Question: please help me answer #2. PLEASE do not send me an excel spreadsheet or some other type of word document. i need for your answer

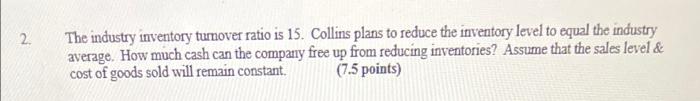

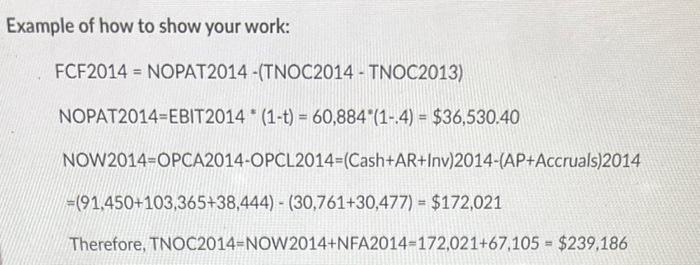

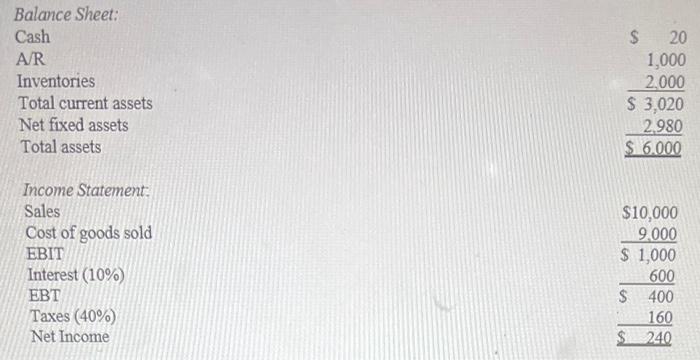

2. The industry inventory tumover ratio is 15. Collins plans to reduce the inventory level to equal the industry average. How much cash can the company free up from reducing inventories? Assume that the sales level & cost of goods sold will remain constant. (7.5 points) Example of how to show your work: FCF2014 = NOPAT2014 -(TNOC2014 - TNOC2013) NOPAT2014=EBIT2014 (1-t) = 60,884*(1-.4) = $36,530.40 NOW2014=OPCA2014-OPCL2014=(Cash+AR+Inv)2014-(AP+Accruals)2014 +(91,450+103,365+38,444) - (30,761+30,477) = $172,021 Therefore, TNOC2014=NOW2014+NFA2014=172,021+67,105 = $239,186 Balance Sheet: Cash AR Inventories Total current assets Net fixed assets Total assets $ 20 1,000 2.000 $ 3,020 2.980 $ 6.000 Income Statement: Sales Cost of goods sold EBIT Interest (10%) EBT Taxes (40%) Net Income $10,000 9.000 $ 1,000 600 $ 400 160 $240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts