Question: Please help me (a) A fundamental problem associated with earnings valuations is how to price risk, particularly when markets are volatile. To summarize, they fail

Please help me

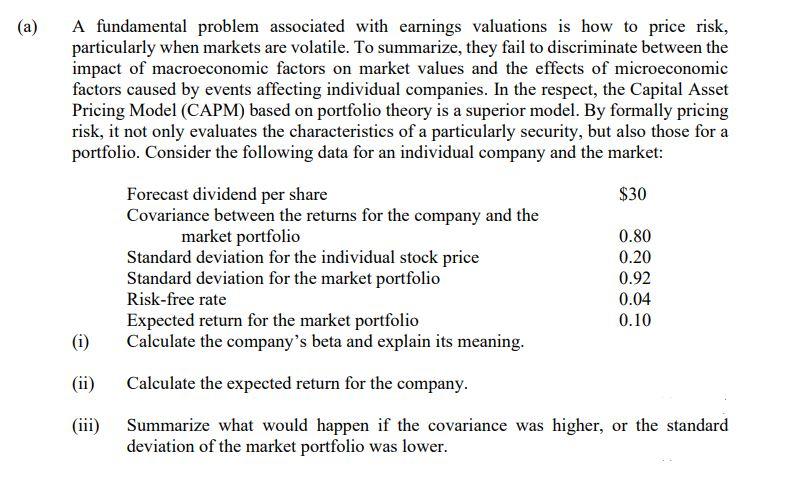

(a) A fundamental problem associated with earnings valuations is how to price risk, particularly when markets are volatile. To summarize, they fail to discriminate between the impact of macroeconomic factors on market values and the effects of microeconomic factors caused by events affecting individual companies. In the respect, the Capital Asset Pricing Model (CAPM) based on portfolio theory is a superior model. By formally pricing risk, it not only evaluates the characteristics of a particularly security, but also those for a portfolio. Consider the following data for an individual company and the market: Forecast dividend per share $30 Covariance between the returns for the company and the market portfolio 0.80 Standard deviation for the individual stock price 0.20 0.92 Standard deviation for the market portfolio Risk-free rate 0.04 Expected return for the market portfolio 0.10 (i) Calculate the company's beta and explain its meaning. (ii) Calculate the expected return for the company. (iii) Summarize what would happen if the covariance was higher, or the standard deviation of the market portfolio was lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts