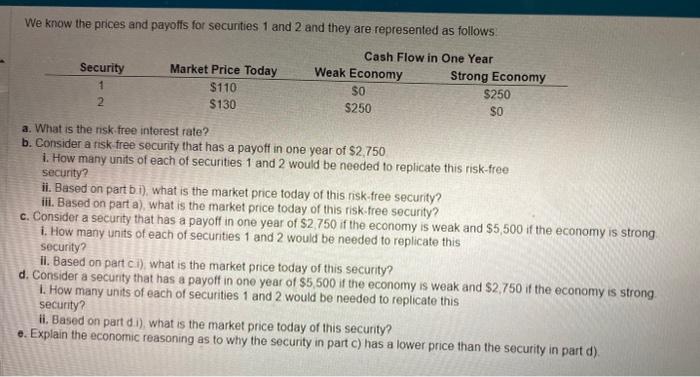

Question: Please help me answer part A-E. thank you! We know the prices and payoffs for secunties 1 and 2 and they are represented as follows:

We know the prices and payoffs for secunties 1 and 2 and they are represented as follows: a. What is the nisk.free interest rate? b. Consider a risk free security that has a payoff in one year of $2,750 1. How many units of each of securities 1 and 2 would be needed to replicate this risk-free security? ii. Based on part b.i), what is the market price today of this nisk-free security? iii. Based on part a). what is the market price today of this risk-free security? c. Consider a security that has a payoff in one year of $2,750 if the economy is weak and $5,500 if the economy is strong. i. How many units of each of securities 1 and 2 would be needed to replicate this security? ii. Based on part cii), what is the market price today of this security? d. Consider a secunty that has a payoff in one year of $5,500 if the economy is weak and $2,750 if the economy is strong. 1. How many units of each of securities 1 and 2 would be needed to replicate this security? ii. Based on part di.), what is the market price today of this secunty? e. Explain the economic reasoning as to why the security in part c) has a lower price than the security in part d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts