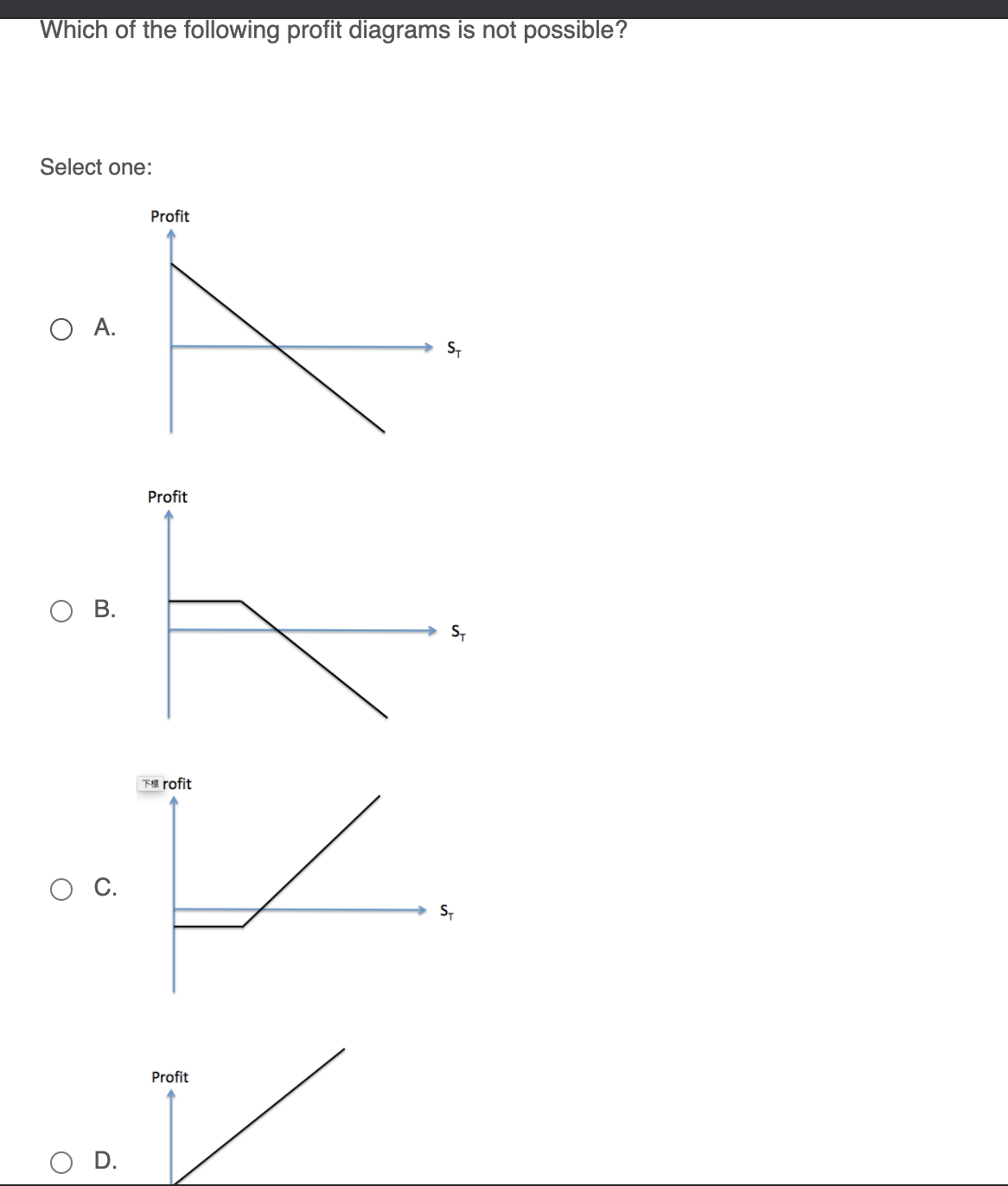

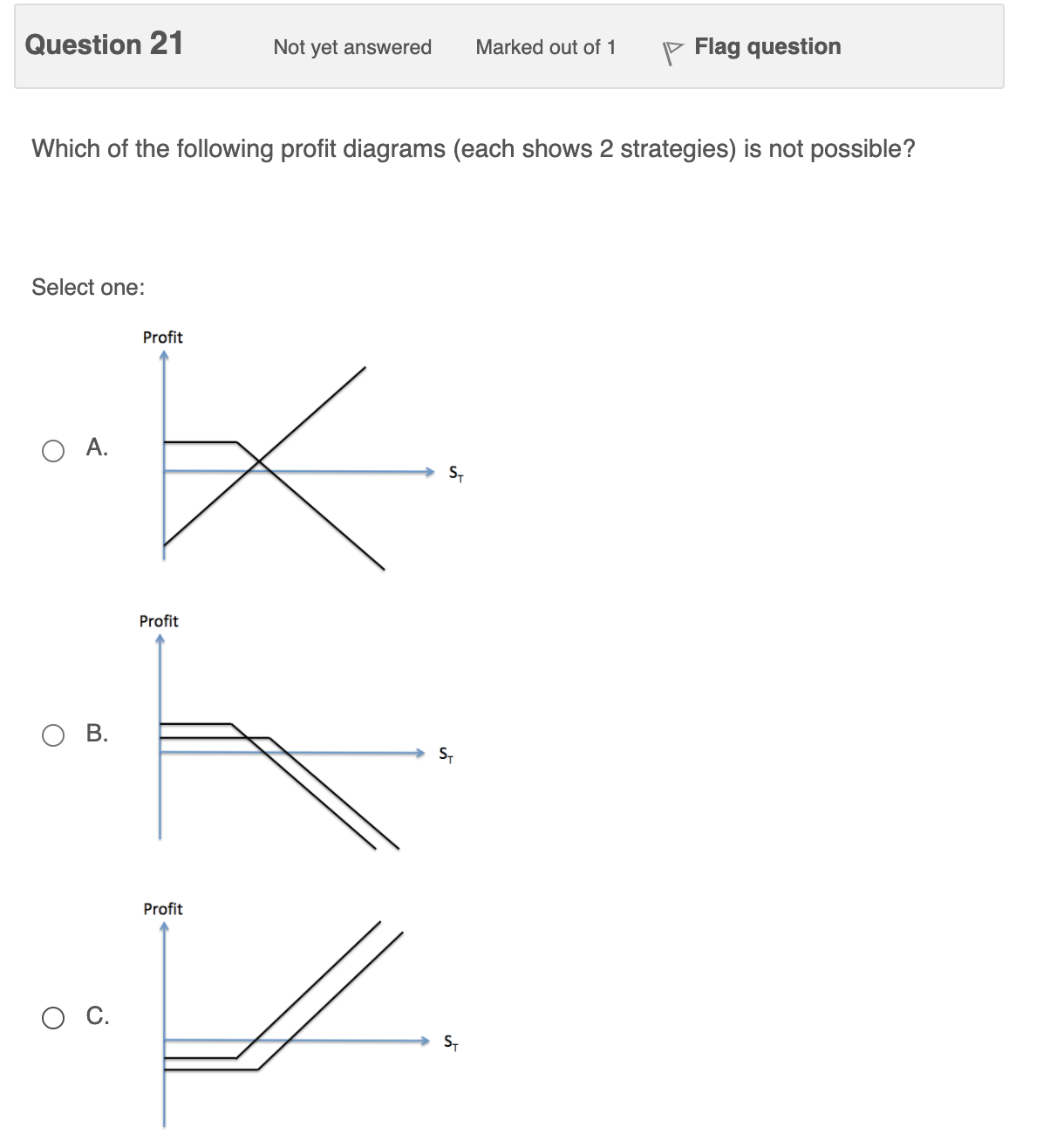

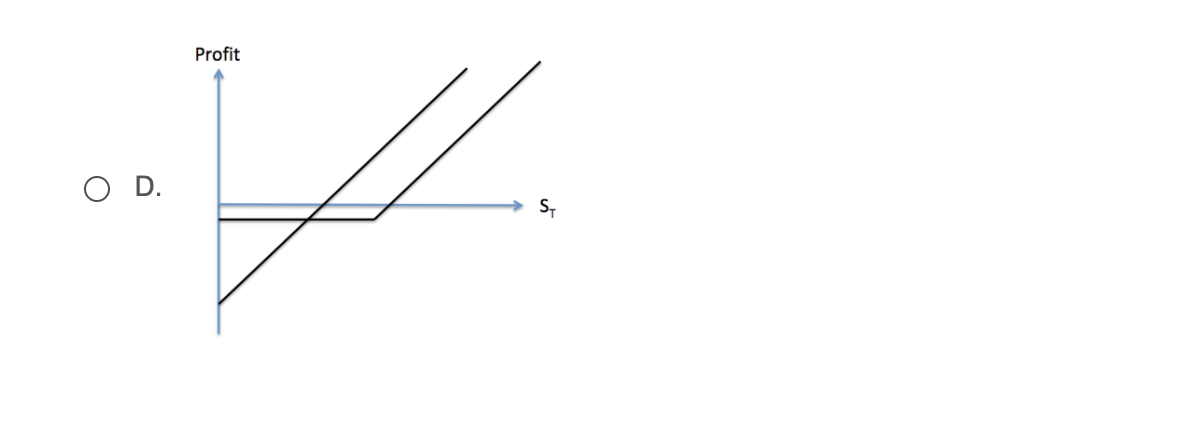

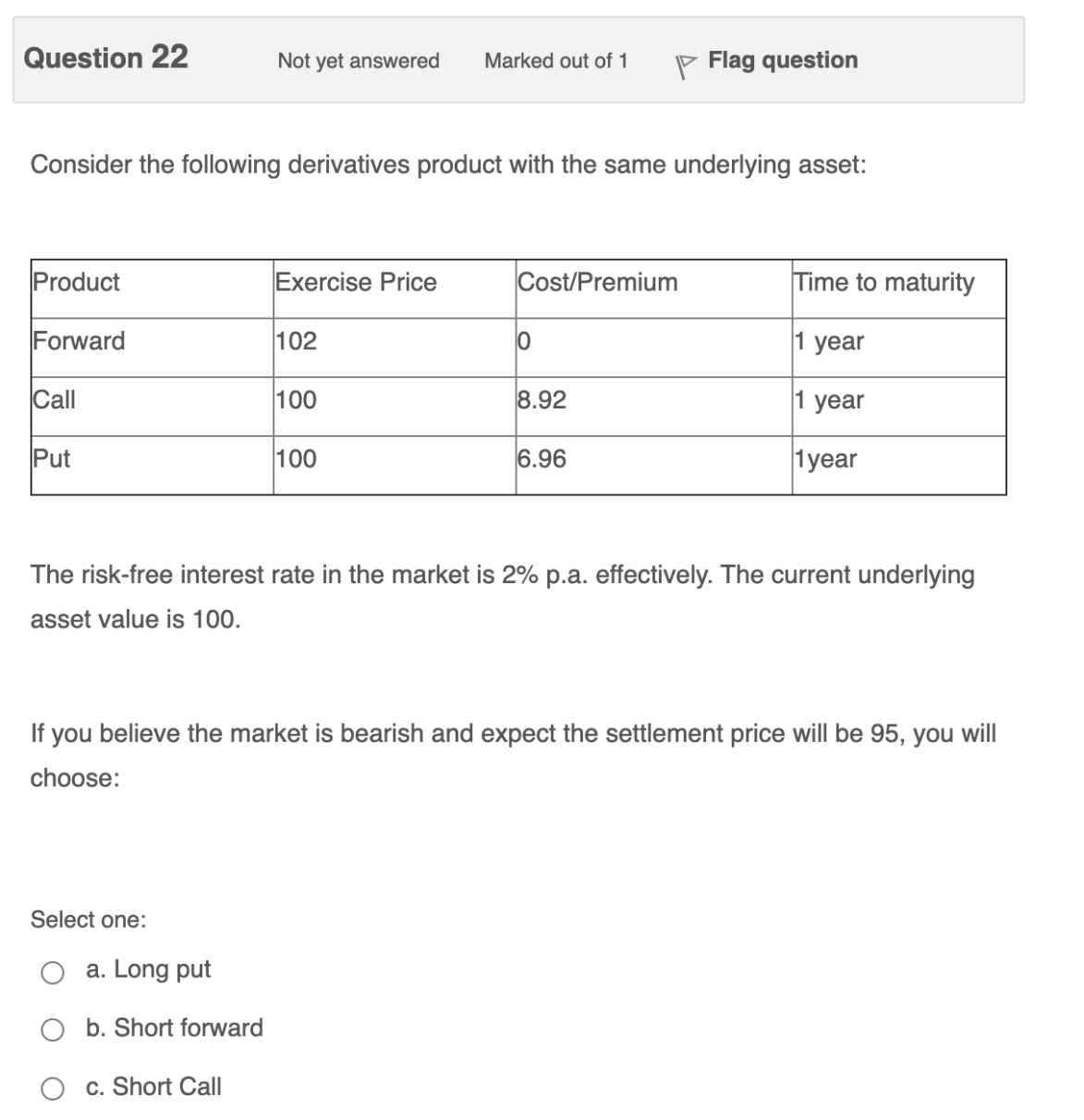

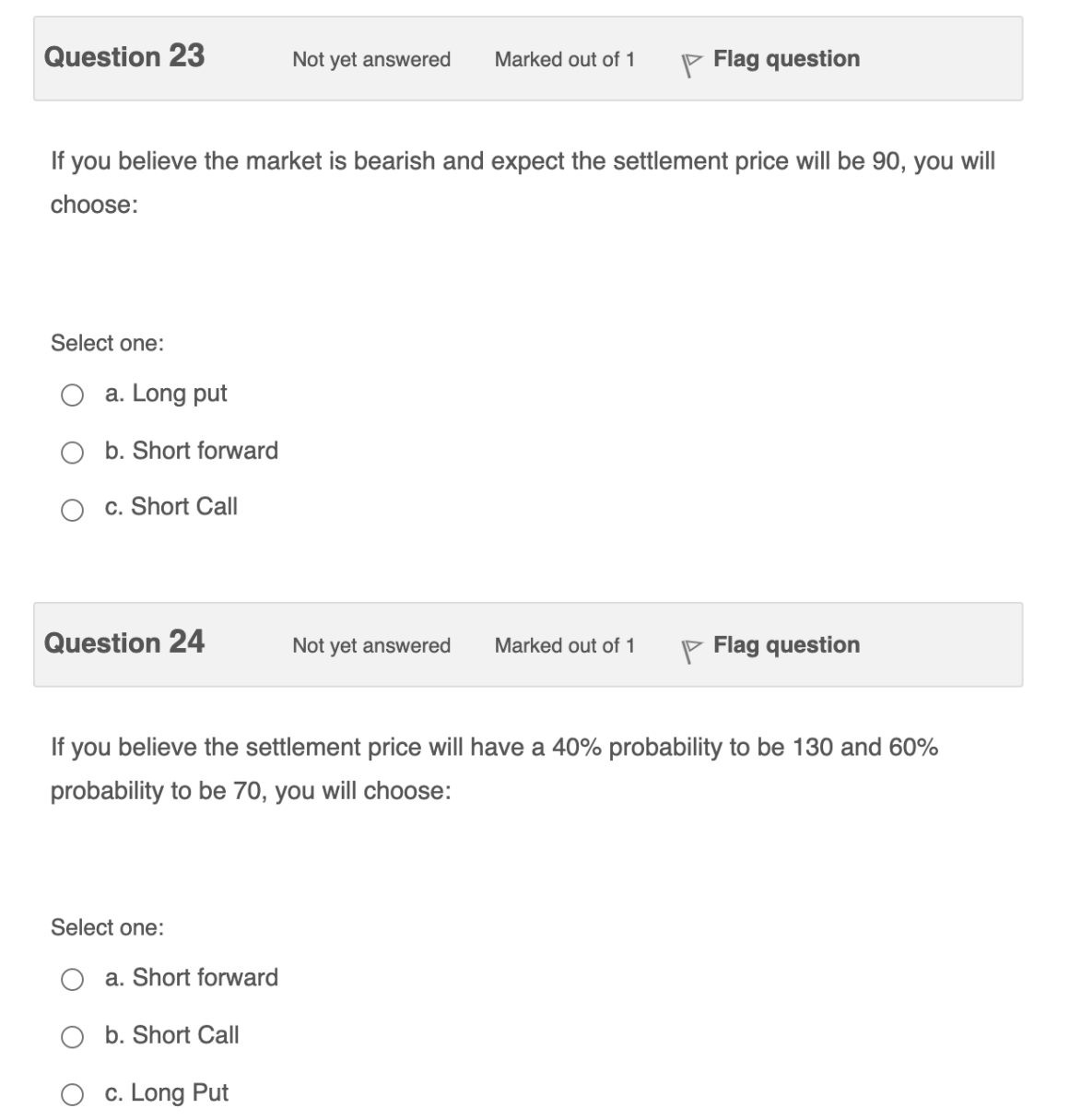

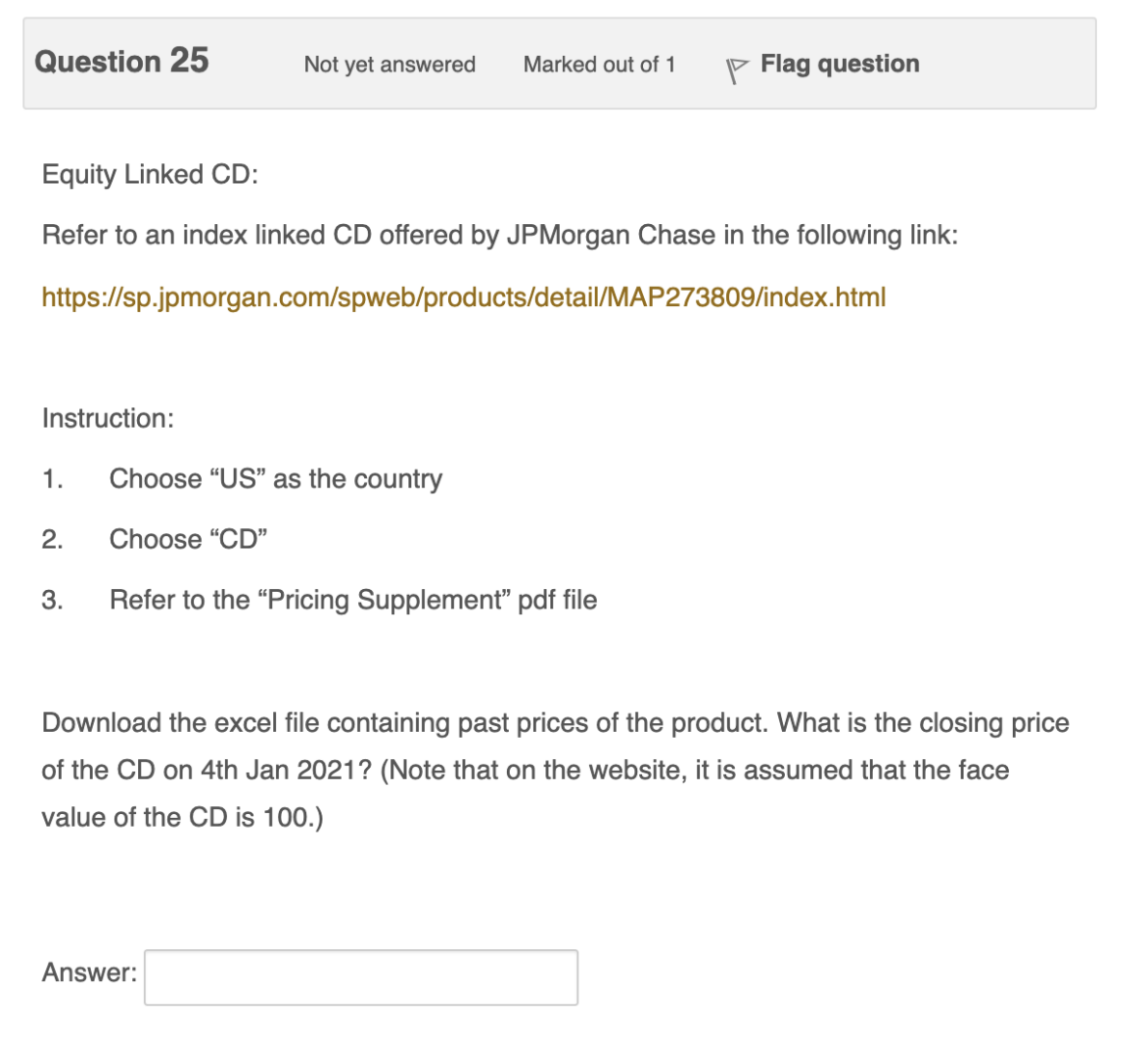

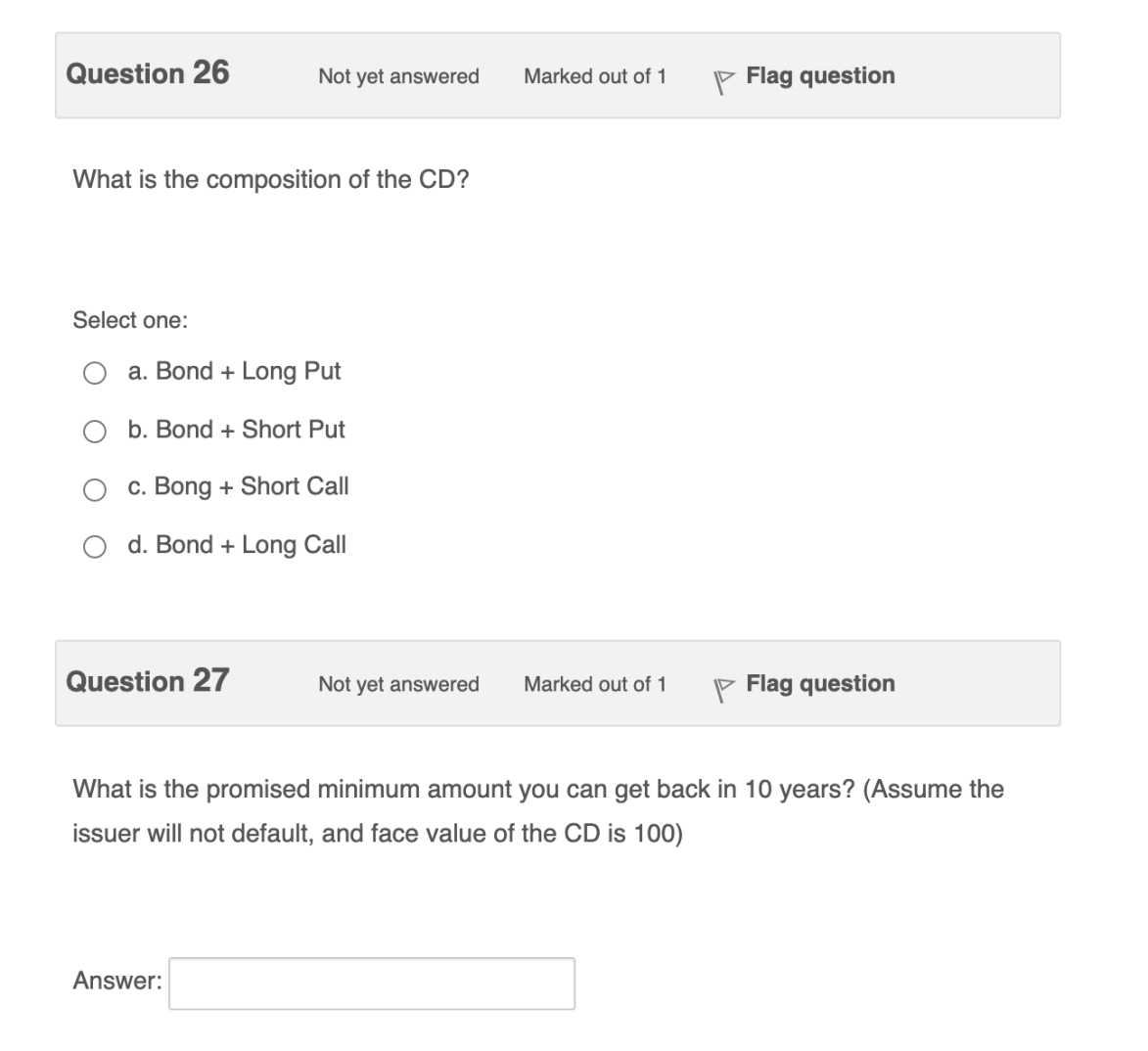

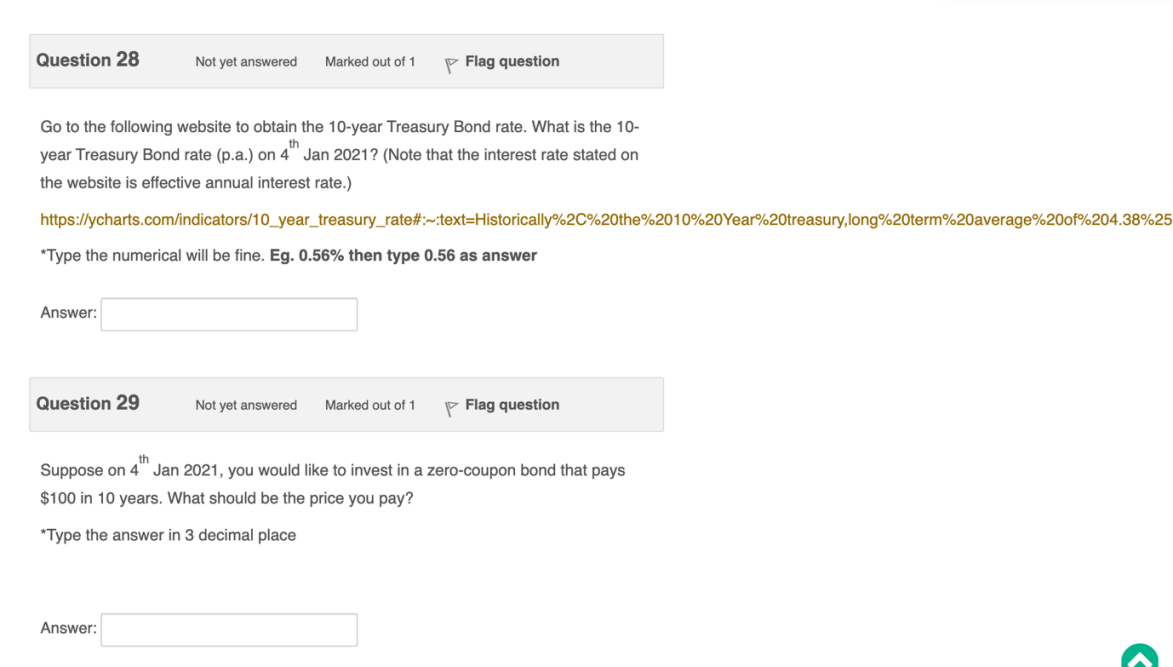

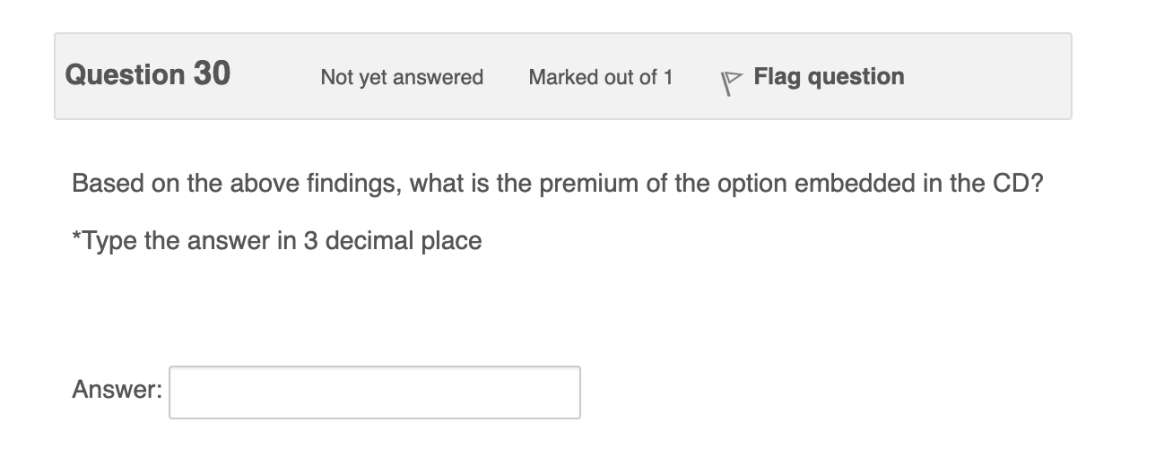

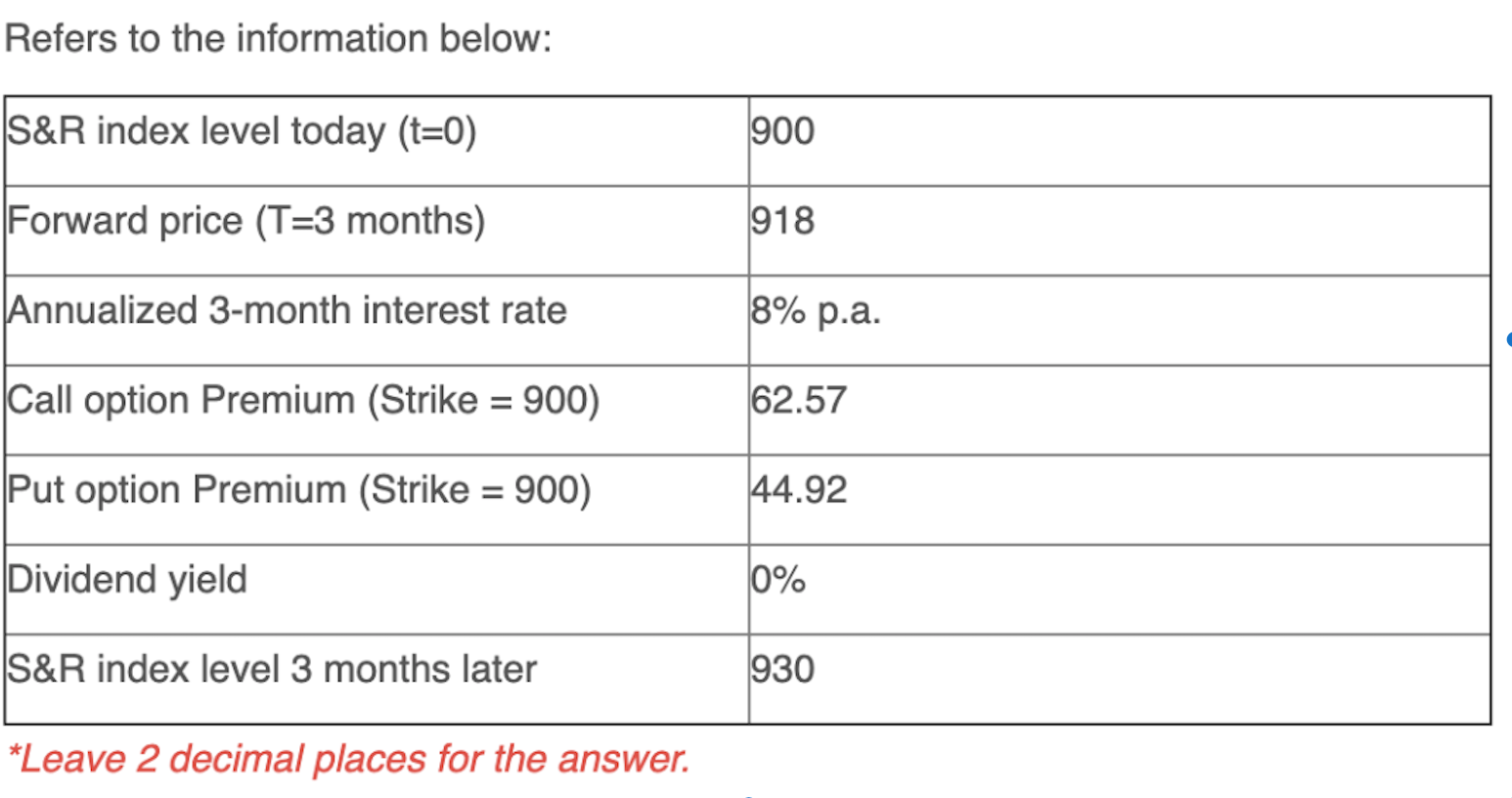

Which of the following profit diagrams is not possible? Select one: Profit O A. ST Profit O B. ST F# rofit O C. ST Profit O D.Question 21 Not yet answered Marked out of 1 V Flag question Which of the following profit diagrams (each shows 2 strategies) is not possible? Select one: Prot 0 A sT Prot 0 B. sT Prot 0 c. \fQuestion 22 Not yet answered Marked out of 1 \\V Flag question Consider the following derivatives product with the same underlying asset: Exercise Price me to maturity 102 I 1 year The risk-free interest rate in the market is 2% p.a. effectively. The current underlying asset value is 100. If you believe the market is bearish and expect the settlement price will be 95, you will choose: Select one: Q a. Long put 0 b. Short fowvard O 0. Short Call Question 23 Not yet answered Marked out at 1 '9' Flag question If you believe the market is bearish and expect the settlement price will be 90, you will choose: Select one: Q a. Long put 0 b. Short forward 0 c. Short Call Question 24 Not yet answered Marked out 011 V Flag question If you believe the settlement price will have a 40% probability to be 130 and 60% probability to be 70, you will choose: Select one: Q a. Short toward 0 b. Short Call 0 0. Long Put Question 25 Not yet answered Marked out of 1 Flag question Equity Linked CD: Refer to an index linked CD offered by JPMorgan Chase in the following link: https://sp.jpmorgan.com/spweb/products/detail/MAP273809/index.html Instruction: 1. Choose "US" as the country 2. Choose "CD" 3. Refer to the "Pricing Supplement" pdf file Download the excel file containing past prices of the product. What is the closing price of the CD on 4th Jan 2021? (Note that on the website, it is assumed that the face value of the CD is 100.) Answer:Question 26 Not yet answered Marked out of1 V Flag question What is the composition of the CD? Select one: Q a. Bond + Long Put 0 b. Bond + Short Put 0 c. Bong + Short Call 0 d. Bond + Long Call Question 27 Not yet answered Marked out of 1 V Flag questlon What is the promised minimum amount you can get back in 10 years? (Assume the issuer will not default, and face value of the CD is 100) Answer: Question 28 Not yet answered Marked out of 1 P Flag question Go to the following website to obtain the 10-year Treasury Bond rate. What is the 10- year Treasury Bond rate (p.a.) on 4" Jan 2021? (Note that the interest rate stated on the website is effective annual interest rate.) https://ycharts.com/indicators/10_year_treasury_rate#:~:text=Historically%20%20the%2010%20Year%20treasury,long%20term%20average%20of%204.38%25 *Type the numerical will be fine. Eg. 0.56% then type 0.56 as answer Answer: Question 29 Not yet answered Marked out of 1 Flag question Suppose on 4" Jan 2021, you would like to invest in a zero-coupon bond that pays $100 in 10 years. What should be the price you pay? *Type the answer in 3 decimal place Answer:Question 30 Not yet answered Marked out at 1 V Flag question Based on the above findings, what is the premium of the option embedded in the CD? *Type the answer in 3 decimal place Answer: Refers to the information below: &R index level today (t=0) Forward price (T=3 months) 'nnualized 3-month interest rate all option Premium (Strike = 900) Put option Premium (Strike = 900) Dividend yield &R index level 3 months later *Leave 2 decimal places for the