Question: please help me 53 Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume that the discount rate for Nagano Golf

please help me

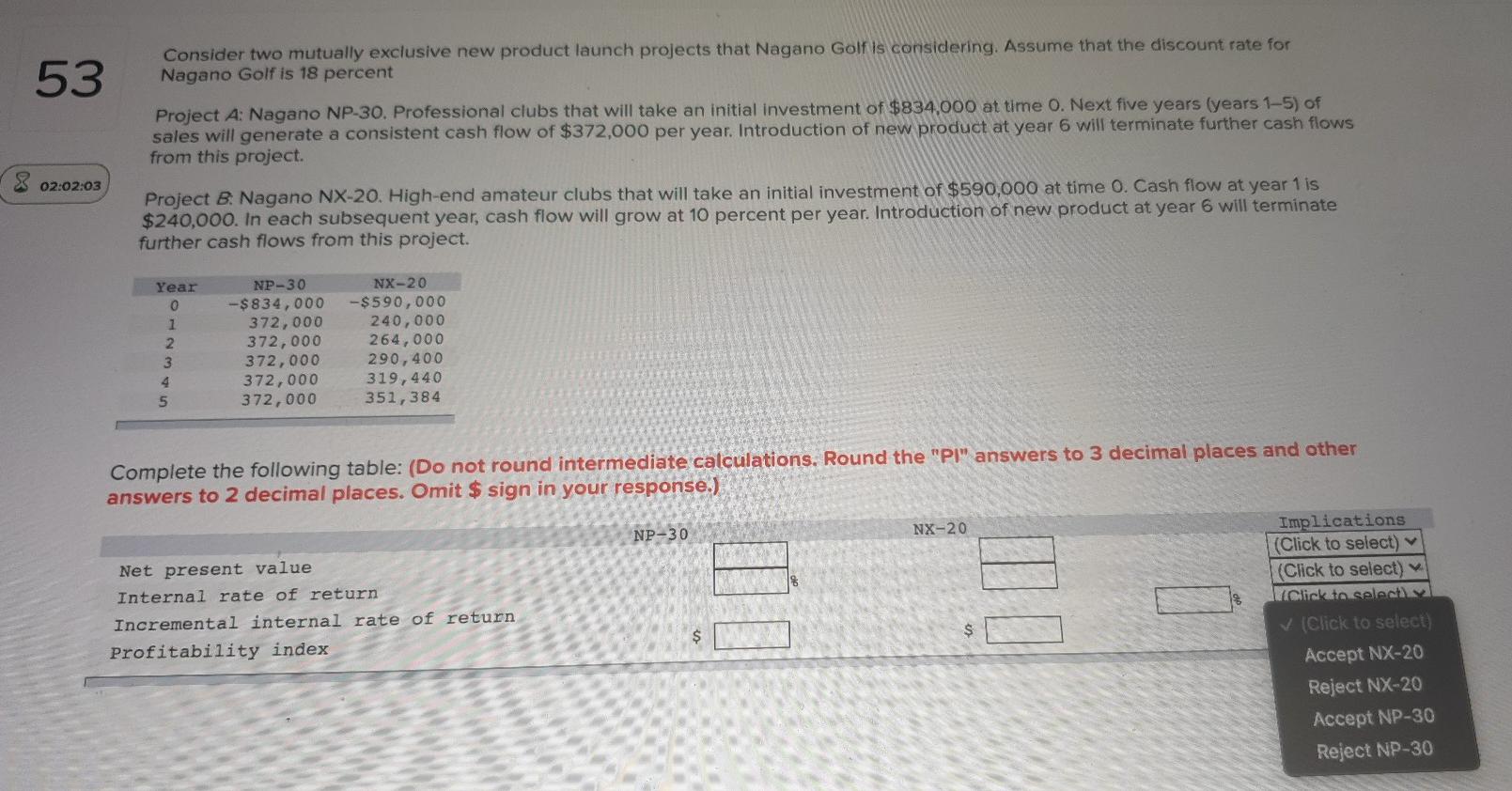

53 Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume that the discount rate for Nagano Golf is 18 percent Project A: Nagano NP-30. Professional clubs that will take an initial investment of $834,000 at time O. Next five years (years 1-5) of sales will generate a consistent cash flow of $372,000 per year. Introduction of new product at year 6 will terminate further cash flows from this project Project B. Nagano NX-20. High-end amateur clubs that will take an initial investment of $590,000 at time 0. Cash flow at year 1 is $240,000. In each subsequent year, cash flow will grow at 10 percent per year. Introduction of new product at year 6 will terminate further cash flows from this project. 02:02:03 Year 0 1 2. 3 4 5 NP-30 -$834,000 372,000 372,000 372,000 372,000 372,000 NX-20 -$590,000 240,000 264,000 290,400 319,440 351,384 Complete the following table: (Do not round intermediate calculations. Round the "PI" answers to 3 decimal places and other answers to 2 decimal places. Omit $ sign in your response.) NP-30 NX-20 Net present value Internal rate of return Incremental internal rate of return Profitability index TI $ $ Implications (Click to select) (Click to select) Click to select (Click to select) Accept NX-20 Reject NX-20 Accept NP-30 Reject NP-30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts