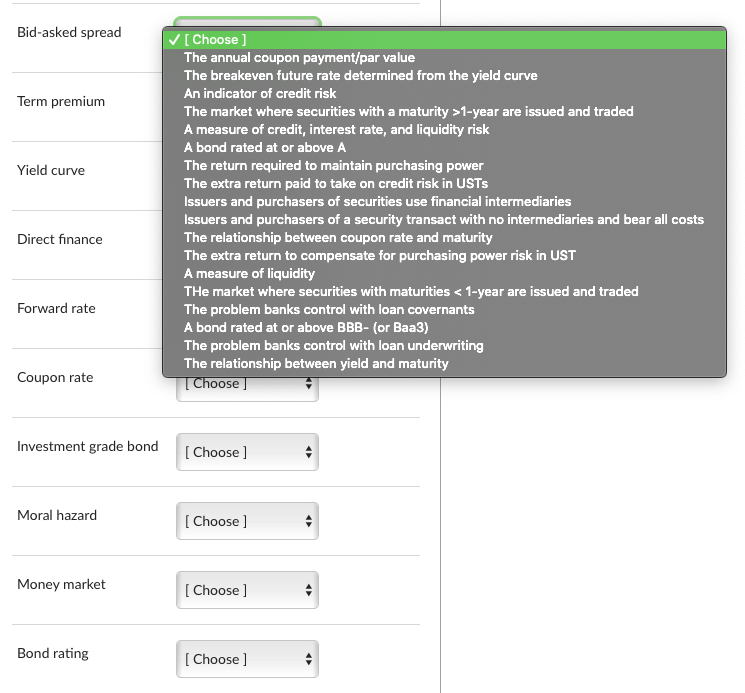

Question: please help match these with ones on side bar... Bid-asked spread Term premium Yield curve [Choose] The annual coupon payment/par value The breakeven future rate

please help match these with ones on side bar...

Bid-asked spread Term premium Yield curve [Choose] The annual coupon payment/par value The breakeven future rate determined from the yield curve An indicator of credit risk The market where securities with a maturity >1-year are issued and traded A measure of credit, interest rate, and liquidity risk A bond rated at or above A The return required to maintain purchasing power The extra return paid to take on credit risk in USTS Issuers and purchasers of securities use financial intermediaries Issuers and purchasers of a security transact with no intermediaries and bear all costs The relationship between coupon rate and maturity The extra return to compensate for purchasing power risk in UST A measure of liquidity The market where securities with maturities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts