Question: Please help I know answer is 73.374 but I don't know how to get it. willy the one-period binomial option pricing model, what is the

Please help I know answer is 73.374 but I don't know how to get it.

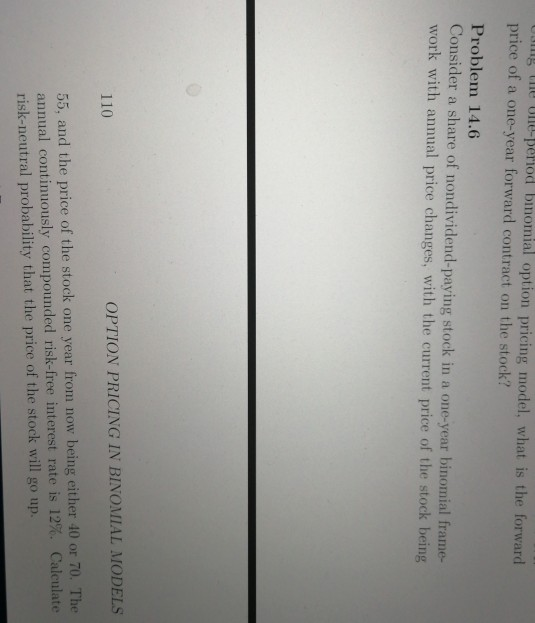

willy the one-period binomial option pricing model, what is the forward price of a one-year forward contract on the stock? Problem 14.6 Consider a share of nondividend-paying stock in a one-year binomial frame. work with annual price changes, with the current price of the stock being 110 OPTION PRICING IN BINOMIAL MODELS 55, and the price of the stock one year from now being either 40 or 70. The annual continuously compounded risk-free interest rate is 12%. Calculate risk-neutral probability that the price of the stock will go up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts