Question: please help in question 16,17, note question 18 is in canada provinces 16. The total of an employee's earnings, taxable allowances, cash taxable benefits is

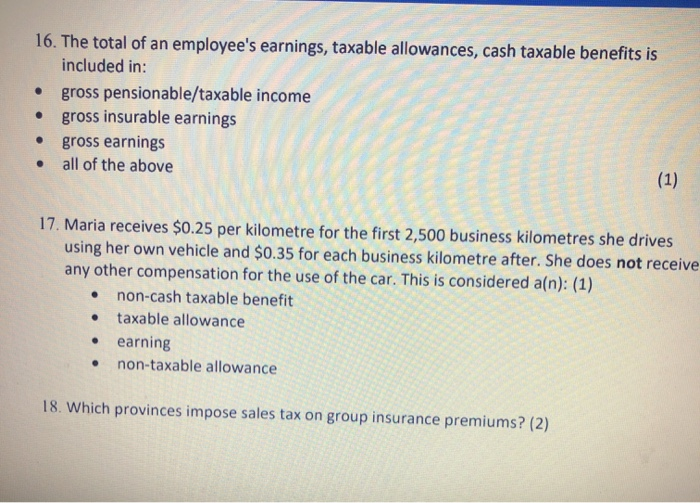

16. The total of an employee's earnings, taxable allowances, cash taxable benefits is included in: gross pensionable/taxable income gross insurable earnings gross earnings all of the above 17. Maria receives $0.25 per kilometre for the first 2,500 business kilometres she drives using her own vehicle and $0.35 for each business kilometre after. She does not receive any other compensation for the use of the car. This is considered a(n): (1) non-cash taxable benefit taxable allowance earning non-taxable allowance 18. Which provinces impose sales tax on group insurance premiums? (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts