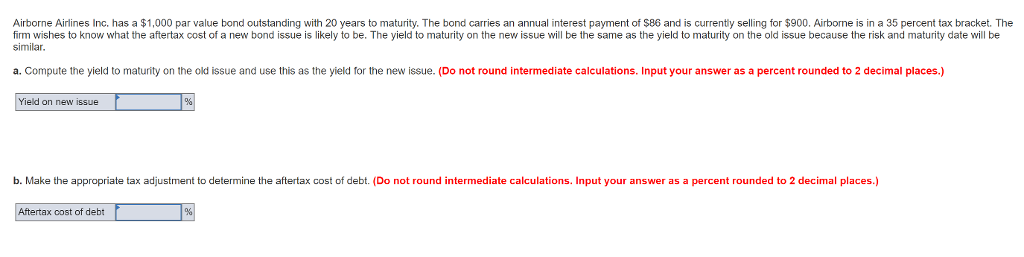

Question: Please help I am taking my final right now: Airborne Airlines nc. has a $1.000 par value bond outstanding with 20 years to maturity. The

Please help I am taking my final right now:

Please help I am taking my final right now:

Airborne Airlines nc. has a $1.000 par value bond outstanding with 20 years to maturity. The bon car es an annua interest payment of 86 and s current se g ?? g A borne sna 5 per cent a racket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Yield on new issue b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aftertax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts