Question: please help me and make the answer clearly. help me please make sure the number is correct and make sure the answer is correct. help

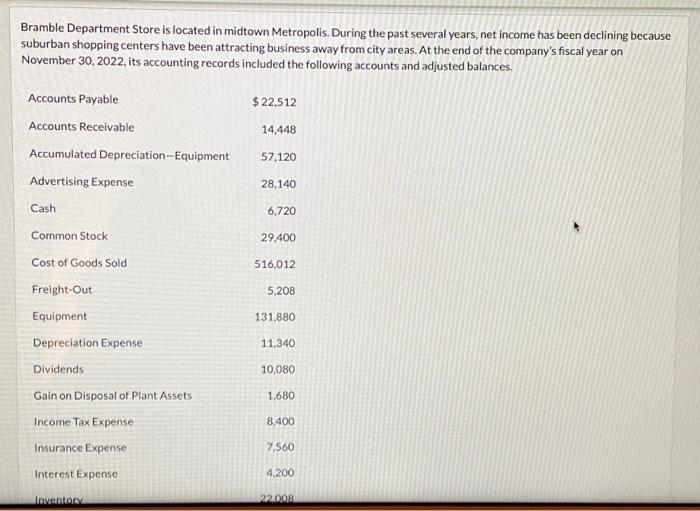

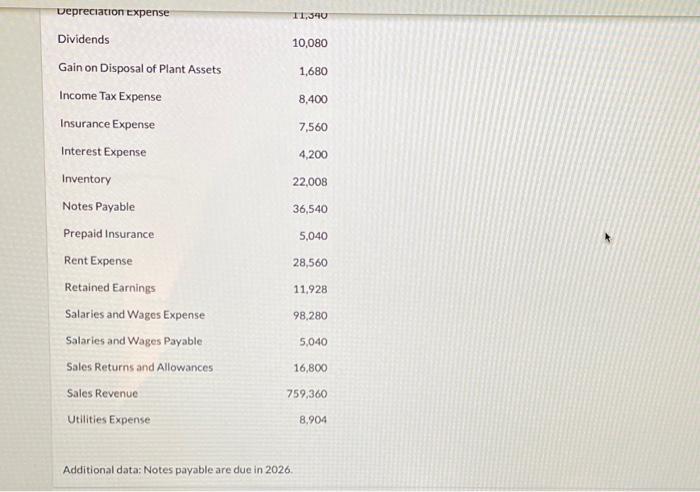

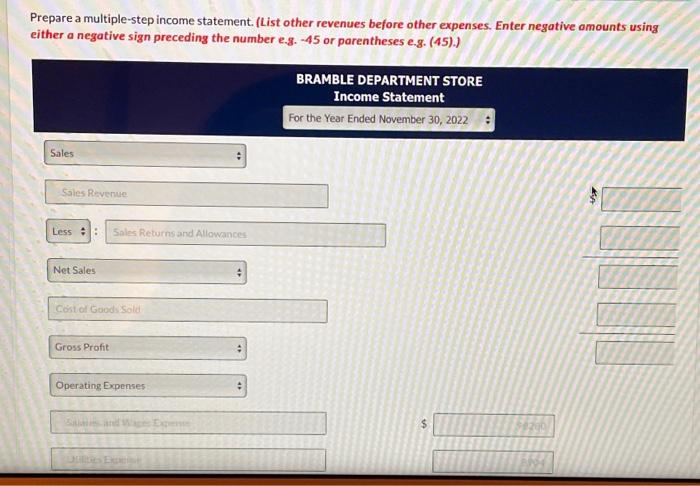

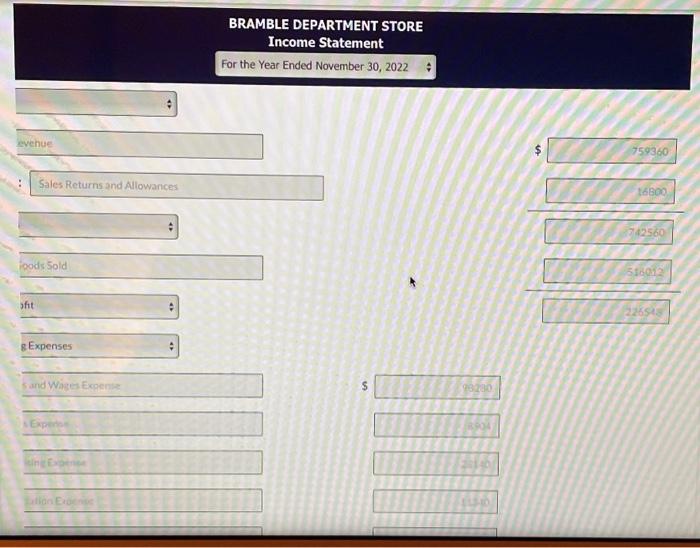

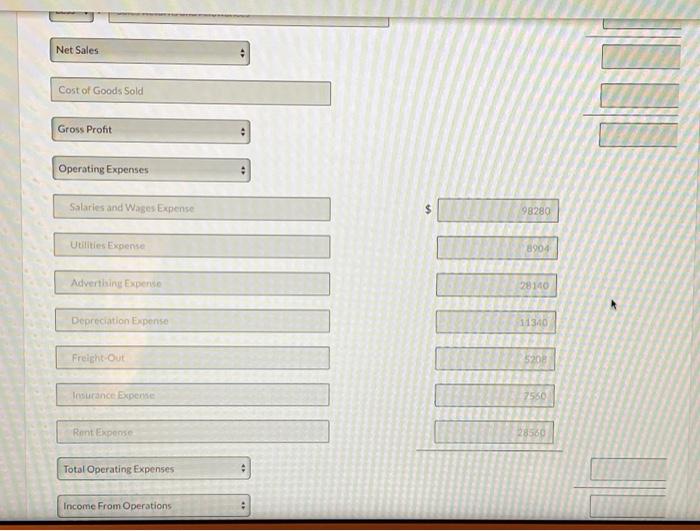

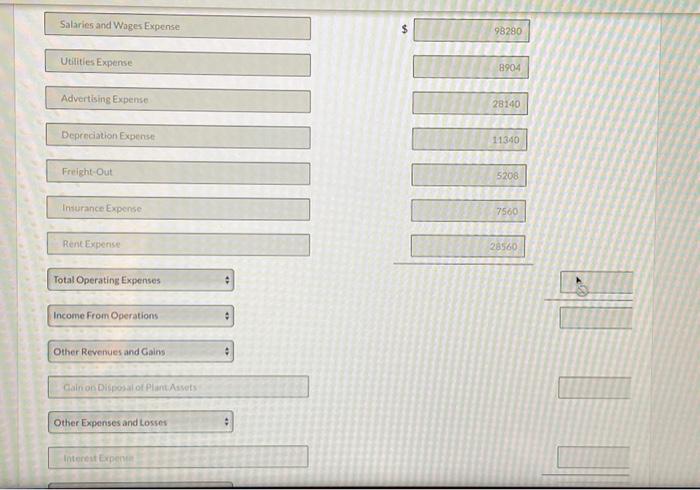

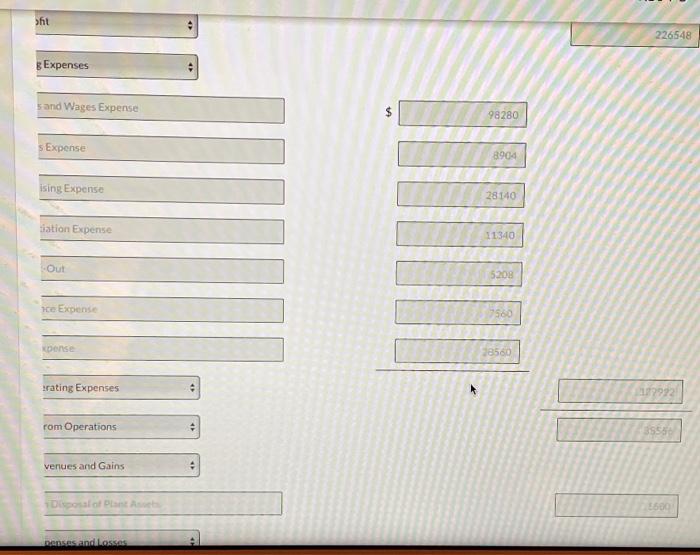

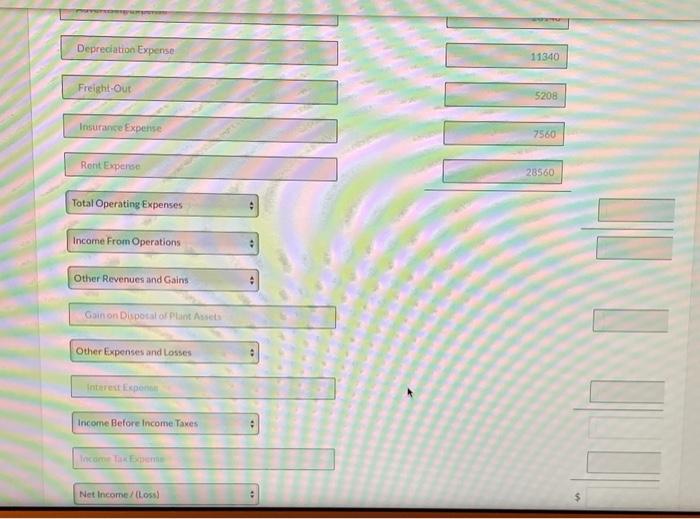

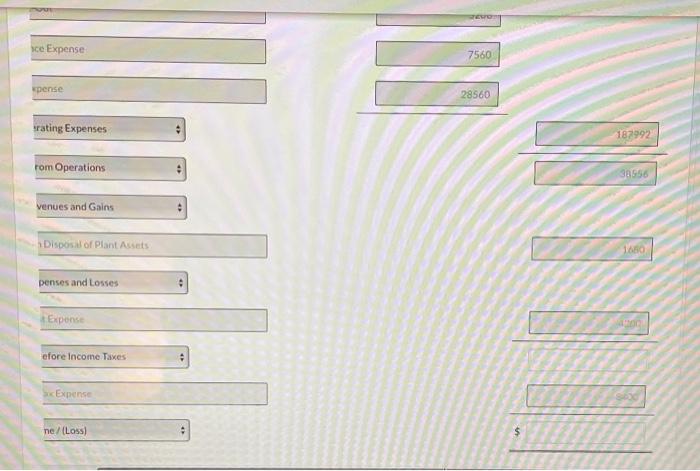

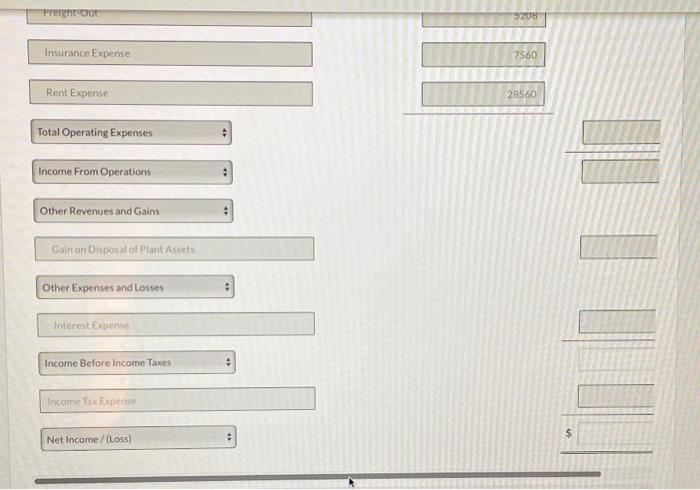

Bramble Department Store is located in midtown Metropolis. During the past several years, net income has been declining because suburban shopping centers have been attracting business away from city areas. At the end of the company's fiscal year on November 30, 2022, its accounting records included the following accounts and adjusted balances. $ 22,512 Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment 14,448 57,120 Advertising Expense 28,140 Cash 6,720 Common Stock 29.400 516,012 5,208 131,880 11,340 Cost of Goods Sold Freight-Out Equipment Depreciation Expense Dividends Gain on Disposal of Plant Assets Income Tax Expense Insurance Expense 10,080 1.680 8.400 7,560 Interest Expense 4,200 Inventory 22.000 Depreciation Expense 11,390 10,080 1,680 8.400 Dividends Gain on Disposal of Plant Assets Income Tax Expense Insurance Expense Interest Expense Inventory 7,560 4,200 22,008 Notes Payable 36,540 5,040 28,560 11,928 98,280 Prepaid Insurance Rent Expense Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Returns and Allowances Sales Revenue Utilities Expense 5,040 16,800 759,360 8.904 Additional data: Notes payable are due in 2026. Prepare a multiple-step income statement. (List other revenues before other expenses. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) BRAMBLE DEPARTMENT STORE Income Statement For the Year Ended November 30, 2022 Sales Sales Revenue Less :: Sales Returns and Allowances Net Sales Cost of Good Sold Gross Profit Operating Expenses $ BRAMBLE DEPARTMENT STORE Income Statement For the Year Ended November 30, 2022 evenue 759360 Sales Returns and Allowances 16800 742560 foods Sold 31.01 fit 22 g Expenses Sand Wices Exoen 20180 Lillan Erdon Net Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Expense 98280 Utilities Expense 8904 Adverthing Experte 29140 Depreciation Expense 11340 Freight our 5208 Insurance Expeme 7560 Rent Expense 28560 Total Operating Expenses Income From Operations 2 Salaries and Wages Expense 98280 Utilities Expense 8904 Advertising Expense 28140 Depreciation Expense 11340 Freight Out 5208 Insurance Expense 7560 Rent Expense 28560 Total Operating Expenses Income From Operations Other Revenues and Gains Canon Disposal of Plant Avots Other Expenses and Losses Interest Expen fit 226548 g Expenses s and Wages Expense 98280 s Expense 8904 ising Expense 28140 Siation Expense 11340 Out 5208 He Expense 1560 xponse 28560 rating Expenses 17922 rom Operations 3555 venues and Gains Dakott 3600 Rosand Lasse Depreciation Expense 11340 Freight Out 5208 Insurance Expense 7560 Rent Experte 28560 Total Operating Expenses Income From Operations Other Revenues and Gains Gainon Disposal of Punt Assets Other Expenses and losses Interest Expono Income Before Income Taxes Income Net Income (Loss) sce Expense 7560 pense 28560 rating Expenses 187992 rom Operations 30956 venues and Gains Disposal of Plant Assets 1650 penses and Losses Exponse efore Income Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts