Question: Please help I only have to answer questions one and eight i. Diversifying their loan portfolios. ii. Using statistical models to analyze borrowers' creditworth ii.

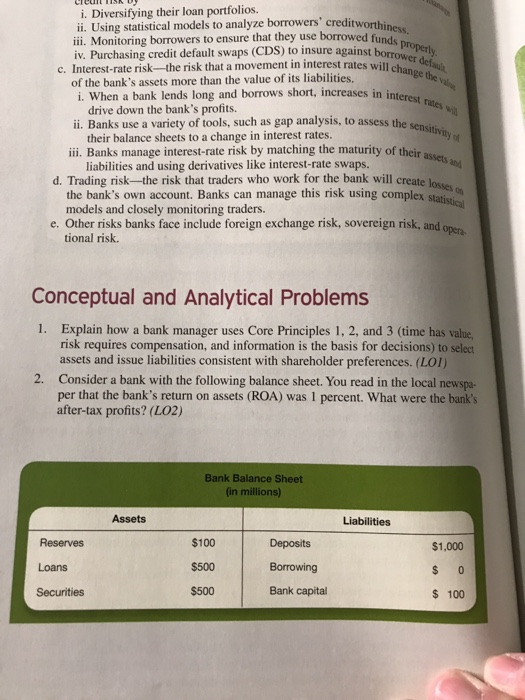

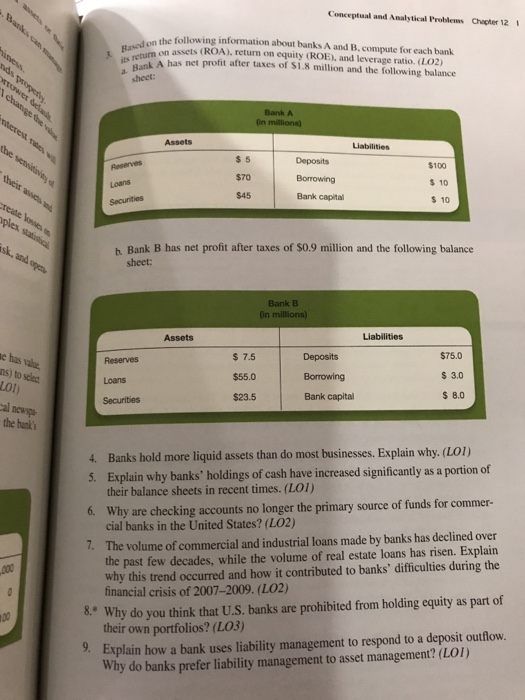

i. Diversifying their loan portfolios. ii. Using statistical models to analyze borrowers' creditworth ii. Monitoring borrowers to ensure that they use borrowed funds n iv. Purchasing credit default swaps (CDS) to insure against borrowol iness c. Interest-rate risk-the risk that a movement in interest rates will ch of the bank's assets more than the value of its liabilities. i. When a bank lends long and borrows short, increases in interes drive down the bank's profits. ii. Banks use a variety of tools, such as gap analysis, to assess the sens sensitivity of their balance sheets to a change in interest rates. ii Banks manage interest-rate risk by matching the maturity of their liabilities and using derivatives like interest-rate swaps. d. Trading risk-the risk that traders who work for the bank will create losse the bank's own account. Banks can manage this risk using complex statis models and closely monitoring traders. e. Other risks banks face include foreign exchange risk, sovereign risk, and tional risk. Conceptual and Analytical Problems 1. Explain how a bank manager uses Core Principles 1, 2, and 3 (time has value risk requires compensation, and information is the basis for decisions) to select assets and issue liabilities consistent with shareholder preferences. (LOI) Consider a bank with the following balance sheet. You read in the local newspa- per that the bank's return on assets (ROA) was 1 percent. What were the bank's after-tax profits? (LO2) 2. Bank Balance Sheet (in millions) Assets Liabilities Reserves Loans Securities $100 $500 $500 Deposits Borrowing Bank capital $1,000 $ 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts