Question: Please Help! I got the answer $ 2 5 3 , 0 2 3 and it was wrong. Im not sure where I am going

Please Help! I got the answer $ and it was wrong. Im not sure where I am going wrong.

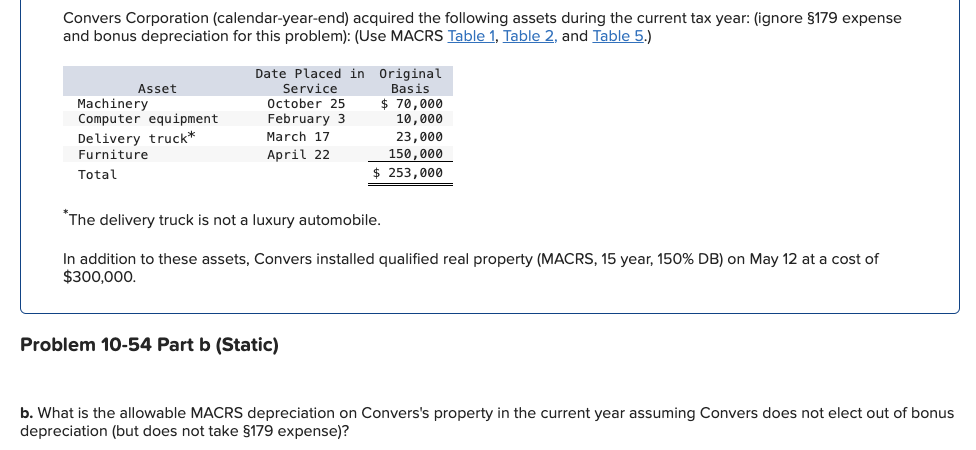

Convers Corporation calendaryearend acquired the following assets during the current tax year: ignore expense and bonus depreciation for this problem: Use MACRS Table Table and Table

Asset Date Placed in Service Original Basis

Machinery October $

Computer equipment February $

Delivery truck March $

Furniture April $

Total$

The delivery truck is not a luxury automobile.

In addition to these assets, Convers installed qualified real property MACRS year, DB on May at a cost of $

b What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus depreciation but does not take $ expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock