Question: please help & help explain The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present

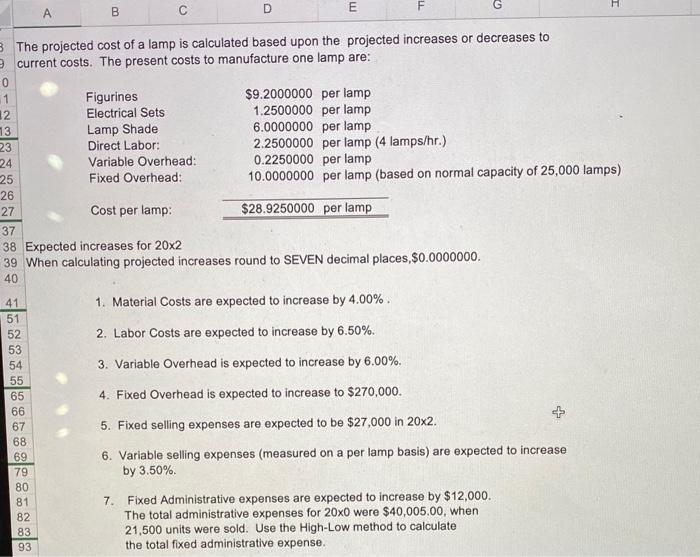

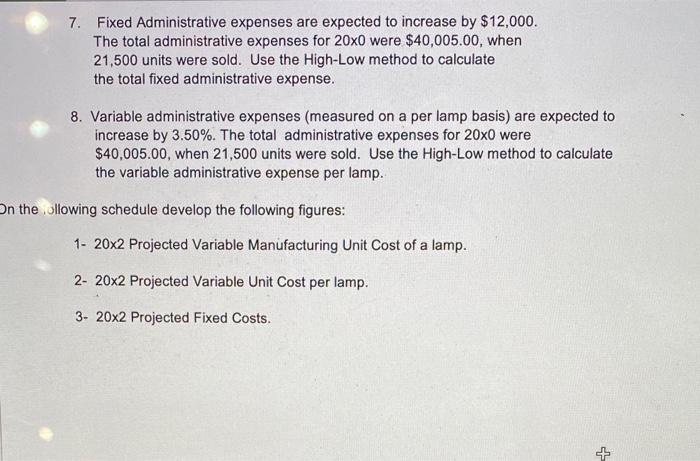

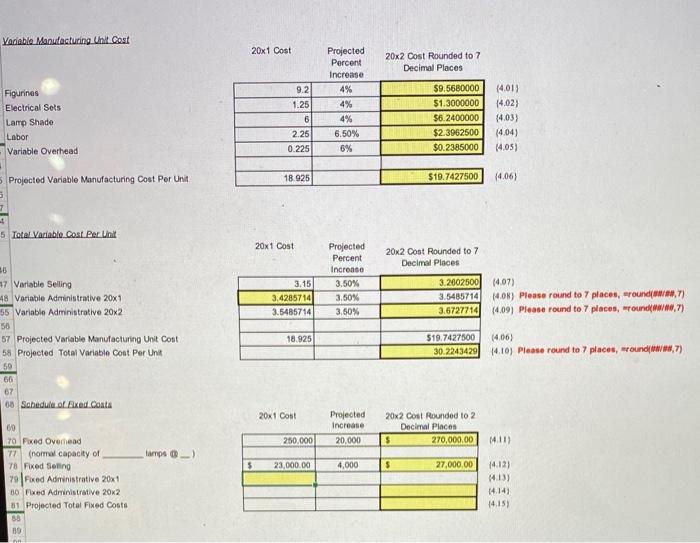

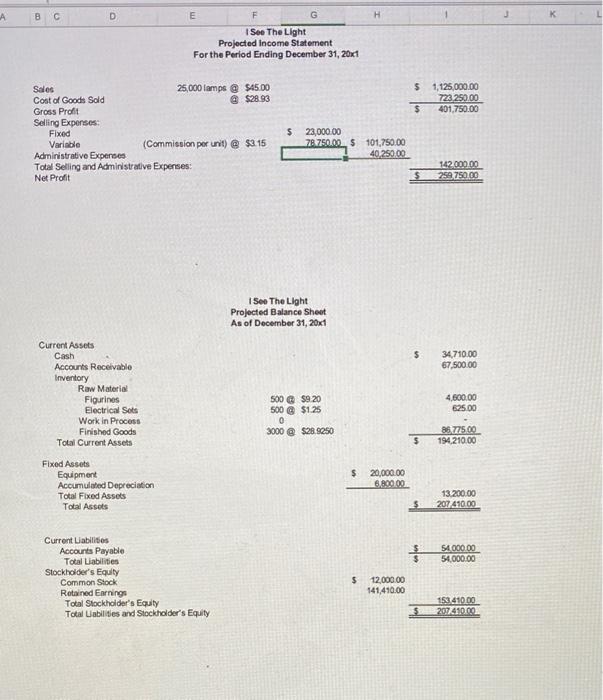

The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to SEVEN decimal places, $0.0000000. 1. Material Costs are expected to increase by 4.00%. 2. Labor Costs are expected to increase by 6.50%. 3. Variable Overhead is expected to increase by 6.00%. 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed selling expenses are expected to be $27,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.50%. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. . Illowing schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. Variable Manudacturing Unit cost 201costDecimalPlacesProjectedPercentInrrasen202costRoundedto7 Figurinas Electrical Sets Lamp Shade Labor Variable Overhead Projocted Variable Manufacturing Cost Per Unit Please round to 7 places, =round(aw/en, 7) A C Sales Cost of Goods Sold Gross Prolt Selling Experses: Fixod Variable Administrativo Experses Total Selling and Administrative Experses: Net Proft Projocted income Statement For the Period Ending December 31, 20x1 \begin{tabular}{rr} 5723,250.001,125,000.00 \\ \hline 5 & 401,750.00 \\ \hline 50.14200000 \\ \hline 509750.00 \\ \hline \end{tabular} Fixed Assets Equipment Accumulded Depreciation Total Fixed Assots Current Assets Cash Accounts Reccetvablo Invertory Raw Materid Figurinos Electrical Sots Work in Process Finishod Goods Total Current Assets Curront Labilisios Accourts Payable Tocal Liablities Stockholder's Equity Common Stock Retained Enrringa Total Stockholder's Equity TotalUabiltesandSiockholdersEquity 512,000,00141,410.005207,41000153,41000 The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to SEVEN decimal places, $0.0000000. 1. Material Costs are expected to increase by 4.00%. 2. Labor Costs are expected to increase by 6.50%. 3. Variable Overhead is expected to increase by 6.00%. 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed selling expenses are expected to be $27,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.50%. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. . Illowing schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. Variable Manudacturing Unit cost 201costDecimalPlacesProjectedPercentInrrasen202costRoundedto7 Figurinas Electrical Sets Lamp Shade Labor Variable Overhead Projocted Variable Manufacturing Cost Per Unit Please round to 7 places, =round(aw/en, 7) A C Sales Cost of Goods Sold Gross Prolt Selling Experses: Fixod Variable Administrativo Experses Total Selling and Administrative Experses: Net Proft Projocted income Statement For the Period Ending December 31, 20x1 \begin{tabular}{rr} 5723,250.001,125,000.00 \\ \hline 5 & 401,750.00 \\ \hline 50.14200000 \\ \hline 509750.00 \\ \hline \end{tabular} Fixed Assets Equipment Accumulded Depreciation Total Fixed Assots Current Assets Cash Accounts Reccetvablo Invertory Raw Materid Figurinos Electrical Sots Work in Process Finishod Goods Total Current Assets Curront Labilisios Accourts Payable Tocal Liablities Stockholder's Equity Common Stock Retained Enrringa Total Stockholder's Equity TotalUabiltesandSiockholdersEquity 512,000,00141,410.005207,41000153,41000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts