Question: Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second quarter of 2020

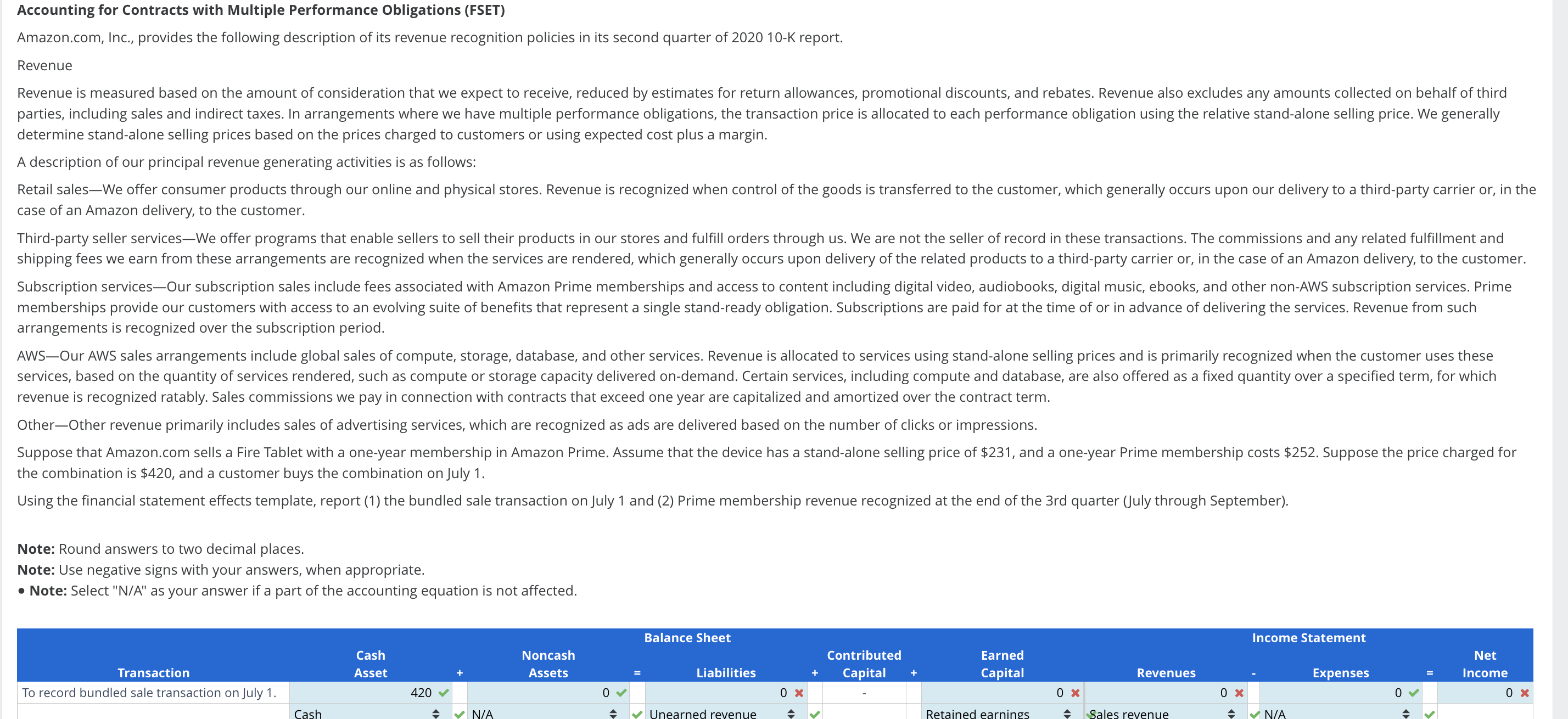

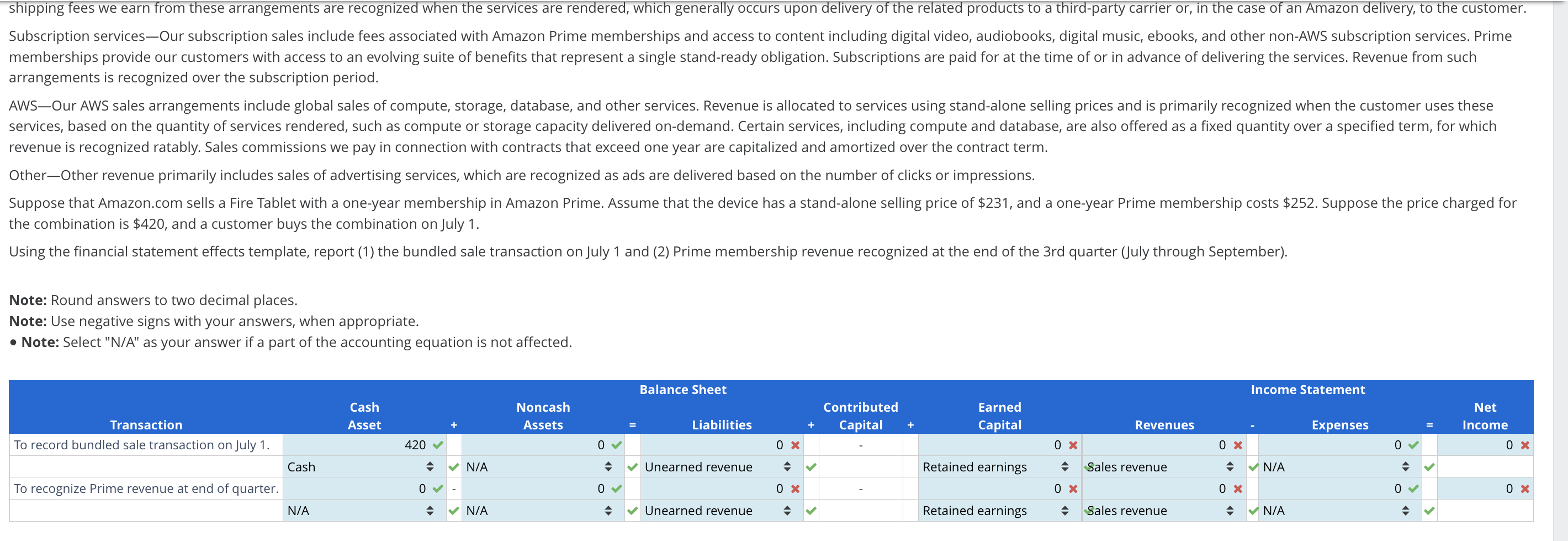

Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second quarter of 2020 10-K report. Revenue determine stand-alone selling prices based on the prices charged to customers or using expected cost plus a margin. A description of our principal revenue generating activities is as follows: case of an Amazon delivery, to the customer. arrangements is recognized over the subscription period. revenue is recognized ratably. Sales commissions we pay in connection with contracts that exceed one year are capitalized and amortized over the contract term. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the combination is $420, and a customer buys the combination on July 1 . Using the financial statement effects template, report (1) the bundled sale transaction on July 1 and (2) Prime membership revenue recognized at the end of the 3rd quarter (July through September). Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. arrangements is recognized over the subscription period. revenue is recognized ratably. Sales commissions we pay in connection with contracts that exceed one year are capitalized and amortized over the contract term. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the combination is $420, and a customer buys the combination on July 1 . Using the financial statement effects template, report (1) the bundled sale transaction on July 1 and (2) Prime membership revenue recognized at the end of the 3rd quarter (July through September). Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. Accounting for Contracts with Multiple Performance Obligations (FSET) Amazon.com, Inc., provides the following description of its revenue recognition policies in its second quarter of 2020 10-K report. Revenue determine stand-alone selling prices based on the prices charged to customers or using expected cost plus a margin. A description of our principal revenue generating activities is as follows: case of an Amazon delivery, to the customer. arrangements is recognized over the subscription period. revenue is recognized ratably. Sales commissions we pay in connection with contracts that exceed one year are capitalized and amortized over the contract term. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the combination is $420, and a customer buys the combination on July 1 . Using the financial statement effects template, report (1) the bundled sale transaction on July 1 and (2) Prime membership revenue recognized at the end of the 3rd quarter (July through September). Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected. arrangements is recognized over the subscription period. revenue is recognized ratably. Sales commissions we pay in connection with contracts that exceed one year are capitalized and amortized over the contract term. Other-Other revenue primarily includes sales of advertising services, which are recognized as ads are delivered based on the number of clicks or impressions. the combination is $420, and a customer buys the combination on July 1 . Using the financial statement effects template, report (1) the bundled sale transaction on July 1 and (2) Prime membership revenue recognized at the end of the 3rd quarter (July through September). Note: Round answers to two decimal places. Note: Use negative signs with your answers, when appropriate. - Note: Select "N/A" as your answer if a part of the accounting equation is not affected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts