Question: Please help! I'm having trouble with this. C.S. Oriole Company had the following transactions involving notes payable. July 1, 2025 Borrows $79,950 from First National

Please help! I'm having trouble with this.

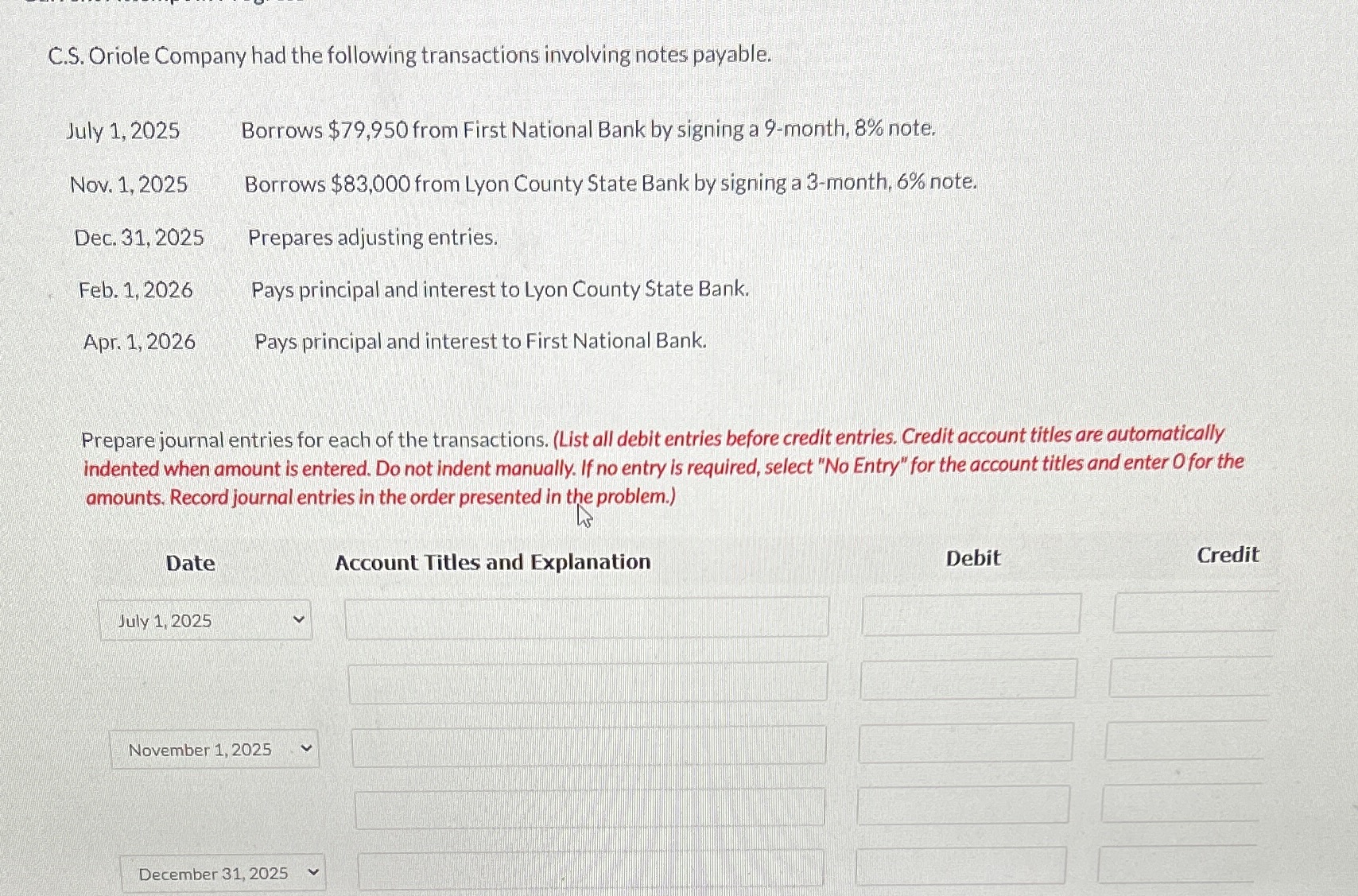

C.S. Oriole Company had the following transactions involving notes payable. July 1, 2025 Borrows $79,950 from First National Bank by signing a 9-month, 8% note. Nov. 1, 2025 Borrows $83,000 from Lyon County State Bank by signing a 3-month, 6% note. Dec. 31, 2025 Prepares adjusting entries. Feb. 1, 2026 Pays principal and interest to Lyon County State Bank. Apr. 1, 2026 Pays principal and interest to First National Bank. Prepare journal entries for each of the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) hs Date Account Titles and Explanation Debit Credit July 1, 2025 November 1, 2025 December 31, 2025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts