Question: please help i would appreciate it so much Balance sheets as of December 2013 and 2019 2019 Assets Current assets Cash Accounts receivable Inventory 2018

please help i would appreciate it so much

please help i would appreciate it so much

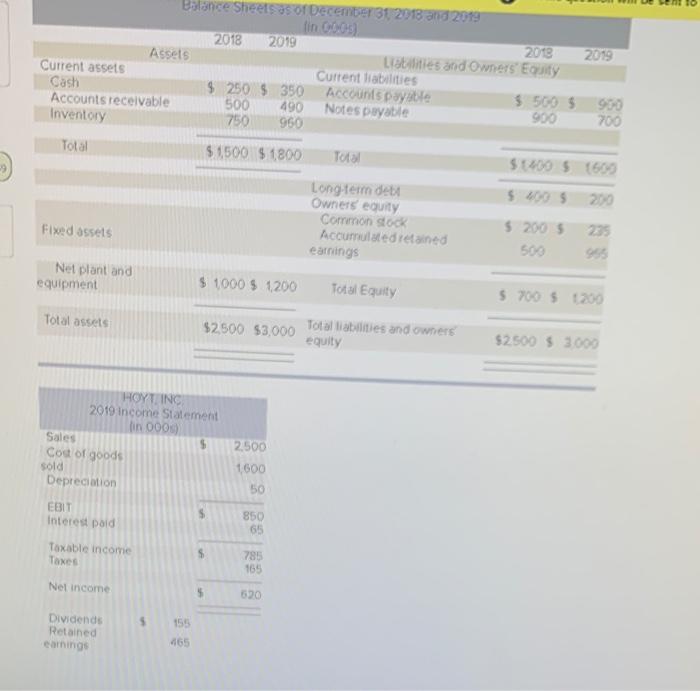

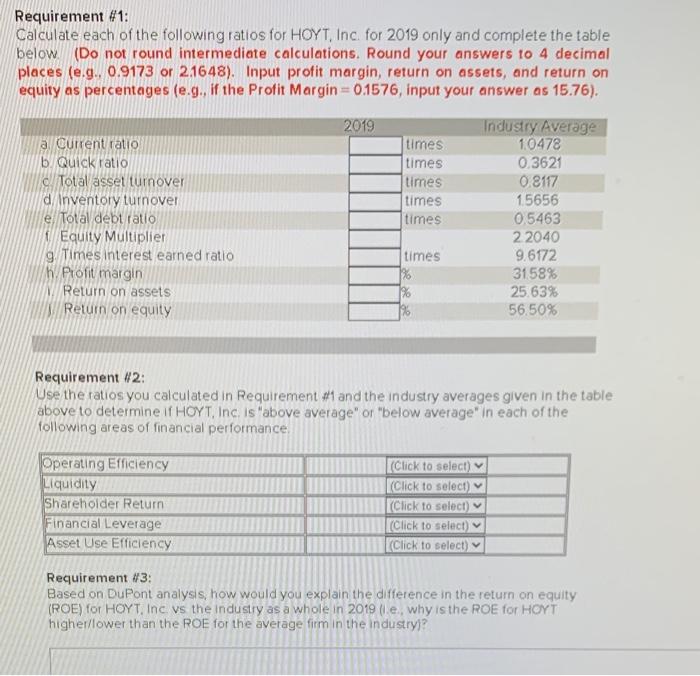

Balance sheets as of December 2013 and 2019 2019 Assets Current assets Cash Accounts receivable Inventory 2018 2019 2013 Liabilities and Owners' Equity Current liabilities $250 $ 350 Accounts payable $500 5 500 490 Notes payable 900 750 960 900 700 Total $ 1500 $ 1800 Total $400 5600 500 5 200 Long term den Owners equity Common stock Accumulated retained earnings Fixed assets $200 500 Net plant and equipment $ 1000 $ 1200 Total Equity $7005200 Total assets $2,500 $3,000 Total abilities and owners equity $2.500 $ 3000 HOYT INC 2019 income Statement in 000 Sales Cost of goods sold Depreciation 2.500 1600 50 EBIT Interest paid 850 65 Taxable income Taxes 785 165 Net income 620 5 155 Dividends Retained earning 465 Requirement #1: Calculate each of the following ratios for HOYT, Inc. for 2019 only and complete the table below (Do not round intermediate calculations. Round your answers 10 4 decimal places (e.g., 0.9173 or 2.1648). Input profit margin, return on assets, and return on equity as percentages (e.g., if the Profit Margin=0.1576, input your answer as 15.76). 2019 a Current ratio b Quick ratio a Total asset turnover d Inventory turnover e Total debt ratio Equity Multiplier g Times interest earned ratio h. Profit margin V Return on assets Return on equity times times times times times Industry Average 10478 0.3621 0.8117 15656 0.5463 2 2040 9.6172 3158% 25.63% 56.50% times 7% 1% Requirement #2: Use the ratios you calculated in Requirement #1 and the industry averages given in the table above to determine if HOYT, Inc. is "above average" or "below average' in each of the following areas of financial performance Operating Efficiency Liquidity Shareholder Return Financial Leverage Asset Use Efficiency (Click to select) Click to select) (Click to select) (Click to select) Click to select) Requirement #3: Based on DuPont analysis, how would you explain the difference in the return on equity (ROE) for HOYT, Inc vs the industry as a whole in 2019 (le, why is the ROE for HOYT higher/lower than the ROE for the average firm in the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts