Question: Please help me all because I will do exactly the same thing in my exam. Ron is planning for retirement and hopes to make withdraws

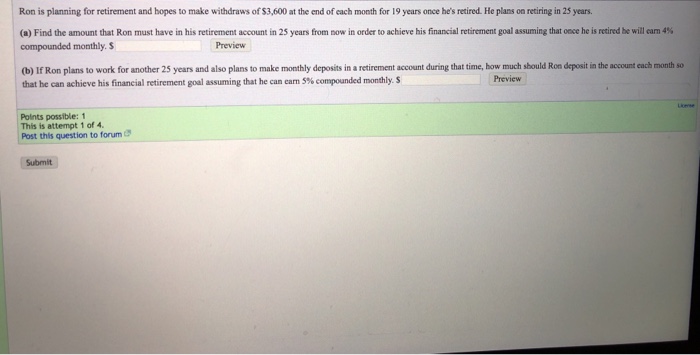

Ron is planning for retirement and hopes to make withdraws of $3,600 at the end of each month for 19 years once he's retired. He plans on retiring in 25 years. (a Find the amount that Ron must have n his retirement account n 25 years from now in order to achieve his financial retrement goal assur ing that oece he is rend be w ten 4% compounded monthly. S Preview (b) If Ron plans to work for another 25 years and also plans to make monthly deposits in a retirement account during that time, how much should Ron deposit in the account each month so that he can achieve his financial retirement goal assuming that he can earn 5% compounded monthly. S Preview Polnts possible: 1 This is attempt 1 of 4 Post this question to forum Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts