Question: please Help me and make sure the answer is correct. make sure the answer is correct You are a financial analyst at a major business

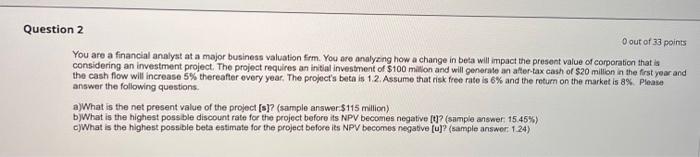

You are a financial analyst at a major business valuation firm. You are analyaing how a change in beta will impact the present value of corporaticn that is considering an investment project. The project requires an inital investment of $100 millon and will generale an aller-tax cash of $20 millon in the frst year and the cash fow will increase 5% thereafer overy year. The project's beta is 1.2. Assume that risk free rate is 6% and the retum on the market is 8% Please answer the following questions. a) What is the net present value of the project [s]? (sample answer $115 milion) b) What is the highest poss ble discount rate for the project before its NPP becomes negative [t]? (sample answer: 15.45% ) c)What is the highest possible beta estimate for the project before its NPV becomes negative [u]? (sample answor: 1.24 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts