Question: Please help me answer B and C. Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000

![applies to the questions displayed below.] Illini Corporation reported taxable income of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e32e0c8dee4_49266e32e0c11e9c.jpg)

Please help me answer B and C.

Please help me answer B and C.

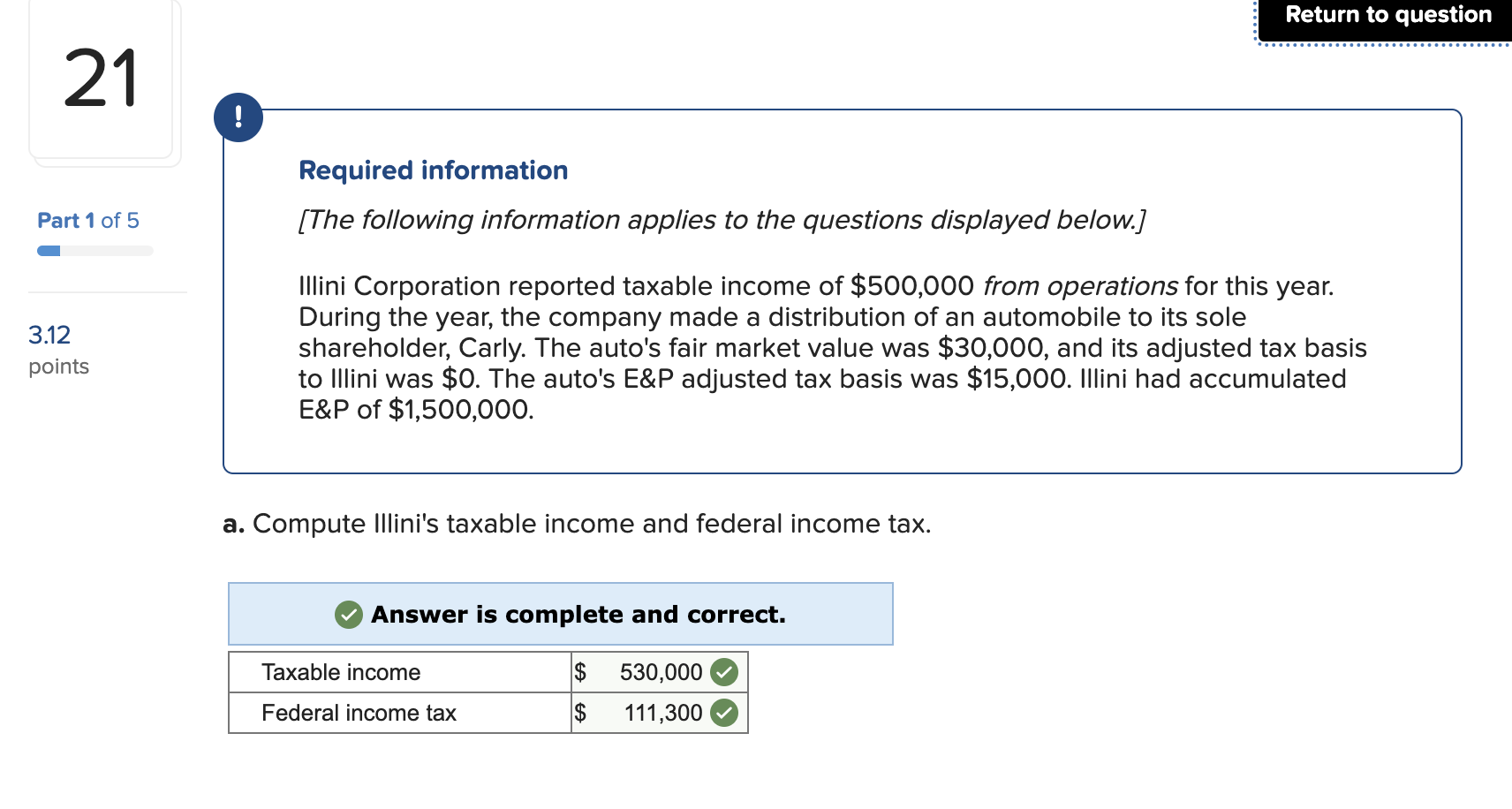

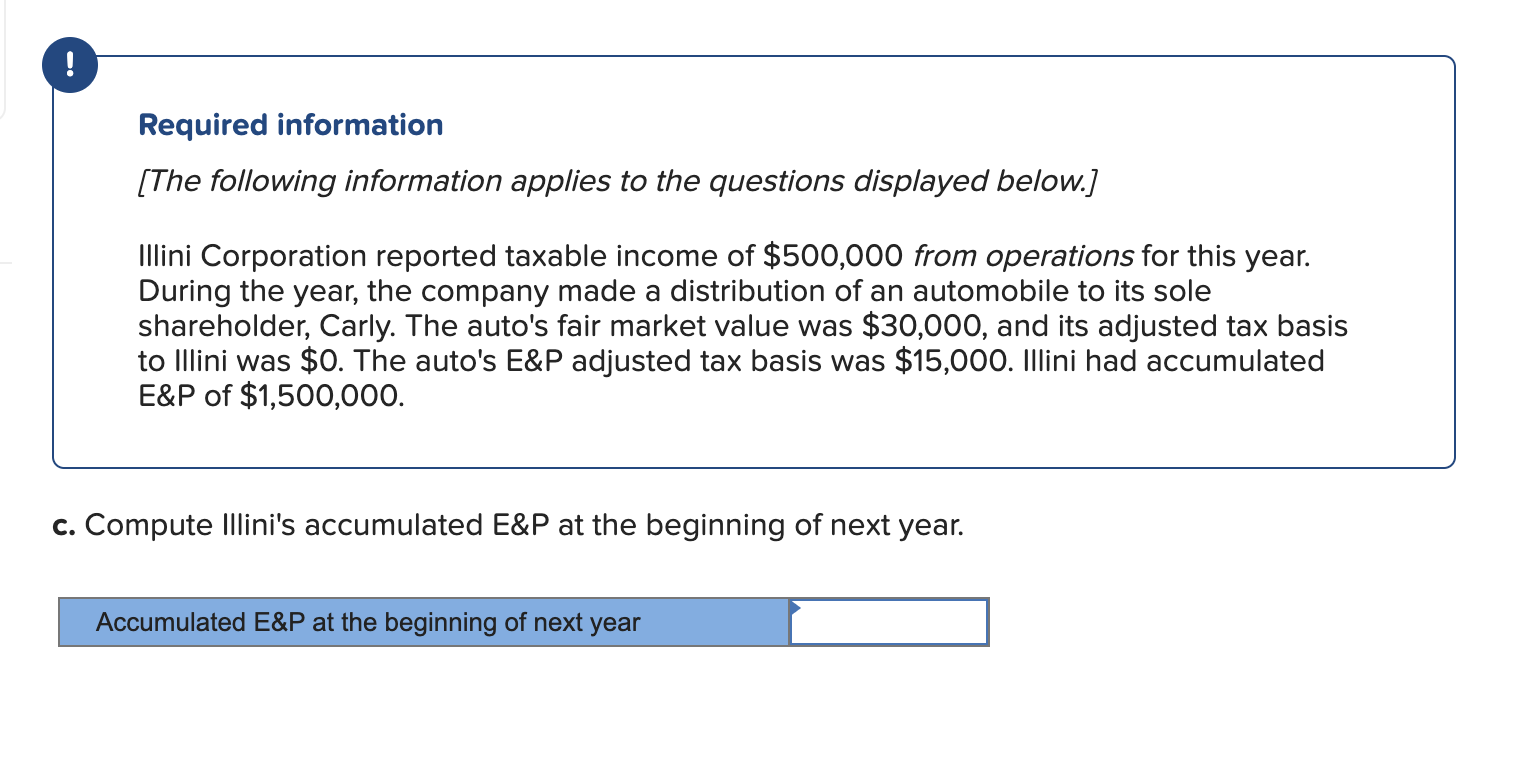

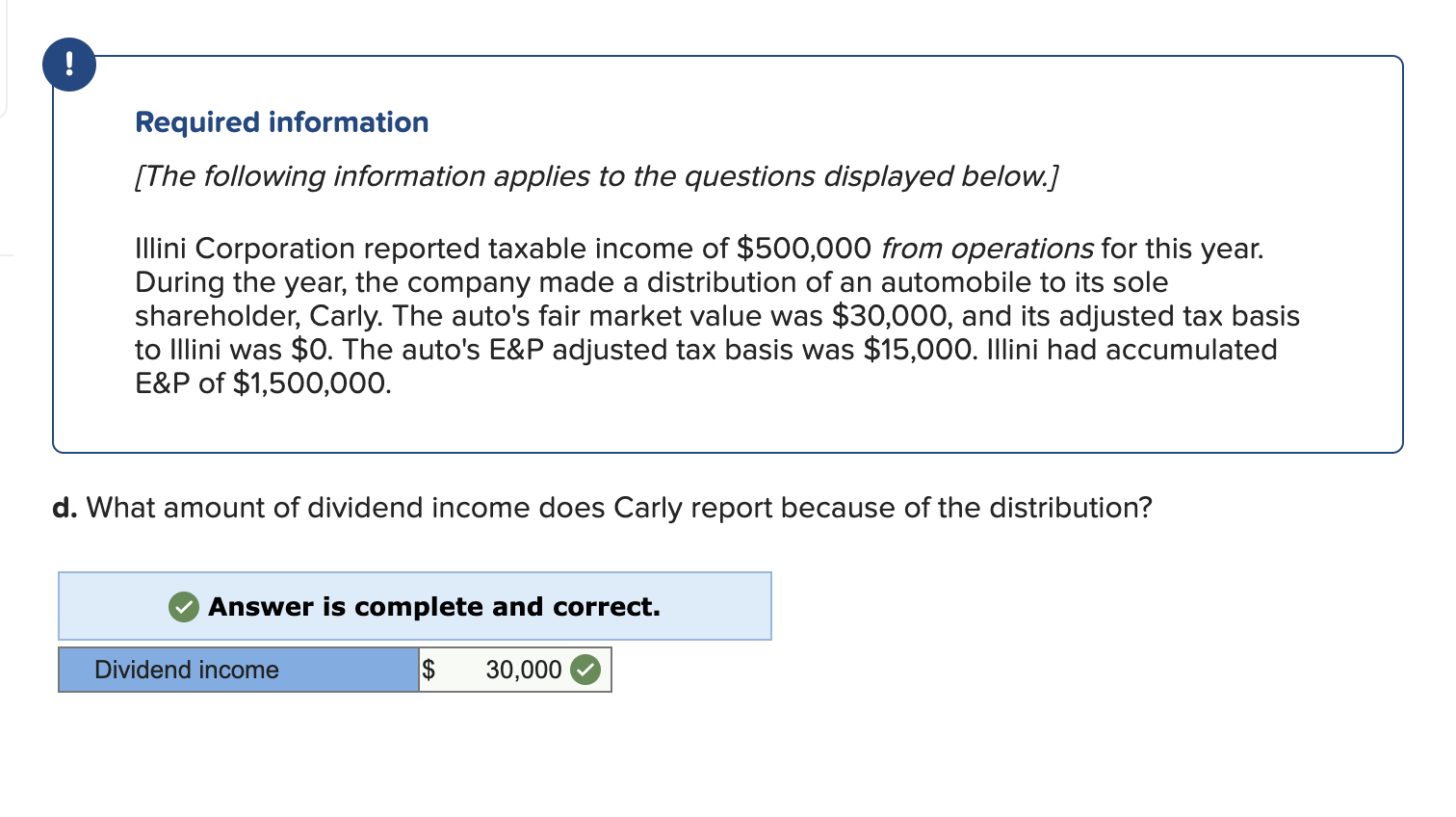

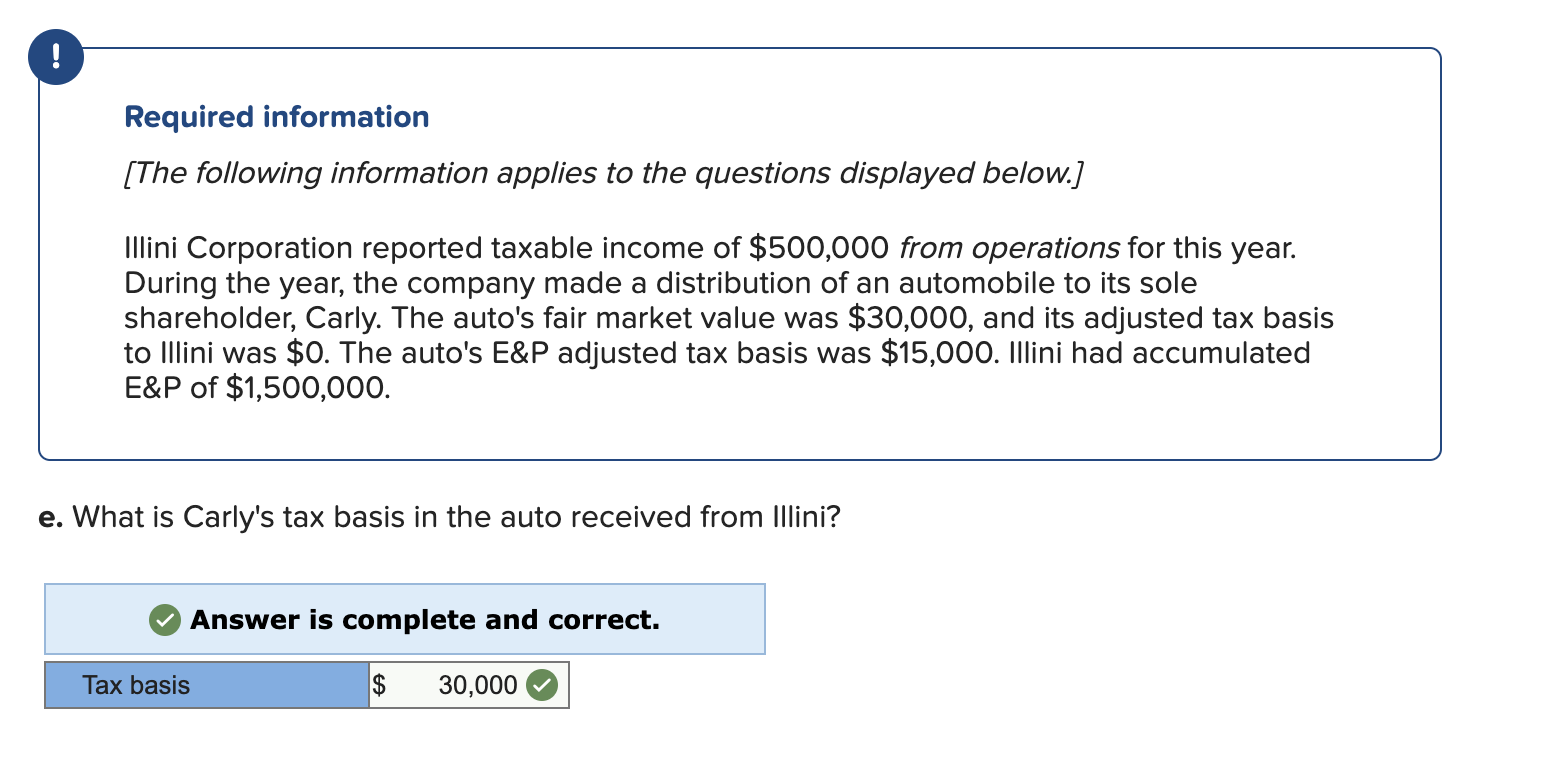

Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly. The auto's fair market value was $30,000, and its adjusted tax basis to Illini was $0. The auto's E\&P adjusted tax basis was $15,000. Illini had accumulated E\&P of $1,500,000. a. Compute Illini's taxable income and federal income tax. Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly. The auto's fair market value was $30,000, and its adjusted tax basis to Illini was $0. The auto's E\&P adjusted tax basis was $15,000. Illini had accumulated E\&P of $1,500,000. b. Compute Illini's current E\&P. Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly. The auto's fair market value was $30,000, and its adjusted tax basis to Illini was $0. The auto's E\&P adjusted tax basis was $15,000. Illini had accumulated E\&P of $1,500,000. c. Compute Illini's accumulated E\&P at the beginning of next year. Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly. The auto's fair market value was $30,000, and its adjusted tax basis to Illini was $0. The auto's E\&P adjusted tax basis was $15,000. Illini had accumulated E\&P of $1,500,000. d. What amount of dividend income does Carly report because of the distribution? Required information [The following information applies to the questions displayed below.] Illini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly. The auto's fair market value was $30,000, and its adjusted tax basis to Illini was $0. The auto's E\&P adjusted tax basis was $15,000. Illini had accumulated E\&P of $1,500,000. e. What is Carly's tax basis in the auto received from Illini? Answer is complete and correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts