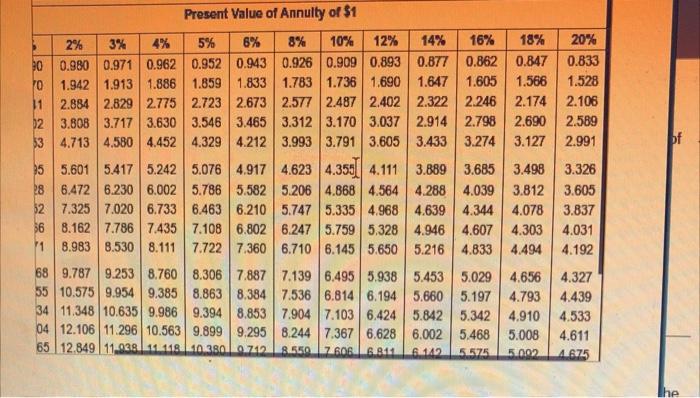

Question: please help if correct ill thumbs it up. im very confused i apologize! here it is please help Present Value of Annulty of 31 begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|}

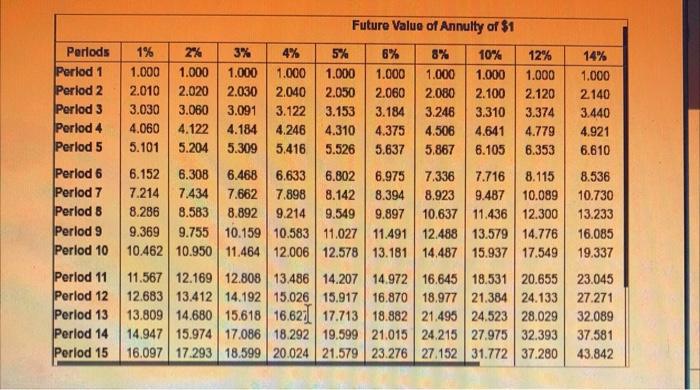

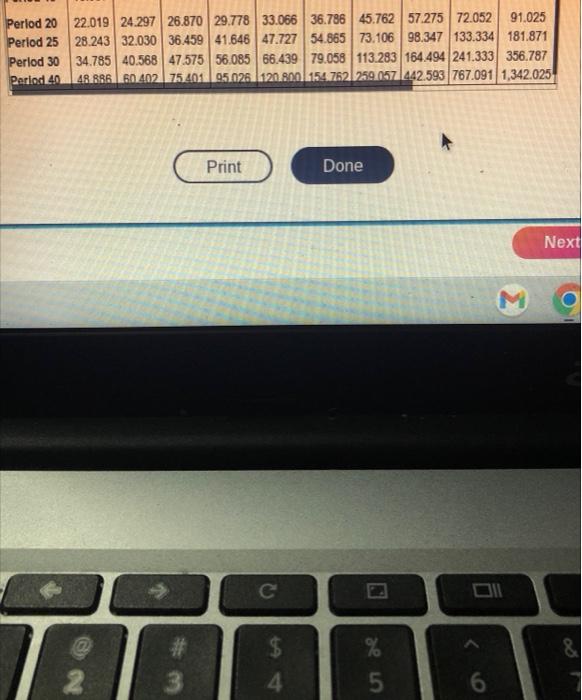

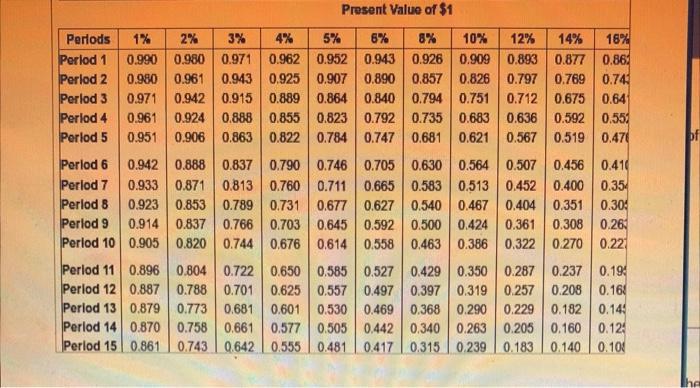

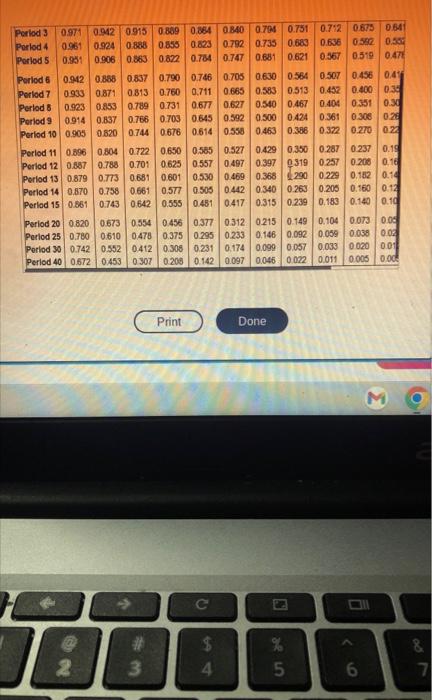

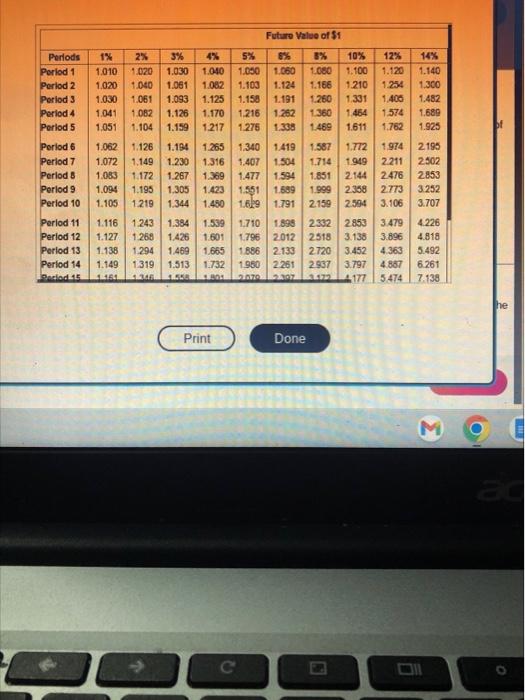

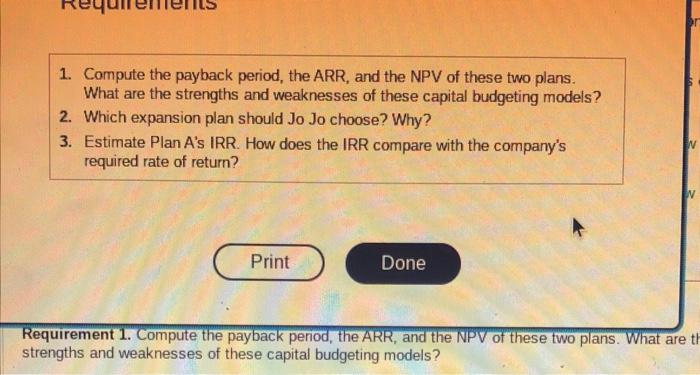

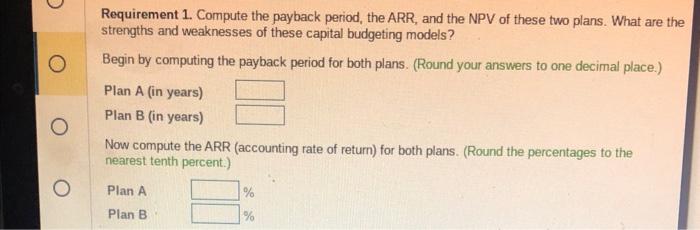

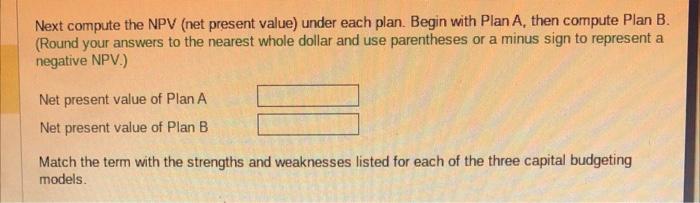

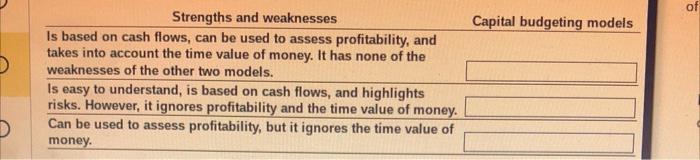

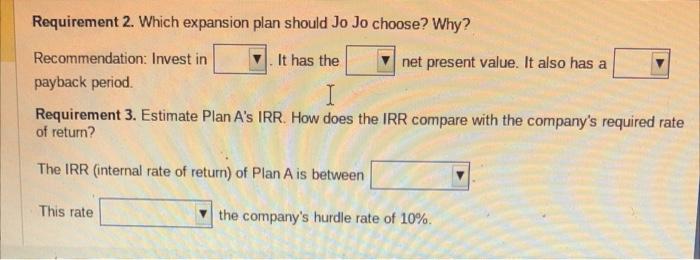

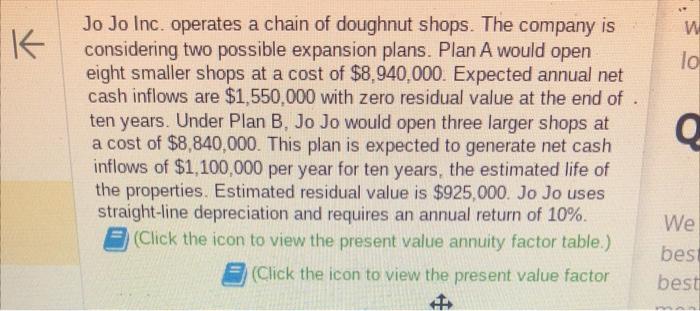

Present Value of Annulty of 31 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Future Value of Annulty of 31} \\ \hline Perlods & 1% & 2% & 3% & 4% & 5% & 6% & 8% & 10% & 12% & 14% \\ \hline Perlod 1 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 \\ Perlod 2 & 2.010 & 2.020 & 2.030 & 2.040 & 2.050 & 2.060 & 2.080 & 2.100 & 2.120 & 2140 \\ Perlod 3 & 3.030 & 3.060 & 3.091 & 3.122 & 3.153 & 3.184 & 3.246 & 3.310 & 3.374 & 3.440 \\ Period 4 & 4.060 & 4.122 & 4.184 & 4.246 & 4.310 & 4.375 & 4.506 & 4.641 & 4.779 & 4.921 \\ Perlod 5 & 5.101 & 5.204 & 5.309 & 5.416 & 5.526 & 5.637 & 5.867 & 6.105 & 6.353 & 6.610 \\ Perlod 6 & 6.152 & 6.308 & 6.468 & 6.633 & 6.802 & 6.975 & 7.336 & 7.716 & 8.115 & 8.536 \\ Period 7 & 7.214 & 7.434 & 7.662 & 7.898 & 8.142 & 8.394 & 8.923 & 9.487 & 10.089 & 10.730 \\ Perlod 8 & 8.286 & 8.583 & 8.892 & 9.214 & 9.549 & 9.897 & 10.637 & 11.436 & 12.300 & 13.233 \\ Period 9 & 9.369 & 9.755 & 10.159 & 10.583 & 11.027 & 11.491 & 12.488 & 13.579 & 14.776 & 16.085 \\ Perlod 10 & 10.462 & 10.950 & 11.464 & 12.006 & 12.578 & 13.181 & 14.487 & 15.937 & 17.549 & 19.337 \\ Perlod 11 & 11.567 & 12.169 & 12.808 & 13.486 & 14.207 & 14.972 & 16.645 & 18.531 & 20.655 & 23.045 \\ Perlod 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 18.977 & 21.384 & 24.133 & 27.271 \\ Perlod 13 & 13.809 & 14.680 & 15.618 & 16.621 & 17.713 & 18.882 & 21.495 & 24.523 & 28.029 & 32.089 \\ Perlod 14 & 14.947 & 15.974 & 17.086 & 18.292 & 19.599 & 21.015 & 24.215 & 27.975 & 32.393 & 37.581 \\ Period 15 & 16.097 & 17.293 & 18.599 & 20.024 & 21.579 & 23.276 & 27.152 & 31.772 & 37.280 & 43.842 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|} \hline Perlod 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.786 & 45.762 & 57.275 & 72.052 & 91.025 \\ \hline Perlod 25 & 28.243 & 32.030 & 36.459 & 41.646 & 47.727 & 54.865 & 73.106 & 98.347 & 133.334 & 181.871 \\ Perlod 30 & 34.785 & 40.568 & 47.575 & 56.085 & 66.439 & 79.058 & 113.283 & 164.494 & 241.333 & 356.787 \\ Period 40 & 48.886 & 60.402 & 75.401 & 95.026 & 120.800 & 154.762 & 259.057 & 442.593 & 767.091 & 1,342.025 \\ \hline \end{tabular} Done Next Present Value of $1 Print Done Future Valee of 5f Done 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Jo Jo choose? Why? 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Requirement 1. Compute the payback penod, the ARR, and the NPV of these two plans. What are strengths and weaknesses of these capital budgeting models? Requirement 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? Begin by computing the payback period for both plans. (Round your answers to one decimal place.) Plan A (in years) Plan B (in years) Now compute the ARR (accounting rate of return) for both plans. (Round the percentages to the nearest tenth percent.) Plan A Plan B % % Next compute the NPV (net present value) under each plan. Begin with Plan A, then compute Plan B (Round your answers to the nearest whole dollar and use parentheses or a minus sign to represent a negative NPV.) Net present value of Plan A Net present value of Plan B Match the term with the strengths and weaknesses listed for each of the three capital budgeting models. Strengths and weaknesses Capital budgeting models Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other two models. Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money. Requirement 2. Which expansion plan should Jo Jo choose? Why? Recommendation: Invest in It has the net present value. It also has a payback period. Requirement 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between This rate the company's hurdle rate of 10%. Jo Jo Inc. operates a chain of doughnut shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,940,000. Expected annual net cash inflows are $1,550,000 with zero residual value at the end of . ten years. Under Plan B, Jo Jo would open three larger shops at a cost of $8,840,000. This plan is expected to generate net cash inflows of $1,100,000 per year for ten years, the estimated life of the properties. Estimated residual value is $925,000. Jo Jo uses straight-line depreciation and requires an annual return of 10%. (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts