Question: please help! I am completely lost. nect HW 7 (Chapter 5) Seved Help Save I 2 5 Harding Company is in the process of purchasing

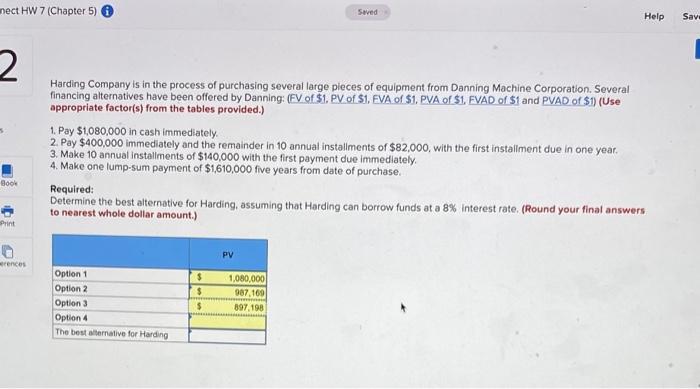

nect HW 7 (Chapter 5) Seved Help Save I 2 5 Harding Company is in the process of purchasing several large places of equipment from Danning Machine Corporation. Several financing alternatives have been offered by Danning: (FV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Pay $1,080,000 in cash immediately 2. Pay $400,000 immediately and the remainder in 10 annual installments of $82,000, with the first installment due in one year 3. Make 10 annual installments of $140,000 with the first payment due immediately 4. Make one lump-sum payment of $1,610,000 five years from date of purchase. Required: Determine the best alternative for Harding, assuming that Harding can borrow funds at a 8% Interest rate (Round your final answers to nearest whole dollar amount.) Bool Print PV rences Option 1 Option 2 Option 3 Option 4 The best imative for Harding $ $ $ 1,080,000 987,160 897.198

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts