Question: please help, i cannot figure out how to get the number in red circles, thanks a lot QUESTION 2 [5 marks] A stock price is

please help, i cannot figure out how to get the number in red circles, thanks a lot

please help, i cannot figure out how to get the number in red circles, thanks a lot

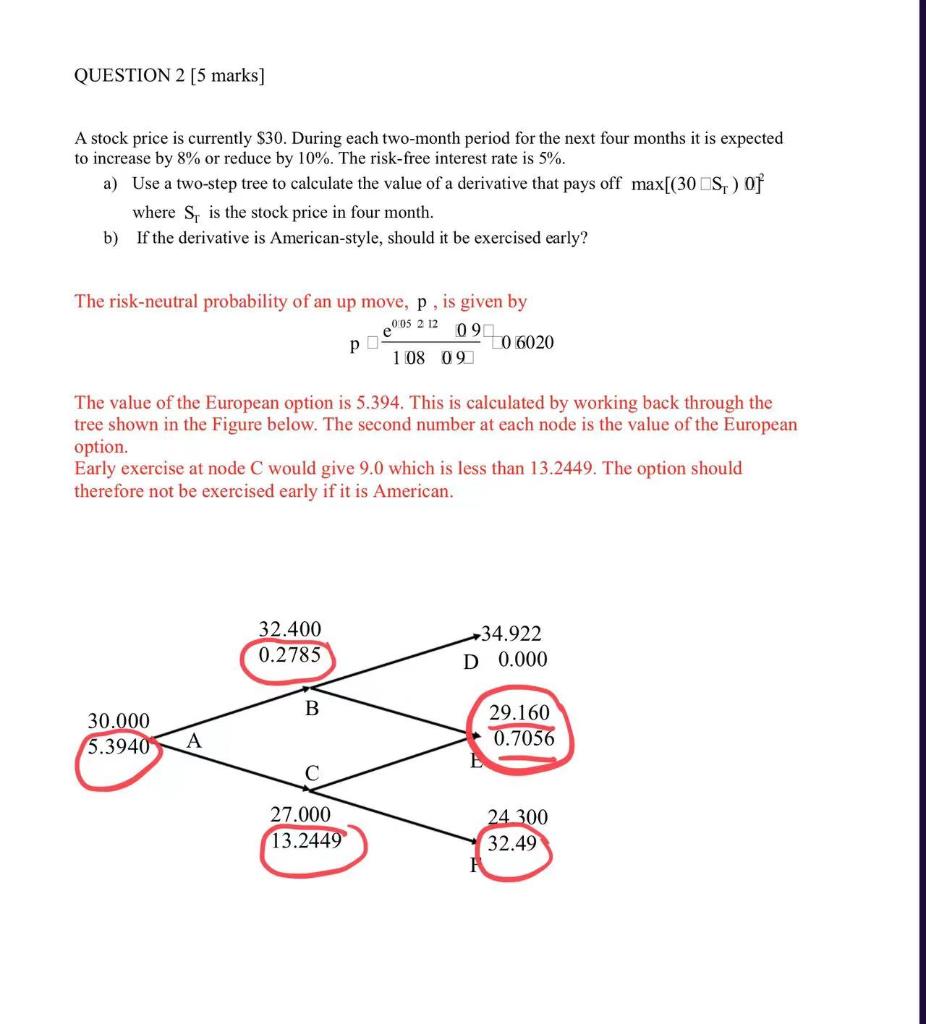

QUESTION 2 [5 marks] A stock price is currently $30. During each two-month period for the next four months it is expected to increase by 8% or reduce by 10%. The risk-free interest rate is 5%. a) Use a two-step tree to calculate the value of a derivative that pays off max[(30S) of where S, is the stock price in four month. b) If the derivative is American-style, should it be exercised early? The risk-neutral probability of an up move, p, is given by po 0:05 2 12 09 108 09 0 6020 The value of the European option is 5.394. This is calculated by working back through the tree shown in the Figure below. The second number at each node is the value of the European option. Early exercise at node C would give 9.0 which is less than 13.2449. The option should therefore not be exercised early if it is American. 32.400 0.2785 34.922 D 0.000 B 30.000 5.3940 29.160 0.7056 24 300 27.000 13.2449 32.49 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts