Question: Please help me answer all question i will give good rating very urgent need answer 1. Jini and Tini are in partnership business selling furniture

Please help me answer all question i will give good rating very urgent need answer

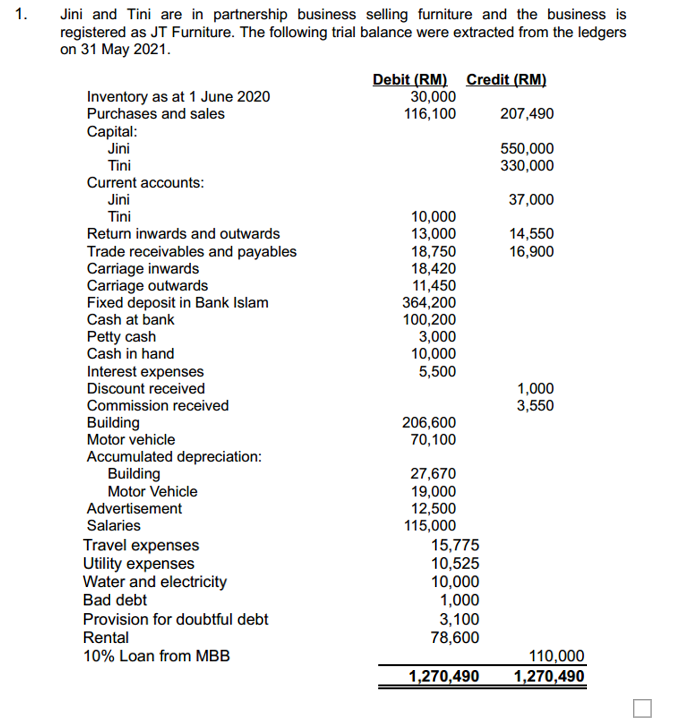

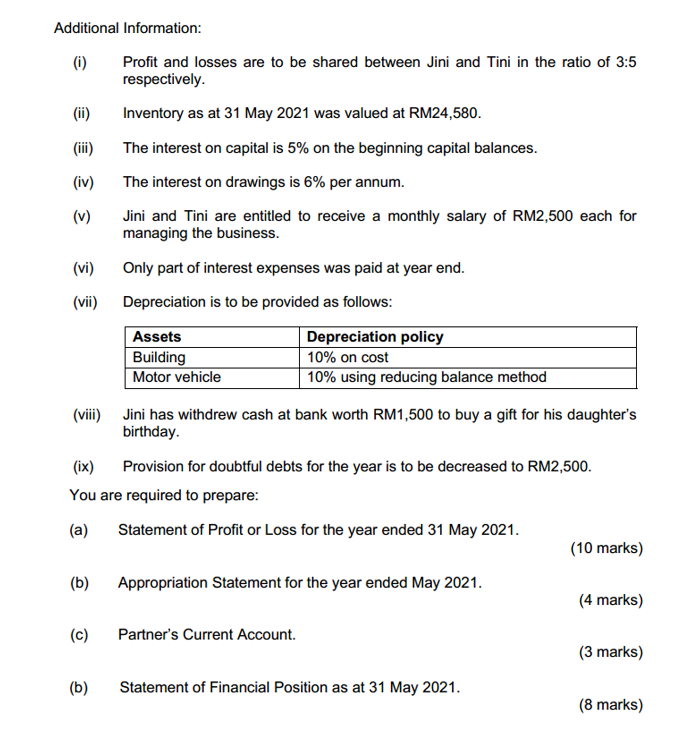

1. Jini and Tini are in partnership business selling furniture and the business is registered as JT Furniture. The following trial balance were extracted from the ledgers on 31 May 2021. Debit (RM) Credit (RM) Inventory as at 1 June 2020 30,000 Purchases and sales 116,100 207,490 Capital: Jini 550,000 Tini 330,000 Current accounts: Jini 37,000 Tini 10,000 Return inwards and outwards 13,000 14,550 Trade receivables and payables 18,750 16,900 Carriage inwards 18,420 Carriage outwards 11,450 Fixed deposit in Bank Islam 364,200 Cash at bank 100,200 Petty cash 3,000 Cash in hand 10,000 Interest expenses 5,500 Discount received 1,000 Commission received 3,550 Building 206,600 Motor vehicle 70,100 Accumulated depreciation: Building 27,670 Motor Vehicle 19,000 Advertisement 12,500 Salaries 115,000 Travel expenses 15,775 Utility expenses 10,525 Water and electricity 10,000 Bad debt 1,000 Provision for doubtful debt 3,100 Rental 78,600 10% Loan from MBB 110,000 1,270,490 1,270,490 (iii) Additional Information: (i) Profit and losses are to be shared between Jini and Tini in the ratio of 3:5 respectively. (ii) Inventory as at 31 May 2021 was valued at RM24,580. The interest on capital is 5% on the beginning capital balances. (iv) The interest on drawings is 6% per annum. (v) Jini and Tini are entitled to receive a monthly salary of RM2,500 each for managing the business. (vi) Only part of interest expenses was paid at year end. (vii) Depreciation is to be provided as follows: Assets Depreciation policy Building 10% on cost Motor vehicle 10% using reducing balance method (viii) Jini has withdrew cash at bank worth RM1,500 to buy a gift for his daughter's birthday. (ix) Provision for doubtful debts for the year is to be decreased to RM2,500. You are required to prepare: (a) Statement of Profit or Loss for the year ended 31 May 2021. (10 marks) Appropriation Statement for the year ended May 2021. (4 marks) (c) Partner's Current Account. (3 marks) (b) (b) Statement of Financial Position as at 31 May 2021. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts