Question: please help homework is due at 11 Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on October 1 for $54,880. The equipment was

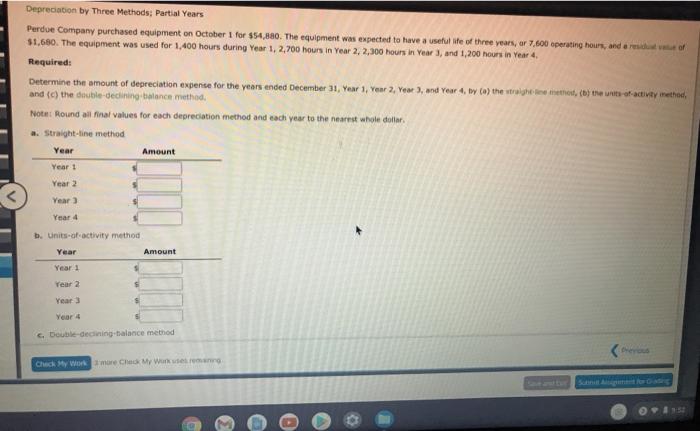

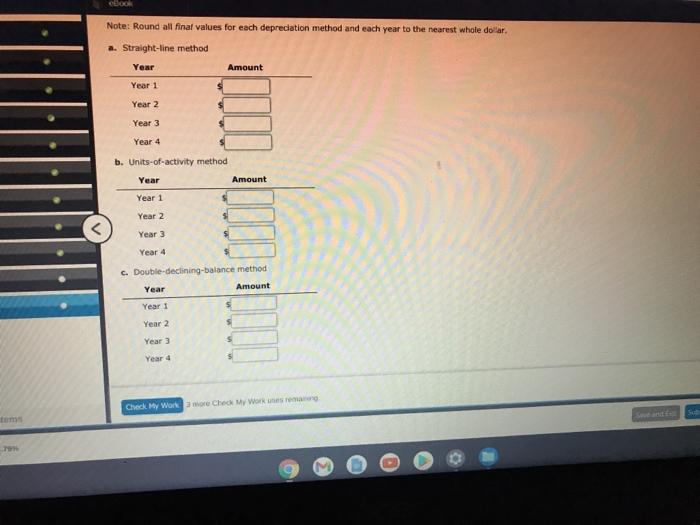

Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on October 1 for $54,880. The equipment was expected to have a useful ife of three years, ar 7.600 operating hours, and of $1,680. The equipment was used for 1.400 hours during Year 1, 2,700 hours in Year 2, 2,300 hours in Year, and 1,200 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Your 1, Year 2, Year), und Year 4. by (o) the right tot, coere was activity method, and (c) the double-declining balance method Note: Round all final values for each depreciation method and each year to the nearest wholu dollar. a. Straight-line method Year Amount Year ! Year 2 Year) $ Year 4 b. units of activity method Year Amount Year 1 Year 2 Year Year 4 Double-decining balance method Check My Workmore Check My Worker Note: Round all final values for each depreciation method and each year to the nearest whole dolar. a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 Year 2 Year 3 Year 4 c. Double-declining-balance method Year Amount Year 1 Year 2 Year 3 Year 4 Check My Work Check Worker

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts