Question: Please Help. I don't know where I went wrong with nonoperating income. Also if you don't mind solving it as if you didn't have the

Please Help. I don't know where I went wrong with nonoperating income. Also if you don't mind solving it as if you didn't have the opperating income answer that would be great, so I can see all the steps together. i.e. solve both parts please and show all work because I'm very confused.

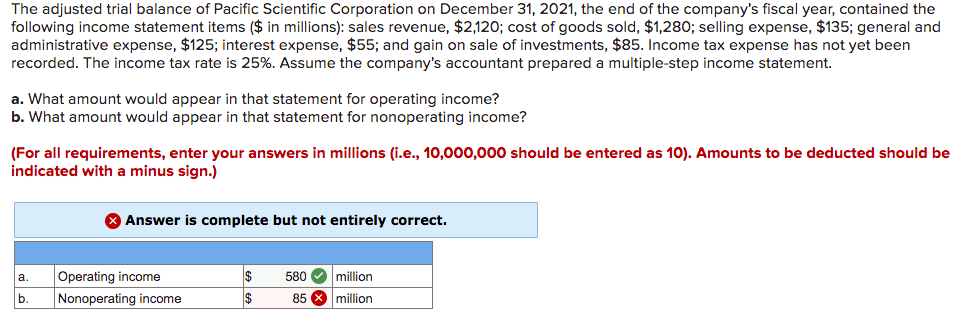

The adjusted trial balance of Pacific Scientific Corporation on December 31, 2021, the end of the company's fiscal year, contained the following income statement items ($ in millions): sales revenue, $2,120; cost of goods sold, $1,280; selling expense, $135; general and administrative expense, $125; interest expense, $55; and gain on sale of investments, $85. Income tax expense has not yet been recorded. The income tax rate is 25%. Assume the company's accountant prepared a multiple-step income statement. a. What amount would appear in that statement for operating income? b. What amount would appear in that statement for nonoperating income? (For all requirements, enter your answers in millions (i.e., 10,000,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.) Answer is complete but not entirely correct. a Operating income Nonoperating income 580 million 85 x million b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts