Question: Please help , I have been trying to solve this problem and I have not being able. value: 40.00 polnts The CDG Carlos, Dan, and

Please help , I have been trying to solve this problem and I have not being able.

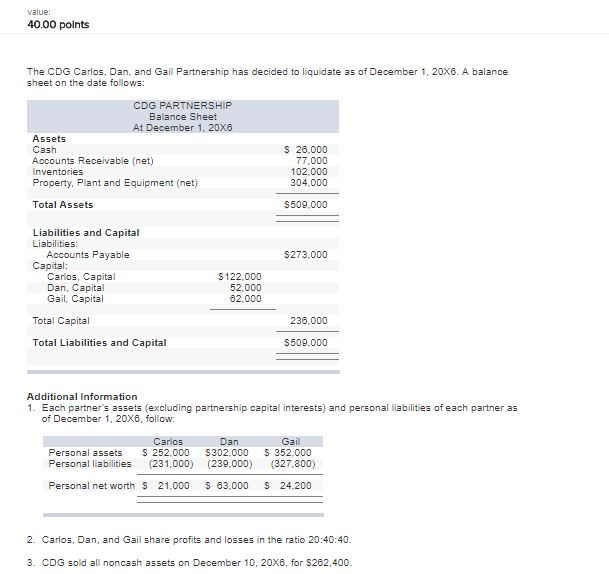

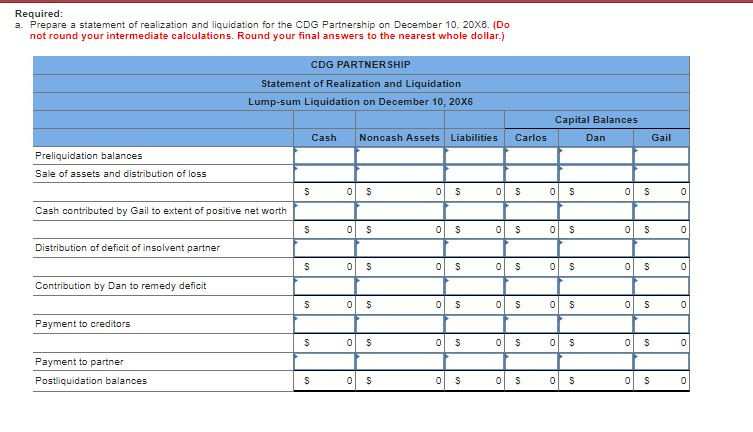

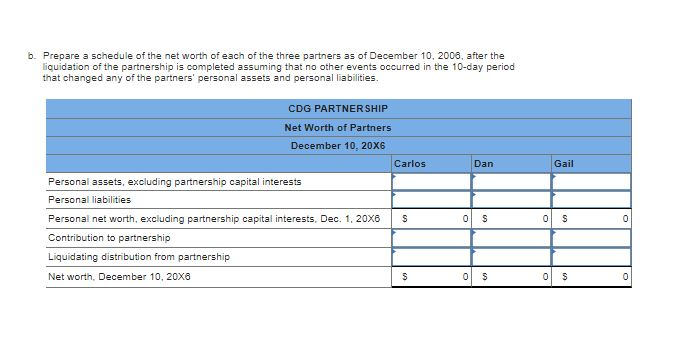

value: 40.00 polnts The CDG Carlos, Dan, and Gail Partnership has decided to liquidate as of December 1, 20x6. A balance sheet on the date follows: CDG PARTNERSHIP Balance Sheet At December 1, 20x6 Assets Cash Accounts Receivable (net) Inventories Property. Plant and Equipment (net) S 26,000 77.000 102,000 304,000 Total Assets 5509,000 Liabilities and Capital Liabilities: Accounts Payable 5273,000 Capital Carlos, Capital Dan, Capital Gail, Capital $122,000 52,000 82.000 Total Capital 236.000 Total Liabilities and Capital 5509,000 Additional Information Each partner's assets (excluding partnership capital interests) and personal liabilities of each partner as of December 1, 20X6, follow Carlos an Personal assets 252,000 5302,000 352,000 Personal liabilities (231.000) (239,000 (327,800) Personal net worth S 21.000 S 63.000 24.200 2. Carlos, Dan, and Gail share profits and losses in the ratio 20:40:40 3. CDG sold all noncash assets on December 10, 20x6, for $262,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts