Question: PLEASE HELP!! Jitterbug Ltd bought a machine on January 1, 2018, incurring a purchase price of $17.2 million in addition to freight and installation costs

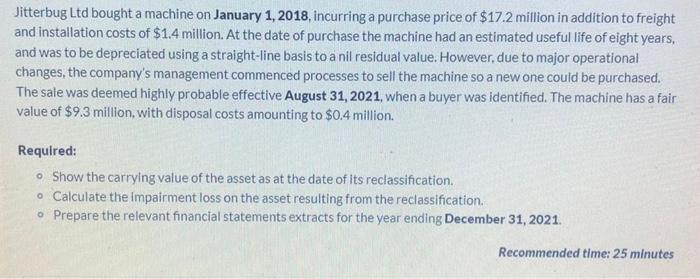

Jitterbug Ltd bought a machine on January 1, 2018, incurring a purchase price of $17.2 million in addition to freight and installation costs of $1.4 million. At the date of purchase the machine had an estimated useful life of eight years, and was to be depreciated using a straight-line basis to a nil residual value. However, due to major operational changes, the company's management commenced processes to sell the machine so a new one could be purchased. The sale was deemed highly probable effective August 31, 2021, when a buyer was identified. The machine has a fair value of $9.3 million, with disposal costs amounting to $0.4 million. Required: o show the carrying value of the asset as at the date of its reclassification. o Calculate the impairment loss on the asset resulting from the reclassification Prepare the relevant financial statements extracts for the year ending December 31, 2021. Recommended time: 25 minutes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts