Question: Please help Instructions: Answer all questions and submit assignment in blackboard by the due date. Each question is 6 points for a total of 30

Please help

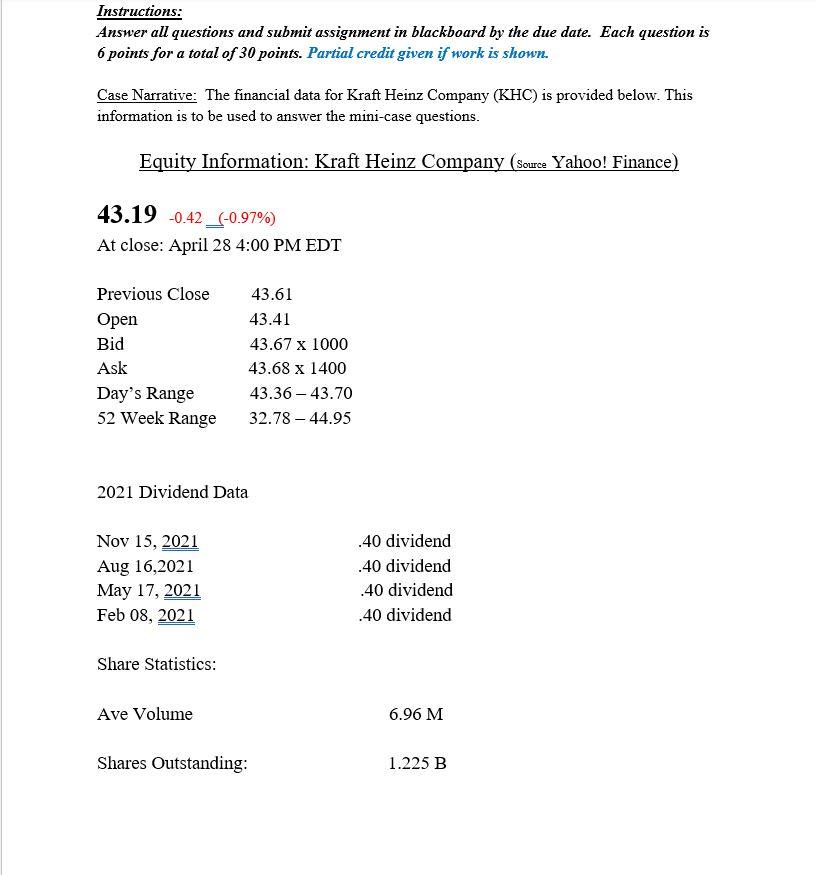

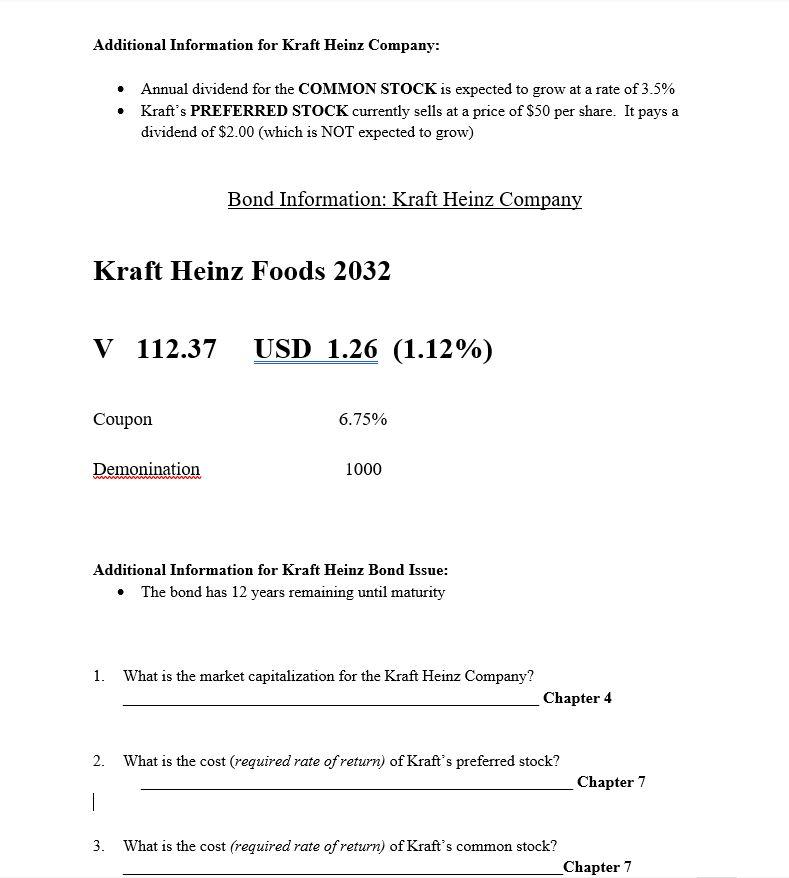

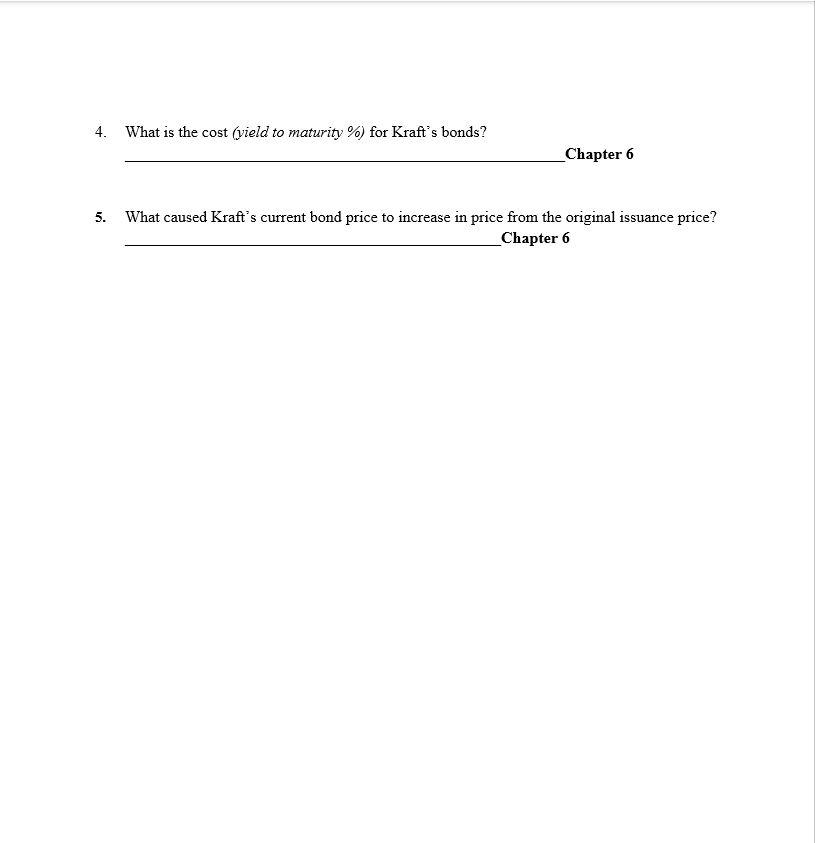

Instructions: Answer all questions and submit assignment in blackboard by the due date. Each question is 6 points for a total of 30 points. Partial credit given if work is shown. Case Narrative: The financial data for Kraft Heinz Company (KHC) is provided below. This information is to be used to answer the mini-case questions. Equity Information: Kraft Heinz Company (source Yahoo! Finance) 43.19 0.42(0.97%) At close: April 28 4:00 PM EDT Additional Information for Kraft Heinz Company: - Annual dividend for the COMMON STOCK is expected to grow at a rate of 3.5% - Kraft's PREFERRED STOCK currently sells at a price of $50 per share. It pays a dividend of $2.00 (which is NOT expected to grow) Bond Information: Kraft Heinz Company Kraft Heinz Foods 2032 Additional Information for Kraft Heinz Bond Issue: - The bond has 12 years remaining until maturity 1. What is the market capitalization for the Kraft Heinz Company? Chapter 4 2. What is the cost (required rate of return) of Kraft's preferred stock? Chapter 7 3. What is the cost (required rate of return) of Kraft's common stock? Chapter 7 4. What is the cost (yield to maturity \%) for Kraft's bonds? Chapter 6 5. What caused Kraft's current bond price to increase in price from the original issuance price? Chapter 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts