Question: please help me answer and explain. this thank you please also include which results in the highest depreciation expense over the life of the asset?

please help me answer and explain. this thank you

please also include which results in the highest depreciation expense over the life of the asset? Highest net income? highest cash flow?

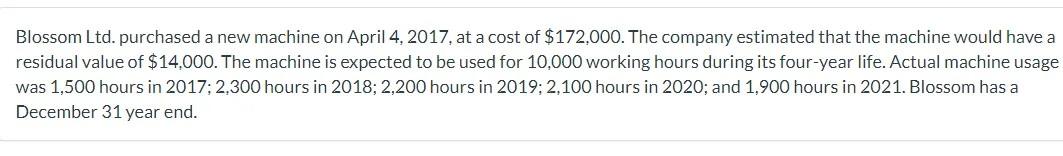

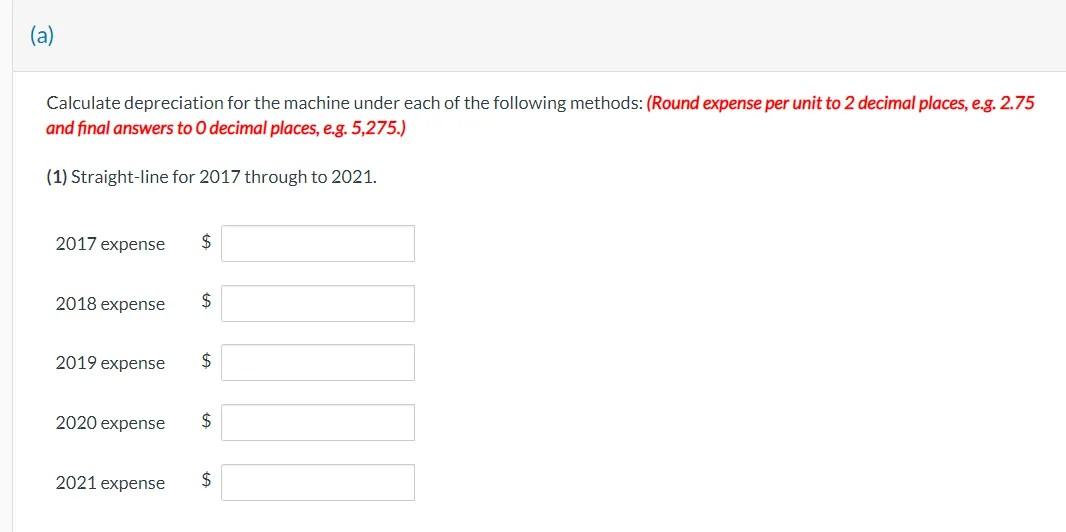

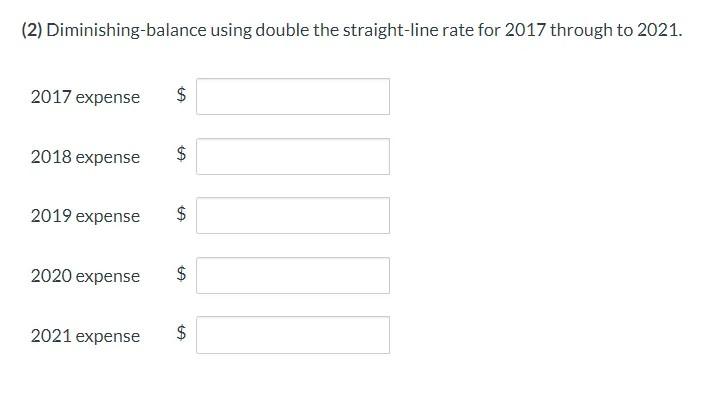

Blossom Ltd. purchased a new machine on April 4,2017 , at a cost of $172,000. The company estimated that the machine would have a residual value of $14,000. The machine is expected to be used for 10,000 working hours during its four-year life. Actual machine usage was 1,500 hours in 2017; 2,300 hours in 2018; 2,200 hours in 2019; 2,100 hours in 2020; and 1,900 hours in 2021. Blossom has a December 31 year end. Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line for 2017 through to 2021. 2017 expense $ 2018 expense $ 2019 expense $ 2020 expense $ 2021 expense $ (2) Diminishing-balance using double the straight-line rate for 2017 through to 2021. $ $ $ $ $ (3) Units-of-production for 2017 through to 2021. $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts