Question: please please help. if the answer is correct ill thumbs it up!! Solve various time value of money scenarios. (Click the icon to view the

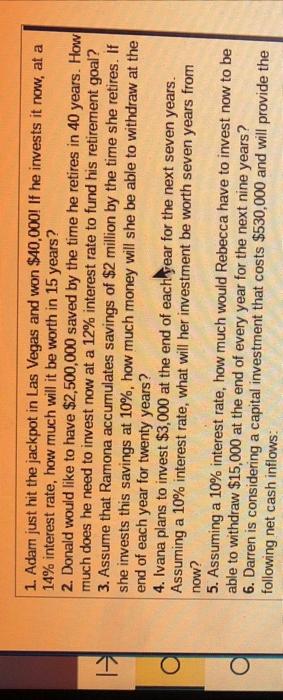

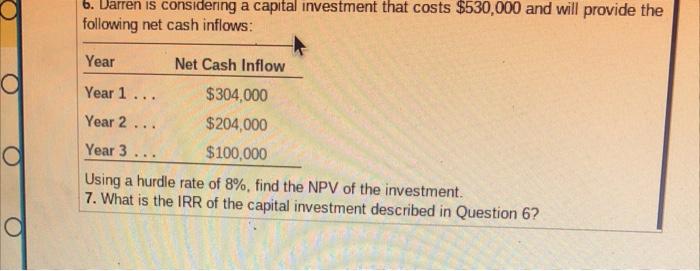

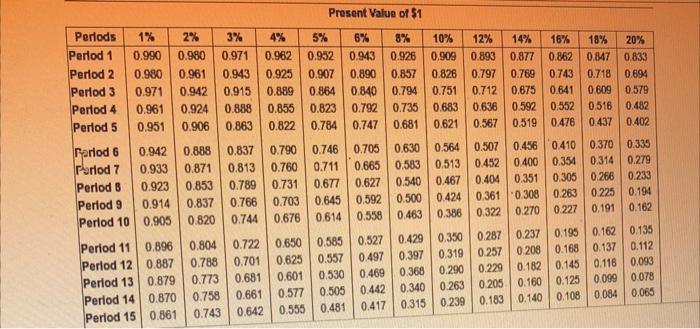

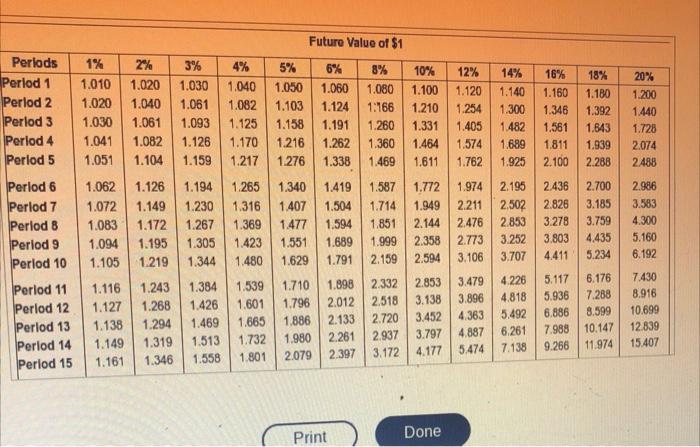

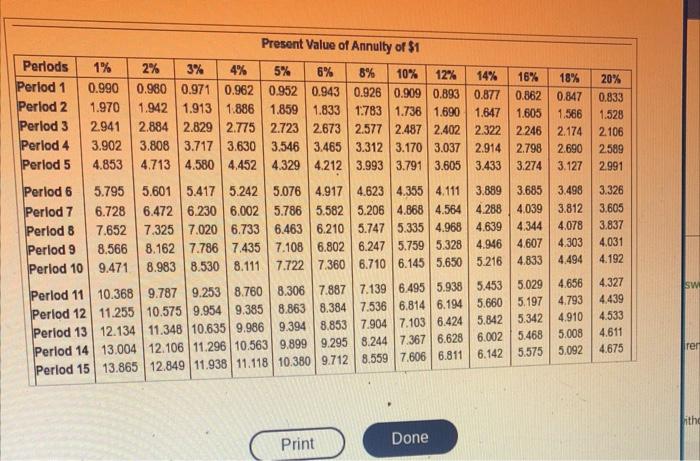

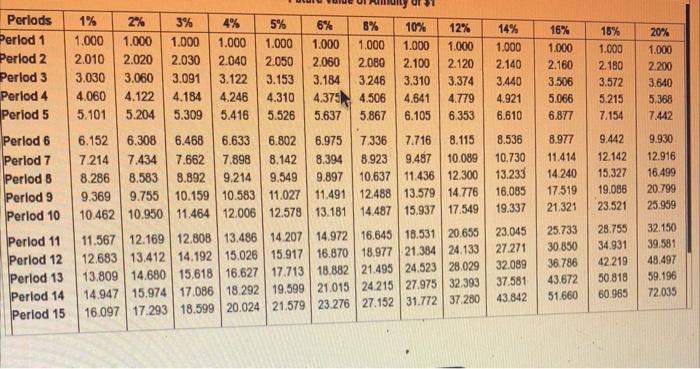

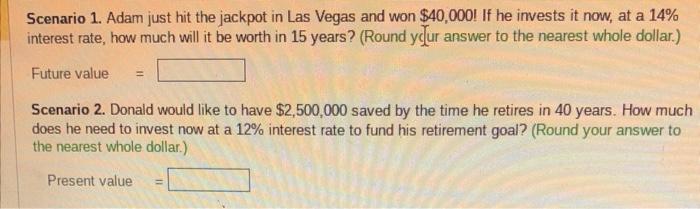

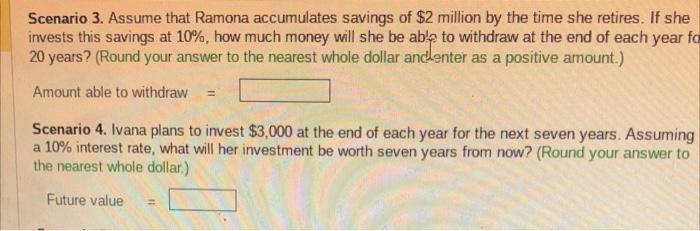

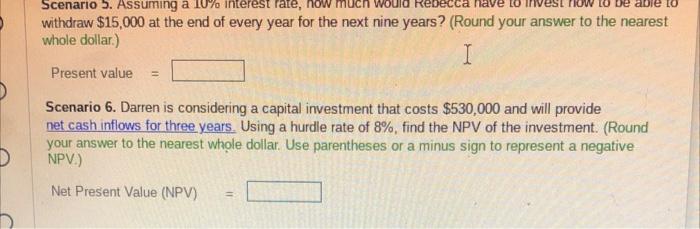

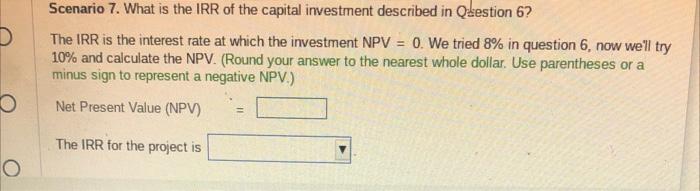

Solve various time value of money scenarios. (Click the icon to view the scenarios.) (Click the icon to view the present value of $1 table.) (Click the icon to view the present value of annuity of $1 table.) (Click the icon to view the future value of $1 table.) future value of annuity of $1 table.) (Click the icon to view the 1. Adarn just hit the jackpot in Las Vegas and won $40,000 ! If he invests it now, at a 14% interest rate, how much will it be worth in 15 years? 2. Donald would like to have $2,500,000 saved by the time he retires in 40 years. How much does he need to invest now at a 12% interest rate to fund his retirement goal? 3. Assume that Ramona accumulates savings of $2 million by the time she retires. If she invests this savings at 10%, how much money will she be able to withdraw at the end of each year for twenty years? 4. Ivana plans to invest $3,000 at the end of eachlyrear for the next seven years. Assuming a 10% interest rate, what will her investment be worth seven years from now? 5. Assuming a 10% interest rate, how much would Rebecca have to invest now to be able to withdraw $15,000 at the end of every year for the next nine years? 6. Darren is considering a capital investment that costs $530,000 and will provide the following net cash inflows: 6. Darren is considering a capital investment that costs $530,000 and will provide the following net cash inflows: Using a hurdle rate of 8%, find the NPV of the investment. 7. What is the IRR of the capital investment described in Question 6 ? Dravand Ualun al EA Future Value of $1 Done Present Value of Annulty of $1 Print Done Scenario 1. Adam just hit the jackpot in Las Vegas and won $40,000 ! If he invests it now, at a 14% interest rate, how much will it be worth in 15 years? (Round y yUur answer to the nearest whole dollar.) Future value = Scenario 2. Donald would like to have $2,500,000 saved by the time he retires in 40 years. How much does he need to invest now at a 12% interest rate to fund his retirement goal? (Round your answer to the nearest whole dollar.) Present value = Scenario 3. Assume that Ramona accumulates savings of $2 million by the time she retires. If she invests this savings at 10%, how much money will she be ably to withdraw at the end of each year fo 20 years? (Round your answer to the nearest whole dollar andenter as a positive amount.) Amount able to withdraw = Scenario 4. Ivana plans to invest $3,000 at the end of each year for the next seven years. Assuming a 10% interest rate, what will her investment be worth seven years from now? (Round your answer to the nearest whole dollar.) Future value = withdraw $15,000 at the end of every year for the next nine years? (Round your answer to the nearest whole dollar.) Present value = Scenario 6. Darren is considering a capital investment that costs $530,000 and will provide net cash inflows for three years. Using a hurdle rate of 8%, find the NPV of the investment. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign to represent a negative NPV.) Net Present Value (NPV) = Scenario 7. What is the IRR of the capital investment described in Qsestion 6 ? The IRR is the interest rate at which the investment NPV =0. We tried 8% in question 6 , now well try 10% and calculate the NPV. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign to represent a negative NPV.) Net Present Value (NPV) = The IRR for the project is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts