Question: please help me and i need all steps and all question please i will give u like Question 1 (5 marks): Assume you are the

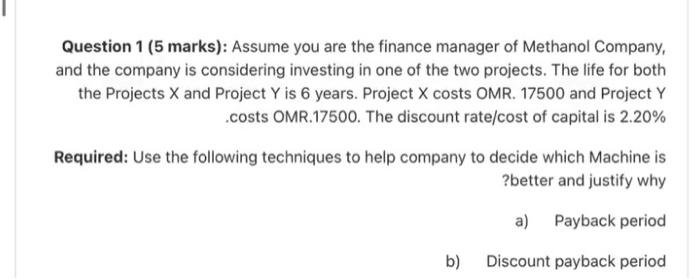

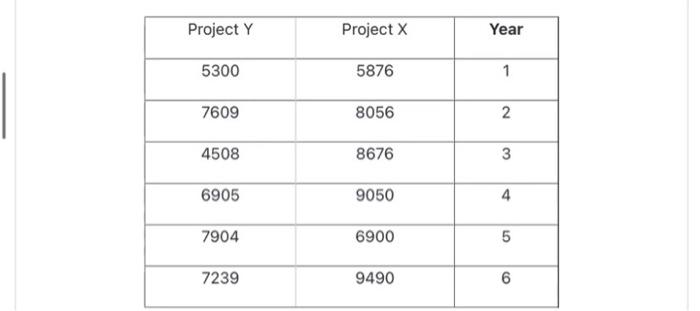

Question 1 (5 marks): Assume you are the finance manager of Methanol Company, and the company is considering investing in one of the two projects. The life for both the Projects X and Project Y is 6 years. Project X costs OMR. 17500 and Project Y costs OMR.17500. The discount rate/cost of capital is 2.20% Required: Use the following techniques to help company to decide which Machine is ?better and justify why a) Payback period b) Discount payback period c) Net Present Value .d) Present value index - Profitability index Project Y Project X Year 5300 5876 1 7609 8056 2 4508 8676 3 6905 9050 4 7904 6900 5 7239 9490 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts