Question: Please help me answer ALL the questions thankyou Chapter 19 Content Learning Worksheet - Answer the question and provide the page number of your solution.

Please help me answer ALL the questions thankyou

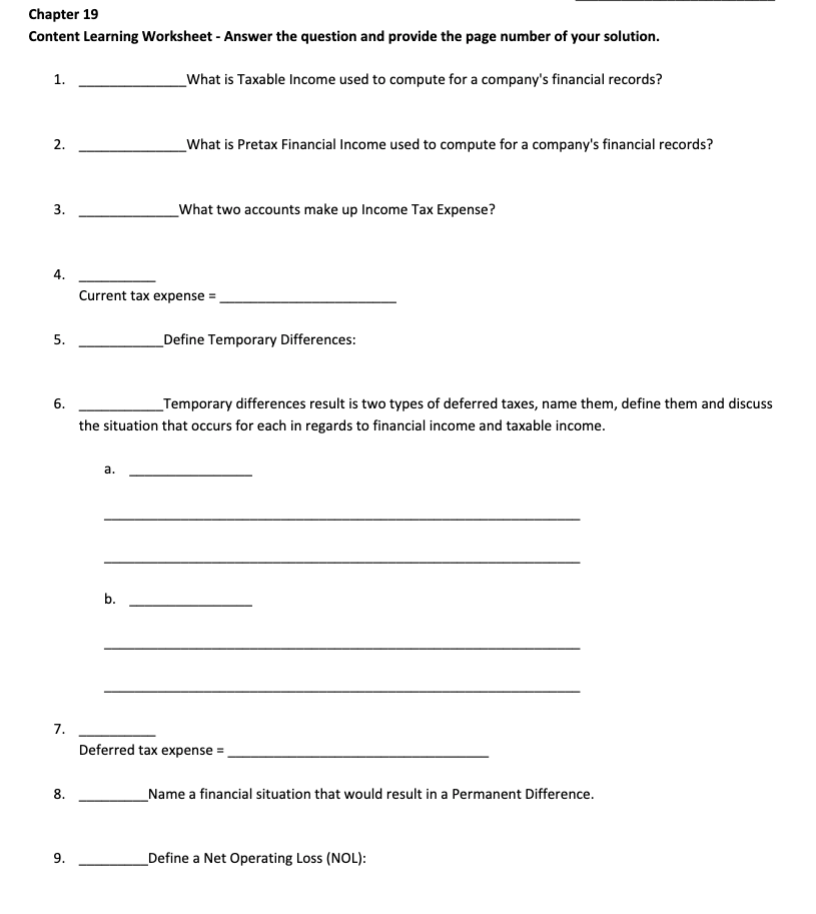

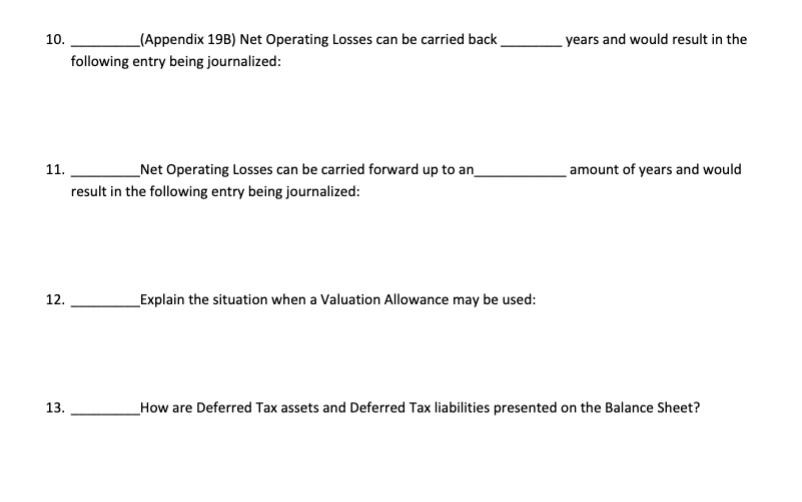

Chapter 19 Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. _What is Taxable Income used to compute for a company's financial records? 2. _What is Pretax Financial Income used to compute for a company's financial records? 3. _What two accounts make up Income Tax Expense? 4. Current tax expense = 5. . _Define Temporary Differences: 6. _Temporary differences result is two types of deferred taxes, name them, define them and discuss the situation that occurs for each in regards to financial income and taxable income. b. 7. Deferred tax expense 8. _Name a financial situation that would result in a Permanent Difference. 9. Define a Net Operating Loss (NOL): 10. _(Appendix 19B) Net Operating Losses can be carried back following entry being journalized: years and would result in the 11. amount of years and would _Net Operating Losses can be carried forward up to an result in the following entry being journalized: 12. _Explain the situation when a Valuation Allowance may be used: 13. How are Deferred Tax assets and Deferred Tax liabilities presented on the Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts