Question: please help im lost i dont know how to do this Assume he hedges half of his production using ONE December futurescantract, and offsets the

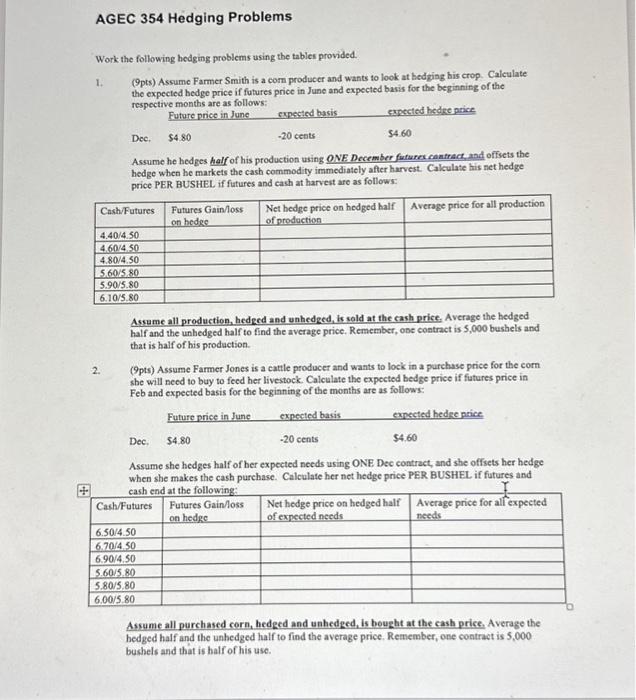

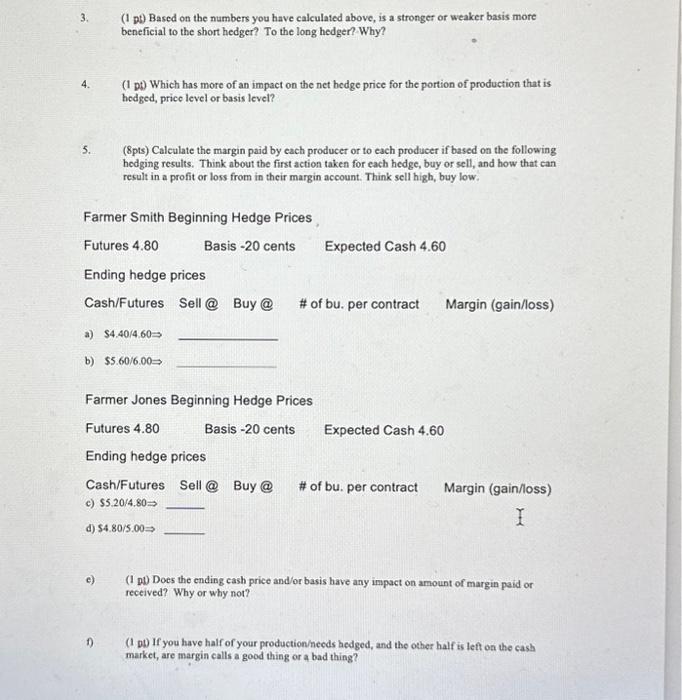

Assume he hedges half of his production using ONE December futurescantract, and offsets the hedge when he markets the cash commodity immediately after harvest. Calculate his net hedge price PER BUSHEL if futures and cash at harvest are as follows: Assume all production, hedeed and unhedged, is sold at the cash price, Average the hedged half and the unhedged half to find the average price. Remember, one contract is 5,000 bushels and that is half of his production. (9pts) Assume Farmer Jones is a cattle producer and wants to lock in a purchase price for the corn she will need to buy to feed her livestock. Calculate the expected bedge price if futures price in Feb and expected basis for the beginning of the months are as follows: Assume she hedges half of her expected needs using ONE Dec contract, and she offsets her hedge when she makes the cash purchase. Calculate her net hedge price PER BUSHEL if futures and Assume all purchased corn, hedeed and unhedged, is bought at the cash price. Average the bedged half and the unbedged half to find the average price. Remember, one contract is 5,000 bushels and that is half of his use. 3. (1 pQ Based on the numbers you have calculated above, is a stronger or weaker basis more beneficial to the short hedger? To the long hedger? Why? 4. (1 pt) Which has more of an impact on the net hedge price for the portion of production that is hodged, price level or basis level? 5. (8pts) Calculate the margin paid by each producer or to each producer if based on the following hedging results. Think about the first action taken for each hedge, buy or sell, and how that can result in a profit or loss from in their margin account. Think sell high, buy low. Farmer Smith Beginning Hedge Prices Futures 4.80 Basis -20 cents Expected Cash 4.60 Ending hedge prices Cash/Futures Sell @ Buy @ \# of bu.per contract Margin (gain/loss) a) $4.40/4.60 b) $5.60/6.00 Farmer Jones Beginning Hedge Prices Futures 4.80 Basis -20 cents Expected Cash 4.60 Ending hedge prices Cash/Futures Sell @ Buy @ \# of bu. per contract Margin (gain/loss) c) $5.20/4.80 d) $4.80/5.00 c) (1 p1) Does the ending cash price and/or basis have any inpact on amount of margin paid or received? Why or why not? f) (1 pt) If you have half of your productioneeds hedged, and the other half is left on the cash market, are margin calls a good thing or a bad thing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts