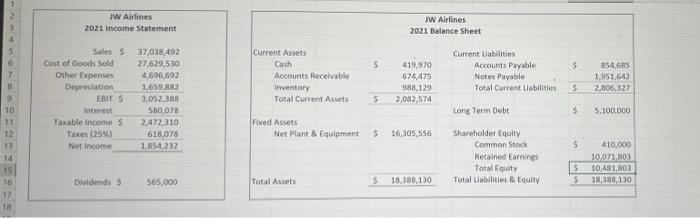

Question: please help.. I cannot seem to figure out this problem!! JW Airlines 2021 Income Statement JW Airlines 2021 Balance Sheet 4 5 6 7 $

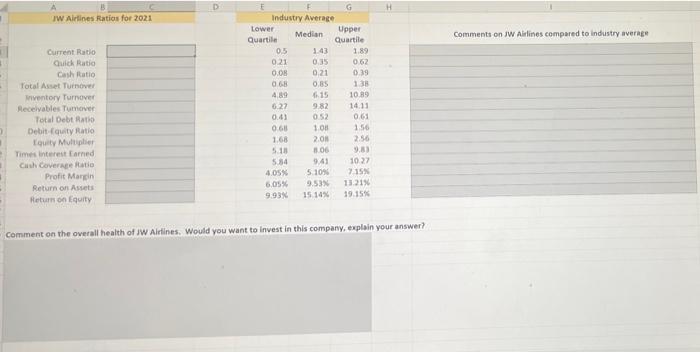

JW Airlines 2021 Income Statement JW Airlines 2021 Balance Sheet 4 5 6 7 $ 5 Current Assets Cash Accounts Receivable Inventory Total Current Assets Current Liabilities Accounts Payable Notes Payable Total Current Liabilities Saless Cost of Goods Sold Other Expenses Deprecation EBIT 5 interest Taxable income 5 Taxes (256) Net Income 419,970 674,475 988,129 2,082 574 854585 1,951,642 2,806,327 37,038,492 27,629,530 4,696,692 1.659.882 3,052,385 560,078 2,472,310 618,078 1.854,232 5 5 Long Term Debt 5 5,100,000 10 11 12 13 14 Fixed Assets Net Plant & Equipment S 16,305,556 $ Shareholder Equity Common Stock Retained Earnings Total Equity Total abilities & Equity $ 5 410,000 10,021,803 10,481,808 38,388,110 Dividends 5 565.000 Total Assets $ 18.388.130 10 17 1 D H IW Airlines Ratios for 2021 Comments on IW Airlines compared to Industry average Current Ratio Quick Ratio Cash Ratio Total Asset Turnover Inventory Turnover Receivables Tumover Total Debt Ratio Debit quity Ratio Louity Multiplier Time interest Earned Cash Cover Ratio Profit Marcin Return on Assets Return on Equity E G Industry Average Lower Upper Median Quartile Quartile 0.5 143 1.89 0.21 0.35 062 0.08 0.21 0.39 0.68 0.85 13 4,89 6.15 10.89 6.22 982 14.11 0.4) 052 0.61 06 10 1.56 1.68 2.08 2.56 5.11 BO 534 9:41 10:27 4.OS 5.105 715% 6.05% 9.53 11215 SON 15 14% 19.15% Comment on the overall health of JW Airlines, Would you want to invest in this company. explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts