Question: Please help me!! Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second

Please help me!!

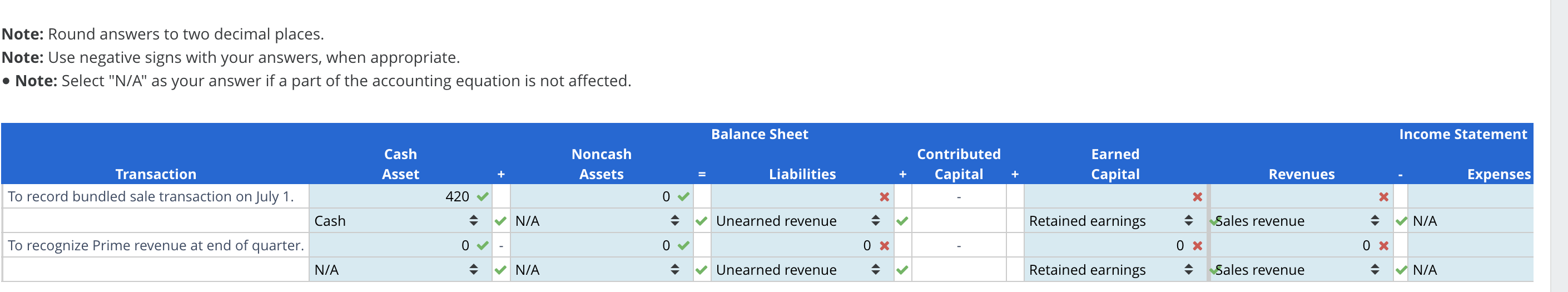

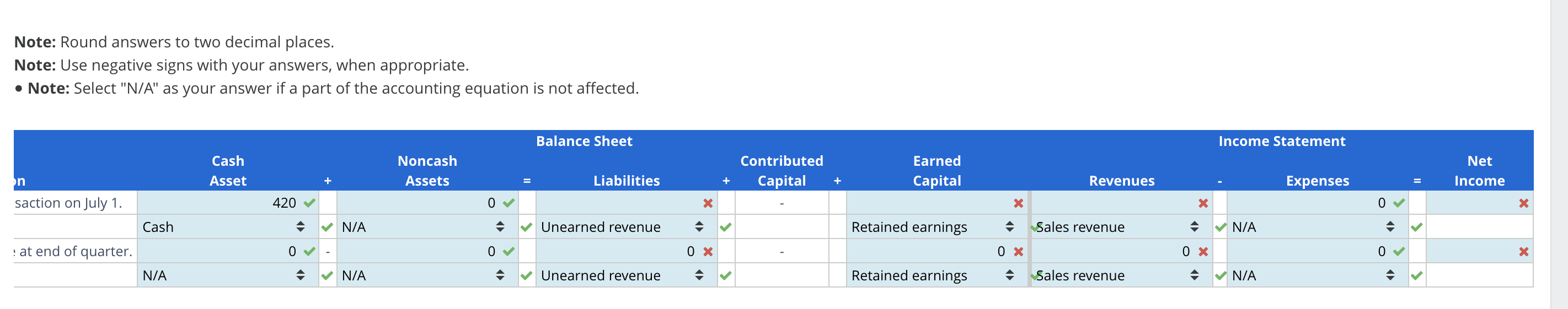

Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second quarter of 2020 10-K report. Revenue relative stand-alone selling price. We generally determine stand-alone selling prices based on the prices charged to customers or using expected cost plus a margin. A description of our principal revenue generating activities is as follows: third-party carrier or, in the case of an Amazon delivery, to the customer. the case of an Amazon delivery, to the customer. of delivering the services. Revenue from such arrangements is recognized over the subscription period. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the price charged for the combination is $420, and a customer buys the combination on July 1 . Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second quarter of 2020 10-K report. Revenue relative stand-alone selling price. We generally determine stand-alone selling prices based on the prices charged to customers or using expected cost plus a margin. A description of our principal revenue generating activities is as follows: third-party carrier or, in the case of an Amazon delivery, to the customer. the case of an Amazon delivery, to the customer. of delivering the services. Revenue from such arrangements is recognized over the subscription period. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the price charged for the combination is $420, and a customer buys the combination on July 1 . Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts