Question: please help. i cant get the rigjt numbers. for the first red x on 2020. straightline. ive gotten both 63,600 and 53000. which are both

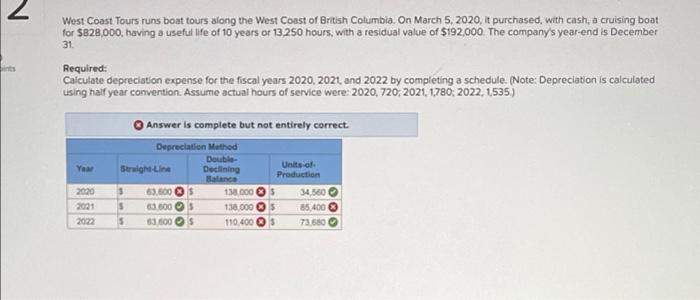

2 West Coast Tours runs boat tours along the West Coast of British Columbia. On March 5, 2020. It purchased with cash, a cruising boat for $828,000, having a useful life of 10 years or 13,250 hours, with a residual value of $192,000 The company's year-end is December 31 Required: Calculate depreciation expense for the fiscal years 2020, 2021, and 2022 by completing a schedule. (Note: Depreciation is calculated using half year convention. Assume actual hours of service were: 2020, 720 2021. 1.780: 2022, 1535) Year Answer is complete but not entirely correct. Depreciation Method Double- Straight-Line Declining Units of Production Balance 63.600 $ 138.000 34.580 5 3.500 5 138.000 85 400 5 63.000 110.400 S 73.680 2020 2021 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts