Question: PLEASE HELP! I don't know how to use excel that well and Im confused Disney requires a four year payback. Based on its cost of

PLEASE HELP! I don't know how to use excel that well and Im confused

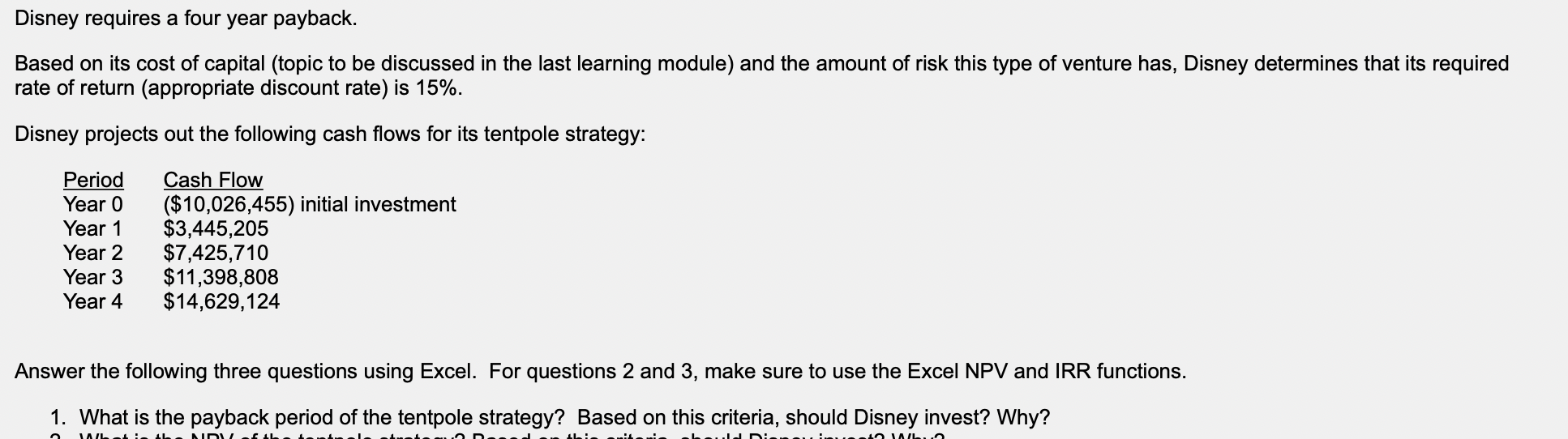

Disney requires a four year payback. Based on its cost of capital (topic to be discussed in the last learning module) and the amount of risk this type of venture has, Disney determines that its required rate of return (appropriate discount rate) is 15%. Disney projects out the following cash flows for its tentpole strategy: Period Year 0 Year 1 Year 2 Year 3 Year 4 Cash Flow ($10,026,455) initial investment $3,445,205 $7,425,710 $11,398,808 $14,629,124 Answer the following three questions using Excel. For questions 2 and 3, make sure to use the Excel NPV and IRR functions. 1. What is the payback period of the tentpole strategy? Based on this criteria, should Disney invest? Why? TAIL MIDI VAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts