Question: please help :) in proper formatting please Question #1 Bob Newhart operates a bed and breakfast hotel in Vermont. Depreciation on the hotel is $12,000

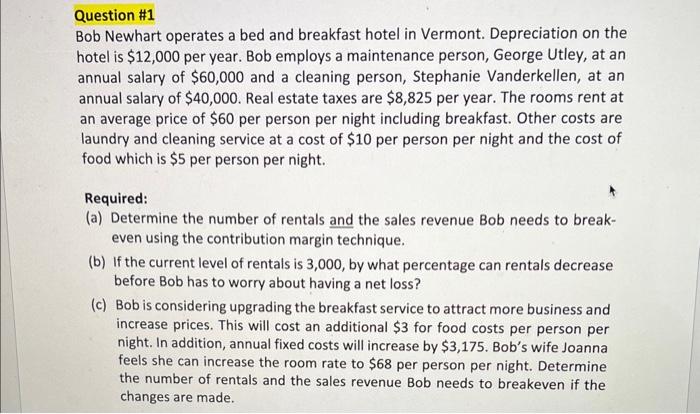

Question \#1 Bob Newhart operates a bed and breakfast hotel in Vermont. Depreciation on the hotel is $12,000 per year. Bob employs a maintenance person, George Utley, at an annual salary of $60,000 and a cleaning person, Stephanie Vanderkellen, at an annual salary of $40,000. Real estate taxes are $8,825 per year. The rooms rent at an average price of $60 per person per night including breakfast. Other costs are laundry and cleaning service at a cost of $10 per person per night and the cost of food which is $5 per person per night. Required: (a) Determine the number of rentals and the sales revenue Bob needs to breakeven using the contribution margin technique. (b) If the current level of rentals is 3,000 , by what percentage can rentals decrease before Bob has to worry about having a net loss? (c) Bob is considering upgrading the breakfast service to attract more business and increase prices. This will cost an additional $3 for food costs per person per night. In addition, annual fixed costs will increase by $3,175. Bob's wife Joanna feels she can increase the room rate to $68 per person per night. Determine the number of rentals and the sales revenue Bob needs to breakeven if the changes are made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts