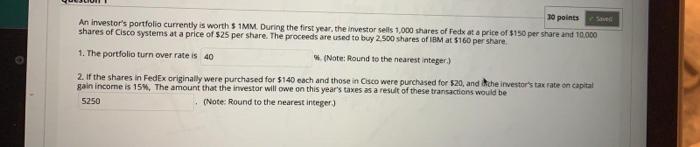

Question: please help if i did right 10 points avec An investor's portfolio currently is worth $ 1MM. During the first year, the investor sells 1,000

10 points avec An investor's portfolio currently is worth $ 1MM. During the first year, the investor sells 1,000 shares of Tedx at a price of $150 per share and 10.000 shares of Cisco systems at a price of $25 per share. The proceeds are used to buy 2.500 shares of IBM at 5160 pershare. 1. The portfolio turn over rate is 40 (Note: Round to the nearest integer.) 2. If the shares in FedEx originally were purchased for $140 each and those in Osco were purchased for $20, and the investor's tax rate on capital gain income is 15%. The amount that the investor will owe on this year's taxes as a result of these transactions would be 5250 (Note: Round to the nearest integer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts