Question: please help! I am asking to understand. Please how formulas with simple format. included part 1 solution Step 1: Consider the same problem as given

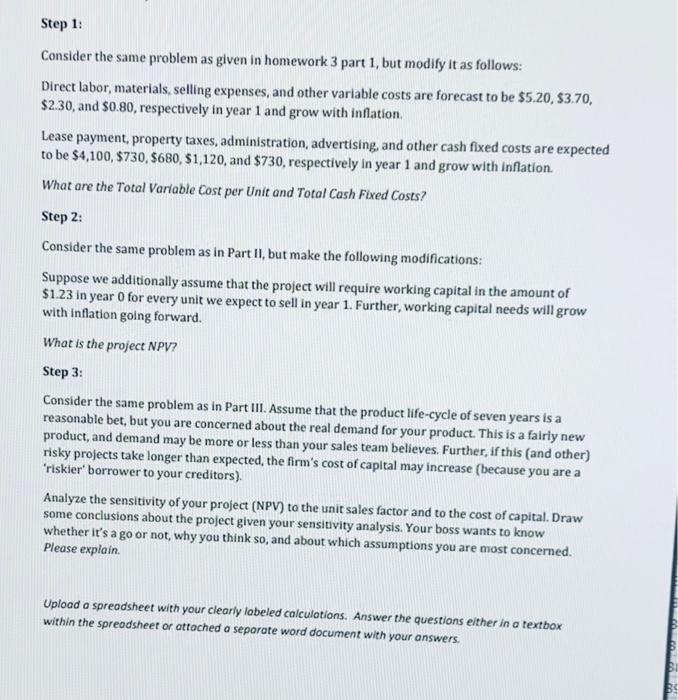

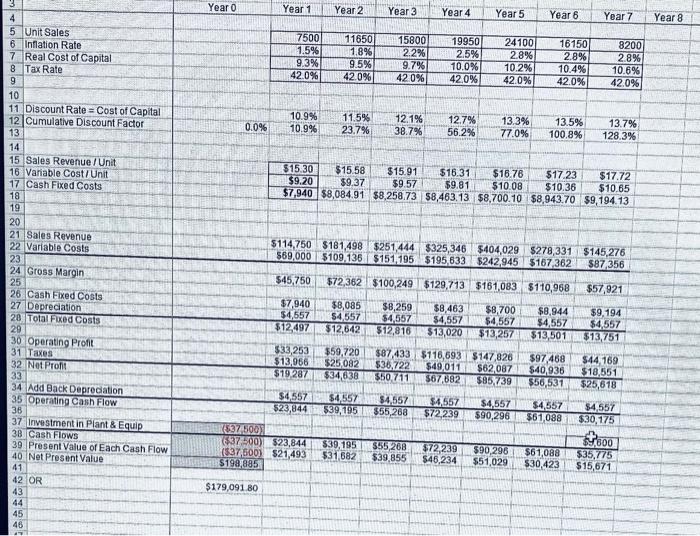

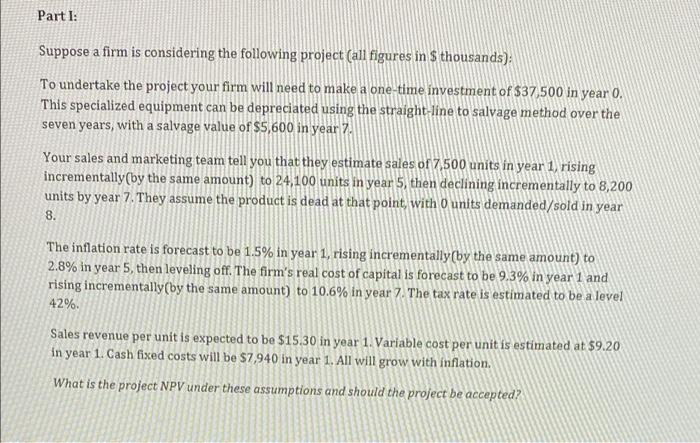

Step 1: Consider the same problem as given in homework 3 part 1, but modify it as follows: Direct labor, materials, selling expenses, and other variable costs are forecast to be $5.20, 370, $2.30, and $0.80, respectively in year 1 and grow with inflation Lease payment, property taxes, administration, advertising, and other cash fixed costs are expected to be $4,100,$730,5680, 81,120, and $730, respectively in year 1 and grow with inflation What are the Total Variable Cost per Unit and Total Cash Fixed Costs? Step 2: Consider the same problem as in Part II, but make the following modifications: Suppose we additionally assume that the project will require working capital in the amount of $1.23 in year 0 for every unit we expect to sell in year 1. Further, working capital needs will grow with inflation going forward. What is the project NPV? Step 3: Consider the same problem as in Part III. Assume that the product life-cycle of seven years is a reasonable bet, but you are concerned about the real demand for your product. This is a fairly new product, and demand may be more or less than your sales team believes. Further, if this and other) risky projects take longer than expected, the firm's cost of capital may increase (because you are a "riskler' borrower to your creditors). Analyze the sensitivity of your project (NPV) to the unit sales factor and to the cost of capital. Draw some conclusions about the project given your sensitivity analysis. Your boss wants to know whether it's a go or not, why you think so, and about which assumptions you are most concerned. Please explain Upload a spreadsheet with your clearly labeled calculations. Answer the questions either in a textbox within the spreadsheet or attached a separate word document with your answers, Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 7500 1.5% 9.3% 42.0% 11650 1.8% 9.5% 15800 2.2% 9.7% 420% 19950 2.5% 10.0% 42,0% 24100 2.8% 10.2% 42.0% 16150 2.8% 10.4% 42.0% 8200 2.8% 10.6% 42.096 42.0% 0.0% 10.9% 10.9% 11.5% 23.7% 12.1% 38.7% 12.7% 56.2% 13.3% 77.0% 13.5% 100.8% 13.7% 128.3% $15.30 $15.58 $15.91 $16.31 $16.76 $17.23 $17.72 $9.20 $9.37 $9.57 $9.81 $10.08 $10.36 $10.65 $7.940 $8,084.91 $8,258.73 $8,463.13 $8,700.10 $8,943.70 $9,194.13 $114,750 $181,498 $251,444 $325,3465404,029 $278,331 $145,276 $69,000 $109.136 $151 195 $195,633 $242,945 5167362 $87,356 4 5 Unit Sales 6 Inflation Rate 7 Real Cost of Capital 8 Tax Rate 9 10 11 Discount Rate = Cost of Capital 12 Cumulative Discount Factor 13 14 15 Sales Revenue / Unit 16 Variable Cost/Unit 17 Cash Fixed Costs 18 19 20 21 Sales Revenue 22 Variable Costs 23 24 Gross Margin 25 26 Cash Fixed Costs 27 Depreciation 20 Total Fixed Costs 29 30 Operating Profit 31 Taxes 32 Net Pront 33 34 Add Back Depreciation 35 Operating Cash Flow 38 37 Investment in Plant & Equip 38 Cash Flows 39 Present Value of Each Cash Flow 40 Net Present Value 41 42 OR 43 44 45 46 545,750 $72,362 $100,249 $129,713 $161,083 $110,968 $57,921 $7,940 $4,557 $12,497 $8,085 $4,557 $12,642 $8,259 $4,567 $12,816 $8,463 $4,557 $13,020 $8,700 $4,557 $13,257 $8.944 $4,557 $13,501 $9,194 $4,557 $13,751 $33,253 $13,066 $19.287 $59,720 $25,082 $34,638 $87,433 $116,693 $147,826 $36,722 $49,011 $62,087 $50.711 $67,682 $85,739 $97,468 $40,936 $50,531 $44 169 $18,551 $25,618 $4,557 $23,844 $4,557 $39,105 $4,557 $55,268 $4,557 $72,239 $4,557 $90,296 $4,557 $61,088 $4,557 $30,175 532500) ($37.500) $23,844 ($37,500 $21,493 S198,885 9 $39,195 $31,682 $55,268 $39,855 $72,239 $46,234 $90.296 $51,029 $61,088 $30,423 $800 $35,775 $15,671 $179,091 80 Part I: Suppose a firm is considering the following project (all figures in $ thousands); To undertake the project your firm will need to make a one-time investment of $37.500 in year 0. This specialized equipment can be depreciated using the straight-line to salvage method over the seven years, with a salvage value of $5,600 in year 7. Your sales and marketing team tell you that they estimate sales of 7,500 units in year 1, rising incrementally(by the same amount) to 24,100 units in year 5, then declining incrementally to 8,200 units by year 7. They assume the product is dead at that point, with O units demanded/sold in year 8. The inflation rate is forecast to be 1.5% in year 1, rising incrementally by the same amount) to 2.8% in year 5, then leveling off. The firm's real cost of capital is forecast to be 9.3% in year 1 and rising incrementally by the same amount) to 10.6% in year 7 The tax rate is estimated to be a level 42% Sales revenue per unit is expected to be $15.30 in year 1. Variable cost per unit is estimated at $9.20 in year 1. Cash fixed costs will be $7,940 in year 1. All will grow with inflation. What is the project NPV under these assumptions and should the project be accepted? Step 1: Consider the same problem as given in homework 3 part 1, but modify it as follows: Direct labor, materials, selling expenses, and other variable costs are forecast to be $5.20, 370, $2.30, and $0.80, respectively in year 1 and grow with inflation Lease payment, property taxes, administration, advertising, and other cash fixed costs are expected to be $4,100,$730,5680, 81,120, and $730, respectively in year 1 and grow with inflation What are the Total Variable Cost per Unit and Total Cash Fixed Costs? Step 2: Consider the same problem as in Part II, but make the following modifications: Suppose we additionally assume that the project will require working capital in the amount of $1.23 in year 0 for every unit we expect to sell in year 1. Further, working capital needs will grow with inflation going forward. What is the project NPV? Step 3: Consider the same problem as in Part III. Assume that the product life-cycle of seven years is a reasonable bet, but you are concerned about the real demand for your product. This is a fairly new product, and demand may be more or less than your sales team believes. Further, if this and other) risky projects take longer than expected, the firm's cost of capital may increase (because you are a "riskler' borrower to your creditors). Analyze the sensitivity of your project (NPV) to the unit sales factor and to the cost of capital. Draw some conclusions about the project given your sensitivity analysis. Your boss wants to know whether it's a go or not, why you think so, and about which assumptions you are most concerned. Please explain Upload a spreadsheet with your clearly labeled calculations. Answer the questions either in a textbox within the spreadsheet or attached a separate word document with your answers, Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 7500 1.5% 9.3% 42.0% 11650 1.8% 9.5% 15800 2.2% 9.7% 420% 19950 2.5% 10.0% 42,0% 24100 2.8% 10.2% 42.0% 16150 2.8% 10.4% 42.0% 8200 2.8% 10.6% 42.096 42.0% 0.0% 10.9% 10.9% 11.5% 23.7% 12.1% 38.7% 12.7% 56.2% 13.3% 77.0% 13.5% 100.8% 13.7% 128.3% $15.30 $15.58 $15.91 $16.31 $16.76 $17.23 $17.72 $9.20 $9.37 $9.57 $9.81 $10.08 $10.36 $10.65 $7.940 $8,084.91 $8,258.73 $8,463.13 $8,700.10 $8,943.70 $9,194.13 $114,750 $181,498 $251,444 $325,3465404,029 $278,331 $145,276 $69,000 $109.136 $151 195 $195,633 $242,945 5167362 $87,356 4 5 Unit Sales 6 Inflation Rate 7 Real Cost of Capital 8 Tax Rate 9 10 11 Discount Rate = Cost of Capital 12 Cumulative Discount Factor 13 14 15 Sales Revenue / Unit 16 Variable Cost/Unit 17 Cash Fixed Costs 18 19 20 21 Sales Revenue 22 Variable Costs 23 24 Gross Margin 25 26 Cash Fixed Costs 27 Depreciation 20 Total Fixed Costs 29 30 Operating Profit 31 Taxes 32 Net Pront 33 34 Add Back Depreciation 35 Operating Cash Flow 38 37 Investment in Plant & Equip 38 Cash Flows 39 Present Value of Each Cash Flow 40 Net Present Value 41 42 OR 43 44 45 46 545,750 $72,362 $100,249 $129,713 $161,083 $110,968 $57,921 $7,940 $4,557 $12,497 $8,085 $4,557 $12,642 $8,259 $4,567 $12,816 $8,463 $4,557 $13,020 $8,700 $4,557 $13,257 $8.944 $4,557 $13,501 $9,194 $4,557 $13,751 $33,253 $13,066 $19.287 $59,720 $25,082 $34,638 $87,433 $116,693 $147,826 $36,722 $49,011 $62,087 $50.711 $67,682 $85,739 $97,468 $40,936 $50,531 $44 169 $18,551 $25,618 $4,557 $23,844 $4,557 $39,105 $4,557 $55,268 $4,557 $72,239 $4,557 $90,296 $4,557 $61,088 $4,557 $30,175 532500) ($37.500) $23,844 ($37,500 $21,493 S198,885 9 $39,195 $31,682 $55,268 $39,855 $72,239 $46,234 $90.296 $51,029 $61,088 $30,423 $800 $35,775 $15,671 $179,091 80 Part I: Suppose a firm is considering the following project (all figures in $ thousands); To undertake the project your firm will need to make a one-time investment of $37.500 in year 0. This specialized equipment can be depreciated using the straight-line to salvage method over the seven years, with a salvage value of $5,600 in year 7. Your sales and marketing team tell you that they estimate sales of 7,500 units in year 1, rising incrementally(by the same amount) to 24,100 units in year 5, then declining incrementally to 8,200 units by year 7. They assume the product is dead at that point, with O units demanded/sold in year 8. The inflation rate is forecast to be 1.5% in year 1, rising incrementally by the same amount) to 2.8% in year 5, then leveling off. The firm's real cost of capital is forecast to be 9.3% in year 1 and rising incrementally by the same amount) to 10.6% in year 7 The tax rate is estimated to be a level 42% Sales revenue per unit is expected to be $15.30 in year 1. Variable cost per unit is estimated at $9.20 in year 1. Cash fixed costs will be $7,940 in year 1. All will grow with inflation. What is the project NPV under these assumptions and should the project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts